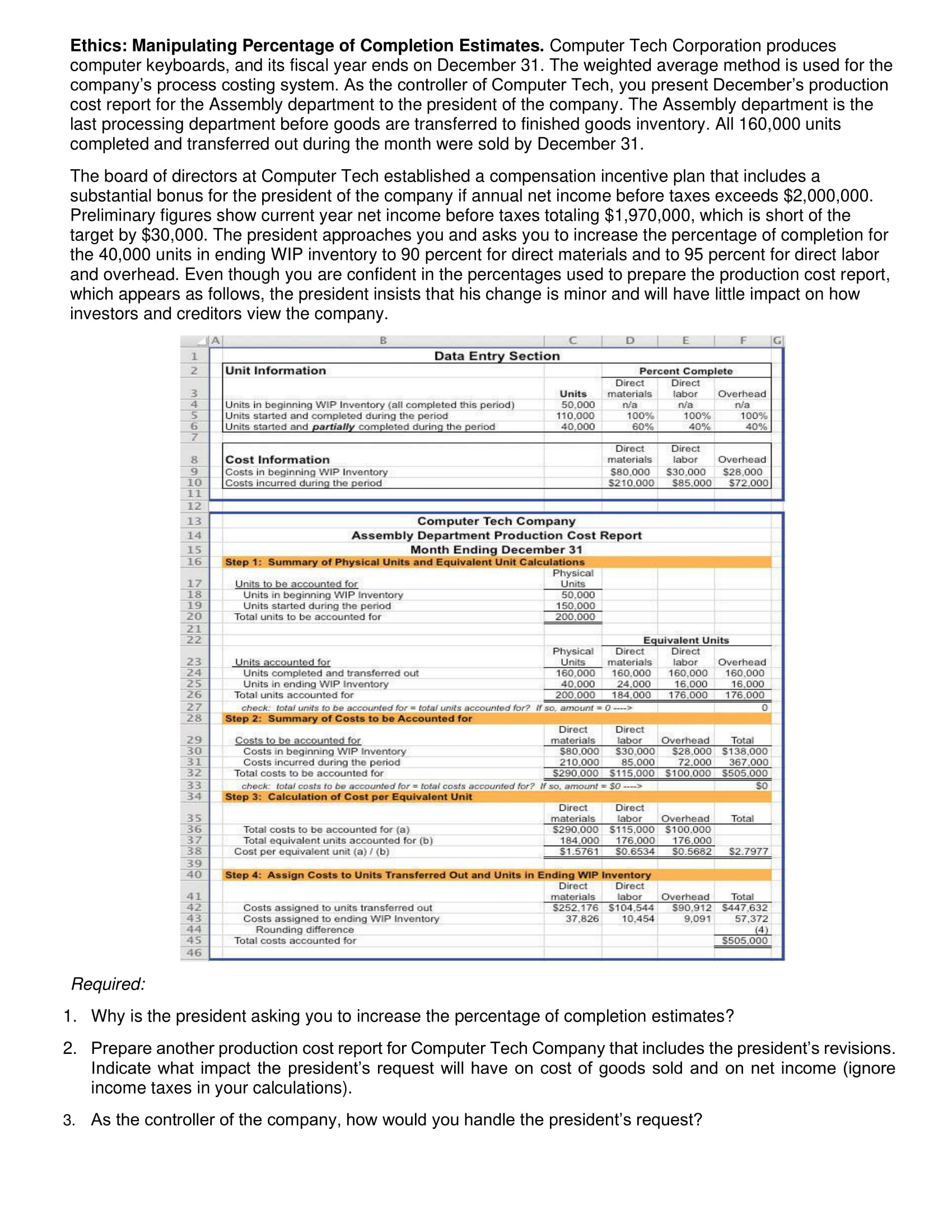

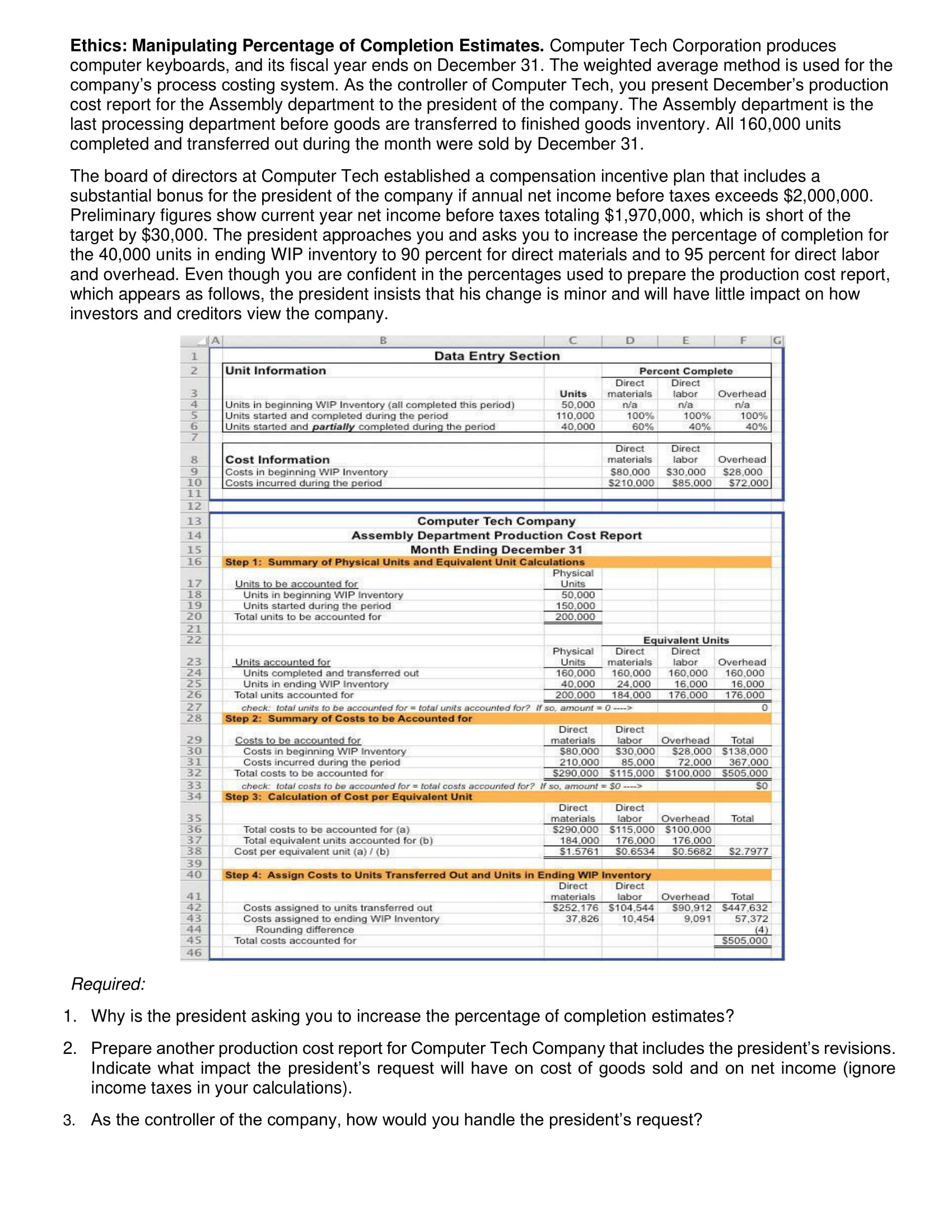

Ethics: Manipulating Percentage of Completion Estimates. Computer Tech Corporation produces computer keyboards, and its fiscal year ends on December 31. The weighted average method is used for the company's process costing system. As the controller of Computer Tech, you present December's production cost report for the Assembly department to the president of the company. The Assembly department is the last processing department before goods are transferred to finished goods inventory. All 160,000 units completed and transferred out during the month were sold by December 31. The board of directors at Computer Tech established a compensation incentive plan that includes a substantial bonus for the president of the company if annual net income before taxes exceeds $2,000,000. Preliminary figures show current year net income before taxes totaling $1,970,000, which is short of the target by $30,000. The president approaches you and asks you to increase the percentage of completion for the 40,000 units in ending WIP inventory to 90 percent for direct materials and to 95 percent for direct labor and overhead. Even though you are confident in the percentages used to prepare the production cost report, which appears as follows, the president insists that his change is minor and will have little impact on how investors and creditors view the company. A D G 1 Data Entry Section Unit Information NOVAWN Percent Complete Direct Direct materials labor Overhead n/a n/a n/a 100% 100% 100% 60% 40% 40% Units 50.000 110.000 40.000 Units in beginning WIP Inventory (all completed this period) Units started and completed during the period Units started and partially completed during the period Cost Information Costs in beginning WIP Inventory Costs incurred during the period Direct materials S80.000 S210.000 Direct labor $30.000 $85.000 Overhead $28.000 $72.000 8 9 10 11 12 13 14 15 16 Computer Tech Company Assembly Department Production Cost Report Month Ending December 31 Step 1: Summary of Physical Units and Equivalent Unit Calculations Physical Units to be accounted for Units Units in beginning WIP Inventory 50.000 Units started during the period 150.000 Total units to be accounted for 200.000 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Equivalent Units Physical Direct Direct Units accounted for Units materials labor Overhead Units completed and transferred out 160.000 160.000 160.000 160.000 Units in ending WIP Inventory 40.000 24.000 16.000 16.000 Total units accounted for 200.000 184.000 176.000 176.000 check: total units to be accounted for = total units accounted for? If so, amount = 0 ----> 0 Step 2: Summary of Costs to be Accounted for Direct Direct