Answered step by step

Verified Expert Solution

Question

1 Approved Answer

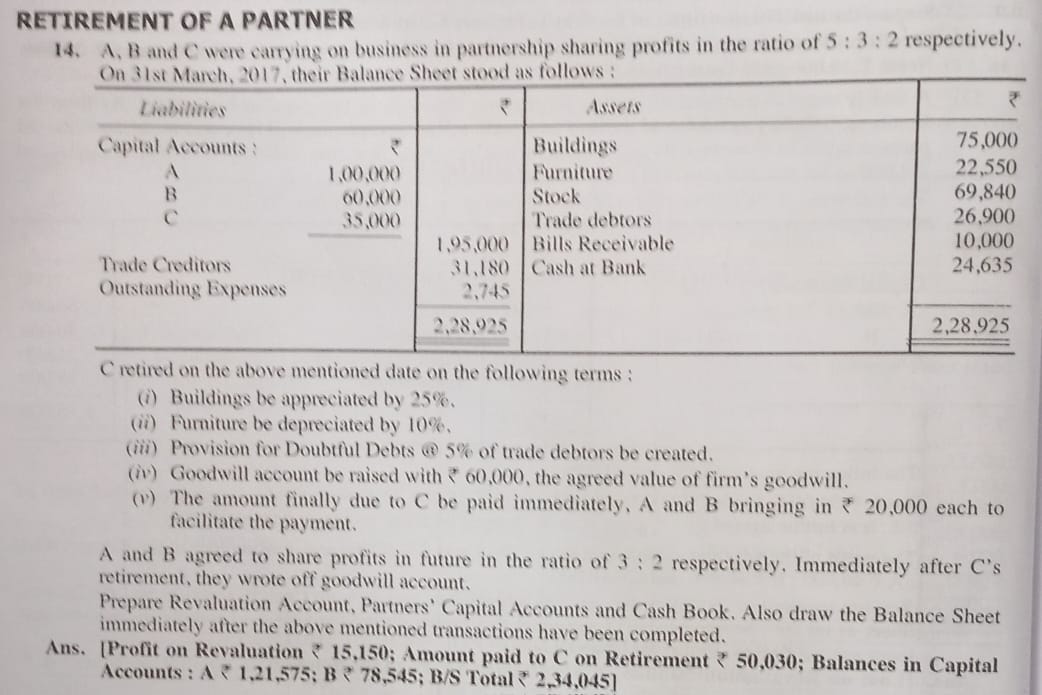

ETIREMENT OF A PARTNER 14. A, B and C were carrying on business in partnership sharing profits in the ratio of 5:3:2 respectively. On ilst

ETIREMENT OF A PARTNER 14. A, B and C were carrying on business in partnership sharing profits in the ratio of 5:3:2 respectively. On ilst Mank 017 , their Ralanes Sheot stood as follows: Cretired on the above mentioned date on the following terms : (i) Buildings be appreciated by 25%, (ii) Furniture be depreciated by 10%, (iii) Provision for Doubtrul Debts (*) 5% of trade debrors be created. (iv) Goodwill account be raised with 00,000 , the agreed value of firm's goodwill. (v) The amount fimally due to C be pad immediately, A and B bringing in 20,000 each to facilitate the payment. A and B agreed to share profits in tuture in the ratio of 3:2 respectively, Immediately after C's retirement, they wrote off goodwill account. Prepare Revaluation Account, Partners' Capital Accounts and Cash Book. Also draw the Balance Sheet immediately after the above mentioned transactions have been completed. Ans. [Profit on Revaluation 15,150; Amount paid to C on Retirement 50,030; Balances in Capital Accounts: A

ETIREMENT OF A PARTNER 14. A, B and C were carrying on business in partnership sharing profits in the ratio of 5:3:2 respectively. On ilst Mank 017 , their Ralanes Sheot stood as follows: Cretired on the above mentioned date on the following terms : (i) Buildings be appreciated by 25%, (ii) Furniture be depreciated by 10%, (iii) Provision for Doubtrul Debts (*) 5% of trade debrors be created. (iv) Goodwill account be raised with 00,000 , the agreed value of firm's goodwill. (v) The amount fimally due to C be pad immediately, A and B bringing in 20,000 each to facilitate the payment. A and B agreed to share profits in tuture in the ratio of 3:2 respectively, Immediately after C's retirement, they wrote off goodwill account. Prepare Revaluation Account, Partners' Capital Accounts and Cash Book. Also draw the Balance Sheet immediately after the above mentioned transactions have been completed. Ans. [Profit on Revaluation 15,150; Amount paid to C on Retirement 50,030; Balances in Capital Accounts: A Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started