Question

Ethics in Budgeting. Carol Chadwick is the manager of the toys division at Matteler, Inc. Carol is in the process of establishing the budgeted income

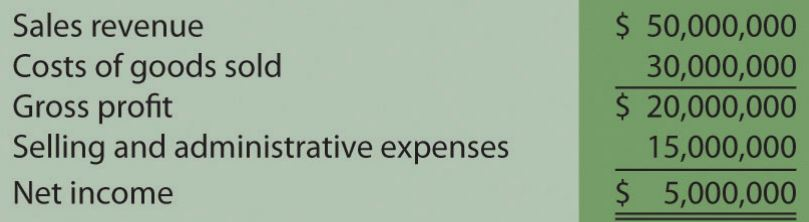

Ethics in Budgeting. Carol Chadwick is the manager of the toys division at Matteler, Inc. Carol is in the process of establishing the budgeted income statement for this coming year, which will be submitted to the company president for approval. The divisions current year actual results were slightly higher than the 5 percent growth Carol had anticipated. These results are shown as follows.

Division managers receive a 20 percent bonus for actual net income in excess of budgeted net income. Carol believes growth in sales this year will be approximately 12 percent. She is considering submitting a budget showing an increase of 5 percent, which will increase her chances of receiving a significant bonus at the end of this coming year. Assume cost of goods sold are variable costs and will increase in proportion with sales revenue. That is, cost of goods sold will always be 60 percent of sales revenue. Assume selling and administrative expenses are fixed costs.

a. Prepare a budgeted income statement for the toys division assuming sales revenue will increase 5 percent.

b. Prepare a budgeted income statement for the toys division assuming sales revenue will increase 12 percent.

c. How much will Carol potentially have to gain in bonus compensation by submitting a budget showing a 5 percent increase in sales revenue if actual growth turns out to be 12 percent?

d. As the president and CEO of Matteler, how might you motivate Carol Chadwick to provide an accurate budgeted income statement?

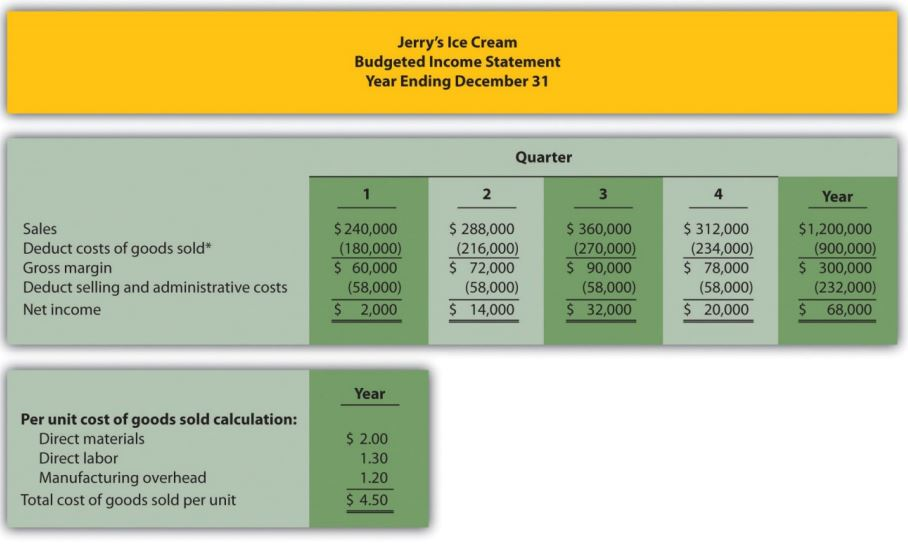

Use this set-up, However, in this problem you are required to complete income statements(above) at various income levels instead of quarters(below).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started