Costs to be accounted for materials labor Overhead Total Costs in beginning WIP Inventory $80.000 $30.000 $28.000 $138.000 Costs incurred during the period 210.000 85.000 72.000 367.000 Total costs to be accounted for S290.000 $115,000 $100.000 $505.000 check: total costs to be accounted for = total costs accounted for? If so, amount = $0 ----> SO Step 3: Calculation of Cost per Equivalent Unit Direct Direct materials labor Overhead Total Total costs to be accounted for (a) S290.000 $115.000 S100.000 Total equivalent units accounted for (b) 184.000 176,000 176.000 Cost per equivalent unit (a) / (b) $1.5761 S0.6534 S0.5682 S2.7977 31 32 33 34 35 36 37 38 39 40 41 42 Step 4: Assign Costs to Units Transferred Out and Units in Ending WIP Inventory Direct Direct materials labor Costs assigned to units transferred out S252,176 S104,544 Costs assigned to ending WIP Inventory 37.826 10.454 Rounding difference Total costs accounted for Overhead Total S90.912 $447,632 9,091 57.372 43 44 45 46 S505.000 Required: 1. Why is the president asking you to increase the percentage of completion estimates? 2. Prepare another production cost report for Computer Tech Company that includes the president's revisions. Indicate what impact the president's request will have on cost of goods sold and on net income (ignore income taxes in your calculations). 3. As the controller of the company, how would you handle the president's request? Ethics: Manipulating Percentage of Completion Estimates. Computer Tech Corporation produces computer keyboards, and its fiscal year ends on December 31. The weighted average method is used for the company's process costing system. As the controller of Computer Tech, you present December's production cost report for the Assembly department to the president of the company. The Assembly department is the last processing department before goods are transferred to finished goods inventory. All 160,000 units completed and transferred out during the month were sold by December 31. The board of directors at Computer Tech established a compensation incentive plan that includes a substantial bonus for the president of the company if annual net income before taxes exceeds $2,000,000. Preliminary figures show current year net income before taxes totaling $1,970,000, which is short of the target by $30,000. The president approaches you and asks you to increase the percentage of completion for the 40,000 units in ending WIP inventory to 90 percent for direct materials and to 95 percent for direct labor and overhead. Even though you are confident in the percentages used to prepare the production cost report, which appears as follows, the president insists that his change is minor and will have little impact on how investors and creditors