Answered step by step

Verified Expert Solution

Question

1 Approved Answer

eTiling is a tiling business that started six months ago. It is owned and run by a gentleman named Alan border. He has set

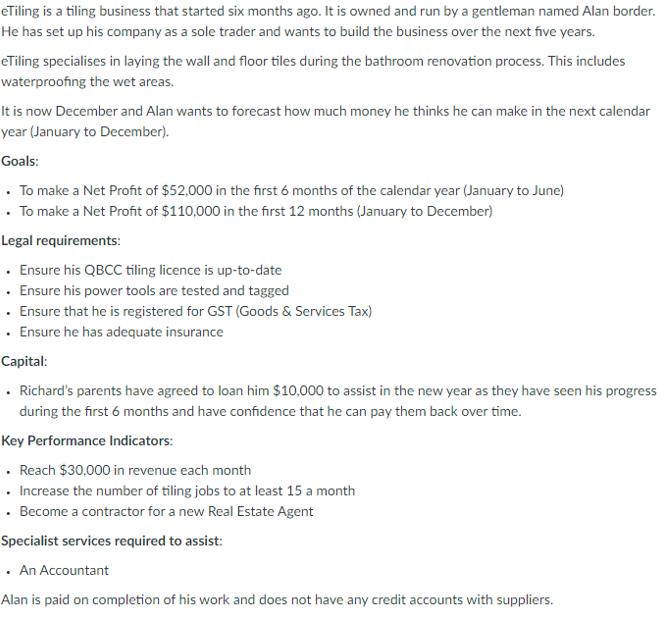

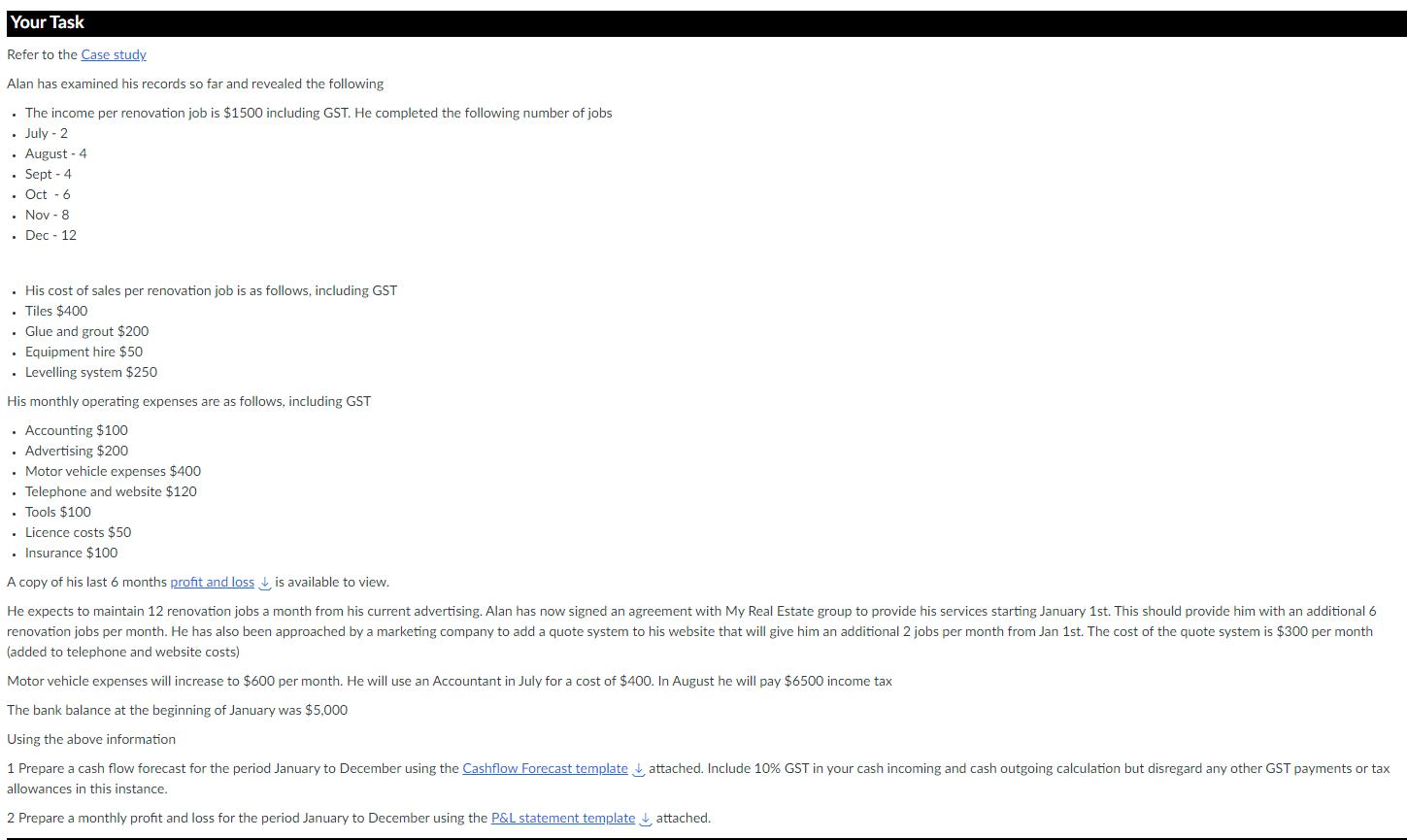

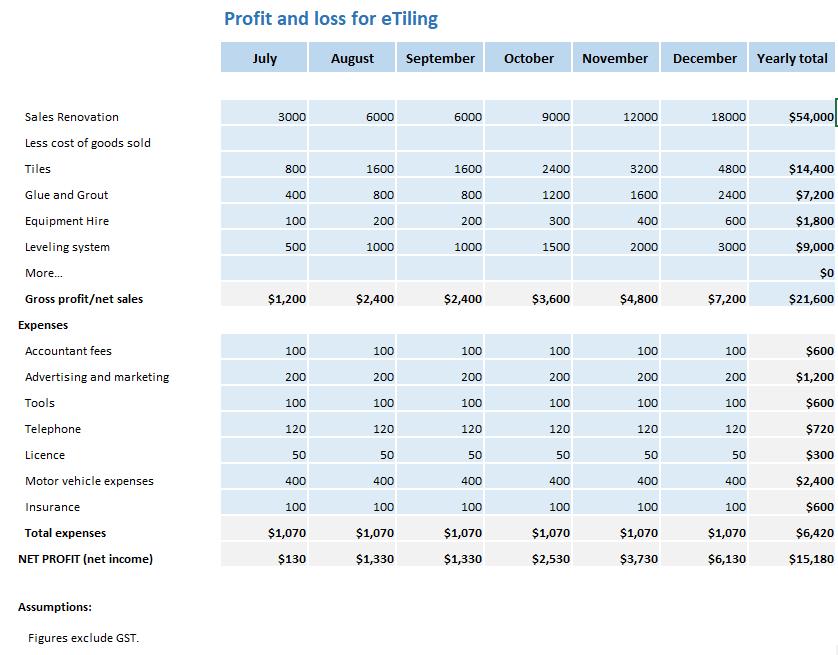

eTiling is a tiling business that started six months ago. It is owned and run by a gentleman named Alan border. He has set up his company as a sole trader and wants to build the business over the next five years. eTiling specialises in laying the wall and floor tiles during the bathroom renovation process. This includes waterproofing the wet areas. It is now December and Alan wants to forecast how much money he thinks he can make in the next calendar year (January to December). Goals: To make a Net Profit of $52,000 in the first 6 months of the calendar year (January to June) . To make a Net Profit of $110,000 in the first 12 months (January to December) Legal requirements: Ensure his QBCC tiling licence is up-to-date Ensure his power tools are tested and tagged Ensure that he is registered for GST (Goods & Services Tax) Ensure he has adequate insurance Capital: . Richard's parents have agreed to loan him $10,000 to assist in the new year as they have seen his progress during the first 6 months and have confidence that he can pay them back over time. Key Performance Indicators: Reach $30,000 in revenue each month Increase the number of tiling jobs to at least 15 a month Become a contractor for a new Real Estate Agent Specialist services required to assist: . An Accountant Alan is paid on completion of his work and does not have any credit accounts with suppliers. Your Task Refer to the Case study Alan has examined his records so far and revealed the following . The income per renovation job is $1500 including GST. He completed the following number of jobs July - 2 . August - 4 . Sept-4. . Oct - 6 .Nov-8 . Dec - 12 . His cost of sales per renovation job is as follows, including GST . Tiles $400 . Glue and grout $200 . Equipment hire $50. . Levelling system $250 His monthly operating expenses are as follows, including GST Accounting $100 . Advertising $200 . Motor vehicle expenses $400 . Telephone and website $120 Tools $100 . Licence costs $50 . Insurance $100 A copy of his last 6 months profit and loss is available to view. He expects to maintain 12 renovation jobs a month from his current advertising. Alan has now signed an agreement with My Real Estate group to provide his services starting January 1st. This should provide him with an additional 6 renovation jobs per month. He has also been approached by a marketing company to add a quote system to his website that will give him an additional 2 jobs per month from Jan 1st. The cost of the quote system is $300 per month (added to telephone and website costs) Motor vehicle expenses will increase to $600 per month. He will use an Accountant in July for a cost of $400. In August he will pay $6500 income tax The bank balance at the beginning of January was $5,000 Using the above information 1 Prepare a cash flow forecast for the period January to December using the Cashflow Forecast template attached. Include 10% GST in your cash incoming and cash outgoing calculation but disregard any other GST payments or tax allowances in this instance. 2 Prepare a monthly profit and loss for the period January to December using the P&L statement template attached. Sales Renovation Less cost of goods sold Tiles Glue and Grout Equipment Hire Leveling system More... Gross profit/net sales Expenses Accountant fees Advertising and marketing Tools Telephone Licence Motor vehicle expenses Insurance Total expenses NET PROFIT (net income) Assumptions: Figures exclude GST. Profit and loss for eTiling August July 3000 800 400 100 500 $1,200 100 200 100 120 50 400 100 $1,070 $130 6000 1600 800 200 1000 $2,400 100 200 100 120 50 400 100 $1,070 $1,330 September 6000 1600 800 200 1000 $2,400 100 200 100 120 50 400 100 $1,070 $1,330 October November December Yearly total 9000 2400 1200 300 1500 $3,600 100 200 100 120 50 400 100 $1,070 $2,530 12000 3200 1600 400 2000 $4,800 100 200 100 120 50 400 100 $1,070 $3,730 18000 4800 2400 600 3000 $7,200 100 200 100 120 50 400 100 $1,070 $6,130 $54,000 $14,400 $7,200 $1,800 $9,000 $0 $21,600 $600 $1,200 $600 $720 $300 $2,400 $600 $6,420 $15,180

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Steps Step 1 of 2 Balance sheet items of Bob the Builder Pty Ltd is given below Cash 125632 Petty ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started