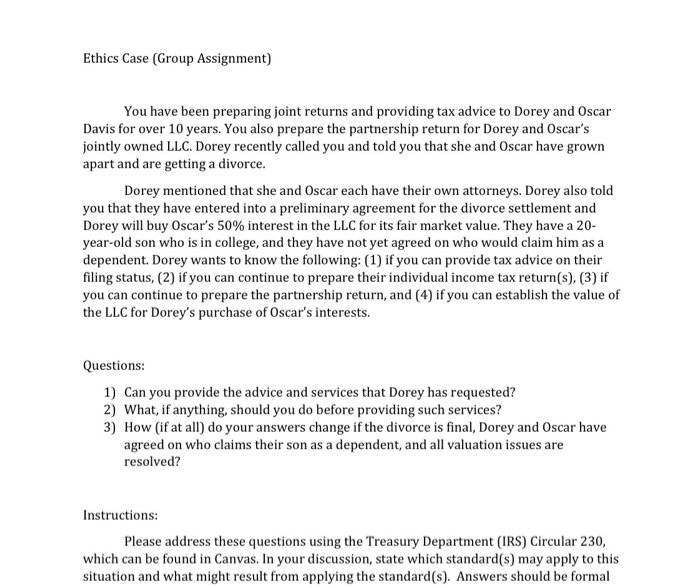

Ethics Case (Group Assignment) You have been preparing joint returns and providing tax advice to Dorey and Oscar Davis for over 10 years. You also prepare the partnership return for Dorey and Oscar's jointly owned LLC. Dorey recently called you and told you that she and Oscar have grown apart and are getting a divorce. Dorey mentioned that she and Oscar each have their own attorneys. Dorey also told you that they have entered into a preliminary agreement for the divorce settlement and Dorey will buy Oscar's 50% interest in the LLC for its fair market value. They have a 20- year-old son who is in college, and they have not yet agreed on who would claim him as a dependent. Dorey wants to know the following: (1) if you can provide tax advice on their filing status, (2) if you can continue to prepare their individual income tax return(s), (3) if you can continue to prepare the partnership return, and (4) if you can establish the value of the LLC for Dorey's purchase of Oscar's interests. Questions: 1) Can you provide the advice and services that Dorey has requested? 2) What, if anything, should you do before providing such services? 3) How (if at all) do your answers change if the divorce is final, Dorey and Oscar have agreed on who claims their son as a dependent, and all valuation issues are resolved? Instructions: Please address these questions using the Treasury Department (IRS) Circular 230, which can be found in Canvas. In your discussion, state which standard(s) may apply to this situation and what might result from applying the standard(s). Answers should be formal Ethics Case (Group Assignment) You have been preparing joint returns and providing tax advice to Dorey and Oscar Davis for over 10 years. You also prepare the partnership return for Dorey and Oscar's jointly owned LLC. Dorey recently called you and told you that she and Oscar have grown apart and are getting a divorce. Dorey mentioned that she and Oscar each have their own attorneys. Dorey also told you that they have entered into a preliminary agreement for the divorce settlement and Dorey will buy Oscar's 50% interest in the LLC for its fair market value. They have a 20- year-old son who is in college, and they have not yet agreed on who would claim him as a dependent. Dorey wants to know the following: (1) if you can provide tax advice on their filing status, (2) if you can continue to prepare their individual income tax return(s), (3) if you can continue to prepare the partnership return, and (4) if you can establish the value of the LLC for Dorey's purchase of Oscar's interests. Questions: 1) Can you provide the advice and services that Dorey has requested? 2) What, if anything, should you do before providing such services? 3) How (if at all) do your answers change if the divorce is final, Dorey and Oscar have agreed on who claims their son as a dependent, and all valuation issues are resolved? Instructions: Please address these questions using the Treasury Department (IRS) Circular 230, which can be found in Canvas. In your discussion, state which standard(s) may apply to this situation and what might result from applying the standard(s). Answers should be formal