Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ethical Decision-Making Field Manual #5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo.

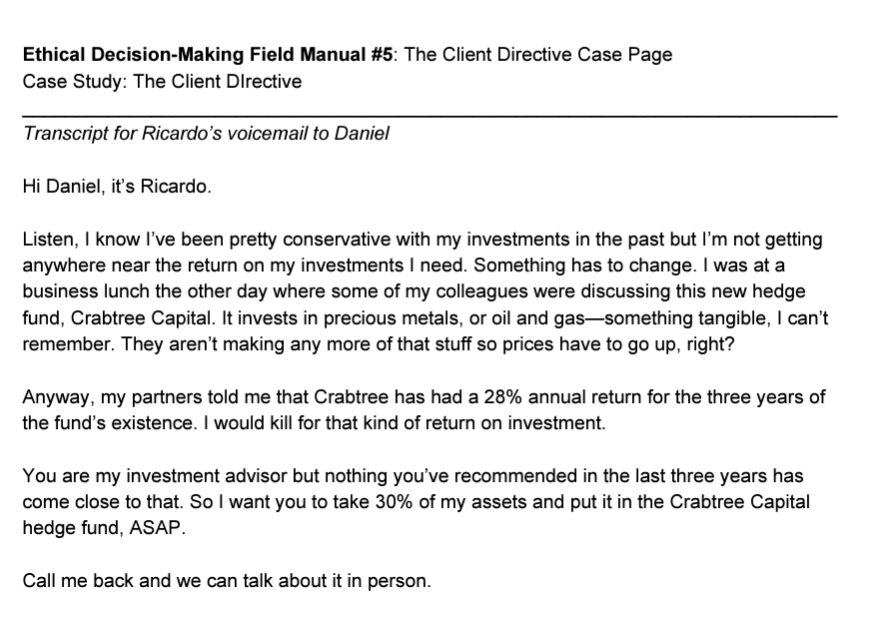

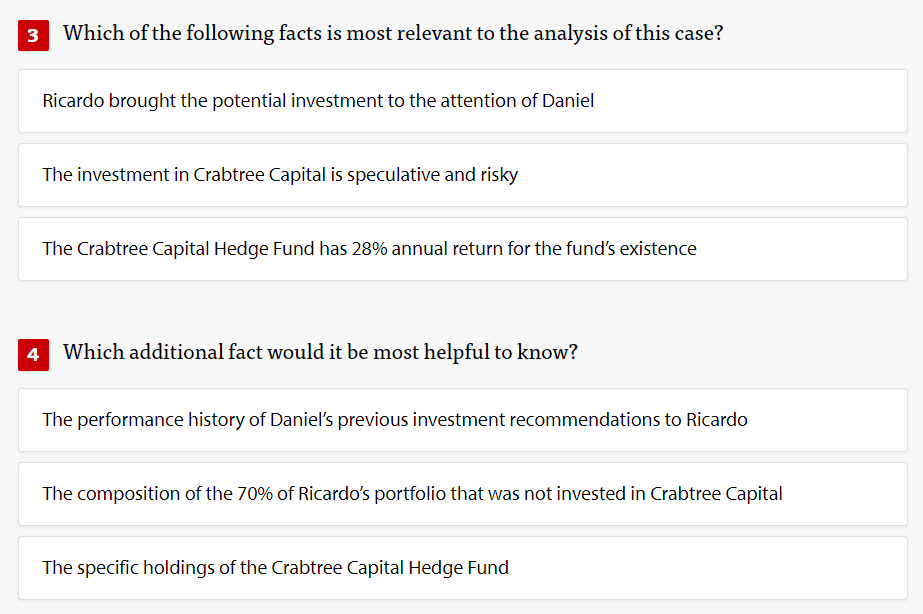

Ethical Decision-Making Field Manual \#5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo. Listen, I know l've been pretty conservative with my investments in the past but I'm not getting anywhere near the return on my investments I need. Something has to change. I was at a business lunch the other day where some of my colleagues were discussing this new hedge fund, Crabtree Capital. It invests in precious metals, or oil and gas-something tangible, I can't remember. They aren't making any more of that stuff so prices have to go up, right? Anyway, my partners told me that Crabtree has had a 28% annual return for the three years of the fund's existence. I would kill for that kind of return on investment. You are my investment advisor but nothing you've recommended in the last three years has come close to that. So I want you to take 30% of my assets and put it in the Crabtree Capital hedge fund, ASAP. Call me back and we can talk about it in person. 3 Which of the following facts is most relevant to the analysis of this case? Ricardo brought the potential investment to the attention of Daniel The investment in Crabtree Capital is speculative and risky The Crabtree Capital Hedge Fund has 28% annual return for the fund's existence 4 Which additional fact would it be most helpful to know? The performance history of Daniel's previous investment recommendations to Ricardo The composition of the 70% of Ricardo's portfolio that was not invested in Crabtree Capital The specific holdings of the Crabtree Capital Hedge Fund

Ethical Decision-Making Field Manual \#5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo. Listen, I know l've been pretty conservative with my investments in the past but I'm not getting anywhere near the return on my investments I need. Something has to change. I was at a business lunch the other day where some of my colleagues were discussing this new hedge fund, Crabtree Capital. It invests in precious metals, or oil and gas-something tangible, I can't remember. They aren't making any more of that stuff so prices have to go up, right? Anyway, my partners told me that Crabtree has had a 28% annual return for the three years of the fund's existence. I would kill for that kind of return on investment. You are my investment advisor but nothing you've recommended in the last three years has come close to that. So I want you to take 30% of my assets and put it in the Crabtree Capital hedge fund, ASAP. Call me back and we can talk about it in person. 3 Which of the following facts is most relevant to the analysis of this case? Ricardo brought the potential investment to the attention of Daniel The investment in Crabtree Capital is speculative and risky The Crabtree Capital Hedge Fund has 28% annual return for the fund's existence 4 Which additional fact would it be most helpful to know? The performance history of Daniel's previous investment recommendations to Ricardo The composition of the 70% of Ricardo's portfolio that was not invested in Crabtree Capital The specific holdings of the Crabtree Capital Hedge Fund Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started