Question

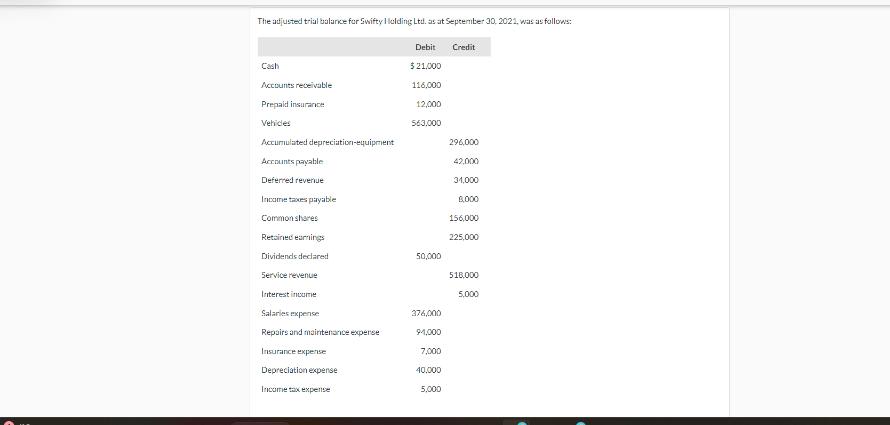

Prepare the closing entries at september 30 The adjusted trial balance for Swifty Holding Ltd. as at September 30, 2021, was as follows: Cash Accounts

The adjusted trial balance for Swifty Holding Ltd. as at September 30, 2021, was as follows: Cash Accounts receivable Prepaid insurance Vehicles Accumulated depreciation-equipment Accounts payable Deferred revenue Income taxes payable Common shares Retained earnings Dividends declared Service revenue Interest income Salaries expense Repairs and maintenance expense Insurance expense Depreciation expense Income tax expense Debit $ 21,000 116,000 12,000 563.000 50,000 376,000 94,000 7,000 40.000 5.000 Credit 296,000 42,000 31,000 8,000 156,000 225,000 518,000 5,000

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the closing entries on September 30 we need to transfer the balances of all temporary acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

7th Canadian Edition Volume 1

1119048508, 978-1119048503

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App