view the company. A D G 1 Data Entry Section Unit Information NOVAWN Percent Complete Direct Direct materials labor Overhead n/a n/a n/a 100% 100% 100% 60% 40% 40% Units 50.000 110.000 40.000 Units in beginning WIP Inventory (all completed this period) Units started and completed during the period Units started and partially completed during the period Cost Information Costs in beginning WIP Inventory Costs incurred during the period Direct materials S80.000 S210.000 Direct labor $30.000 $85.000 Overhead $28.000 $72.000 8 9 10 11 12 13 14 15 16 Computer Tech Company Assembly Department Production Cost Report Month Ending December 31 Step 1: Summary of Physical Units and Equivalent Unit Calculations Physical Units to be accounted for Units Units in beginning WIP Inventory 50.000 Units started during the period 150.000 Total units to be accounted for 200.000 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Equivalent Units Physical Direct Direct Units accounted for Units materials labor Overhead Units completed and transferred out 160.000 160.000 160.000 160.000 Units in ending WIP Inventory 40.000 24.000 16.000 16.000 Total units accounted for 200.000 184.000 176.000 176.000 check: total units to be accounted for = total units accounted for? If so, amount = 0 ----> 0 Step 2: Summary of Costs to be Accounted for Direct Direct Costs to be accounted for materials labor Overhead Total Costs in beginning WIP Inventory $80.000 $30.000 $28.000 $138.000 Costs incurred during the period 210.000 85.000 72.000 367.000 Total costs to be accounted for S290.000 $115,000 $100.000 $505.000 check: total costs to be accounted for = total costs accounted for? If so, amount = $0 ----> SO Step 3: Calculation of Cost per Equivalent Unit Direct Direct materials labor Overhead Total Total costs to be accounted for (a) S290.000 $115.000 S100.000 Total equivalent units accounted for (b) 184.000 176,000 176.000 Cost per equivalent unit (a) / (b) $1.5761 S0.6534 S0.5682 S2.7977 31 32 33 34 35 36 37 38 39 40 41 42 Step 4: Assign Costs to Units Transferred Out and Units in Ending WIP Inventory Direct Direct materials labor Costs assigned to units transferred out S252,176 S104,544 Costs assigned to ending WIP Inventory 37.826 10.454 Rounding difference Total costs accounted for Overhead Total S90.912 $447,632 9,091 57.372 43 44 45 46 S505.000 Required: 1. Why is the president asking you to increase the percentage of completion estimates? 2. Prepare another production cost report for Computer Tech Company that includes the president's revisions. Indicate what impact the president's request will have on cost of goods sold and on net income (ignore income taxes in your calculations). 3. As the controller of the company, how would you handle the president's request