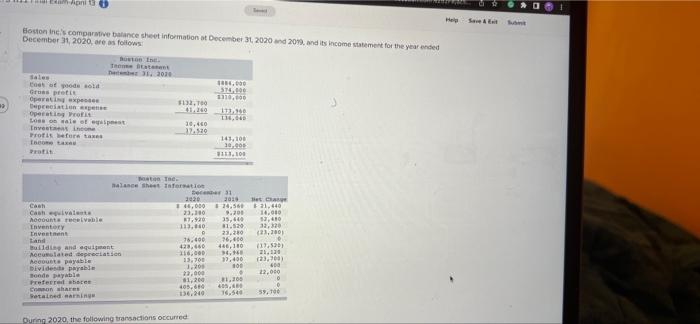

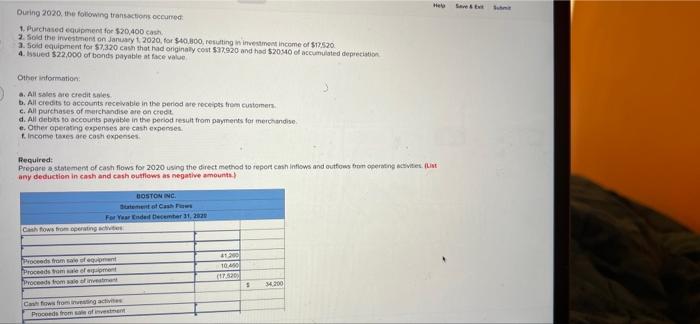

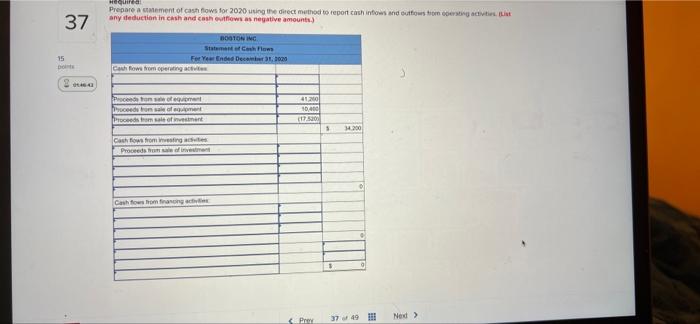

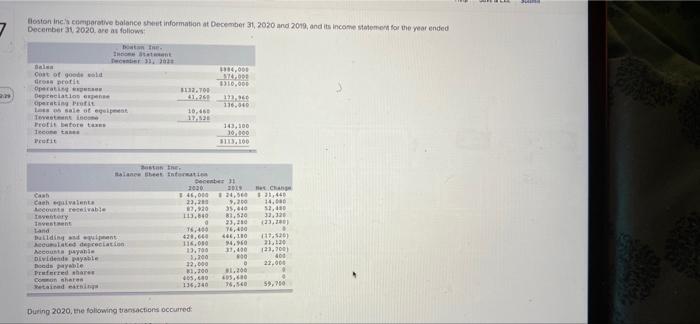

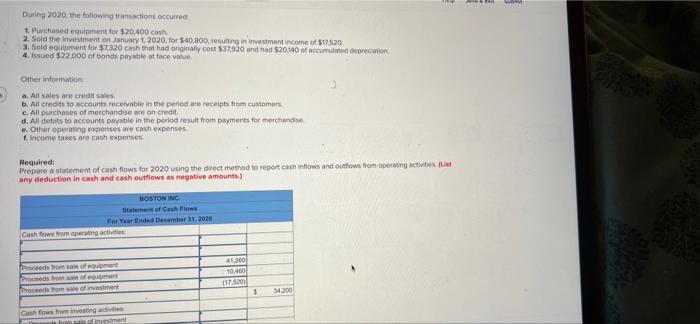

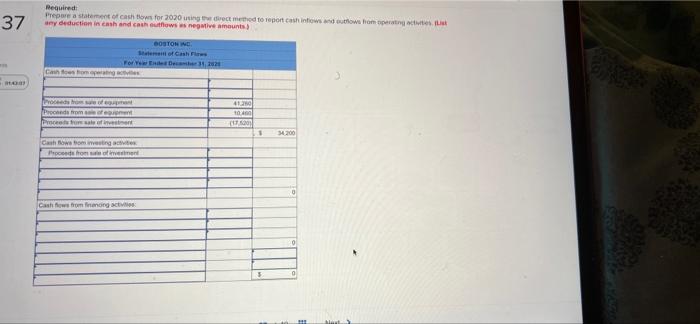

Etudy w O Help SA Bostonines comparte balance sheet information December 31, 2020 and 20% des comment for the year ended December 31, 2020, are as follows: TOE TE 0.000 5.00 Trent Sales boto pode sota Grus preti Operating Depreciation are Operatin Profit Los on le of west The in Protis fors taxes de 133,10 12.10 20,460 32.520 141.100 30,00 9113.100 The. aluse she formation Dec 31 2020 Cash 2010 14.000 19.5 21.40 Casuvate 23.119 .200 14,010 hout recevable 17.920 25,600 93,10 Inventory 113.10 32,20 thentet 23,20 (21,200 tan 78.400 26,400 haldi and quiet 423,660 486,110 12.530) Melated depreciation 216.000 Acute payable 13.700 >>.450 123,700 Divideda payable 100 600 onde pale 22.000 Preferral boce $1,200 1,106 Con whes 403.60 40. retained in 59,00 SOT 22.000 O During 2020 the following transactions occurred Seneste During 2020, the following transactions occurred 1. Purchased equipment for $20,400 cash 2. Sold the investment on January 2020. for $40,800, resulting in investment income of $12.520 3. Sold equipment for $7.320 cash that had originally cost $37920 and had $20940 et accumulated depreciation 4. Issued $22.000 of bonds payable at face value Other information: a. All sales are credit sales b. All credits to accounts receivable in the period are receipts from customers c. All purchases of merchandise are on credit d. All debits to accounts payable in the period result from payments for merchandise e. Other operating expenses are cash expenses 1. Income taxes are cash expenses Required: Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outlows bon operating activities. ILI any deduction in cash and cash outflows as negative amounts BOSTON INC Bent of Cash For Vendet ecember 11, 2020 Cash flows from operating Proceeds from sout Proceeds tromae funt Proceeds from we fine 1200 10 (17.520 S 4200 Cafows fronting active Procords from all of investment Hequired Prepare a statement of cash flows for 2020 using the direct method to report cash indows and customers as any deduction in cash and cash flows as negative amounts) 37 TONING StatCash Flow For Ye Ended Dec, 15 De 8 mm Petons Phoebron samt Proceeds from salesman 41200 10.00 (17.520 $ 200 Cashows from Procesorem Cash from frang 3749 Ned > P 7 Boston Inc.'s comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020. are as follows: Dome Tot Balea Out of de ved HHH PE f| Operatin Depreciation en Operating Pit sale otels Tweetenine Profit before te conta Prati 10LT 1384,000 190.000 10.000 12 170.04 01.26 10,660 12.13 143,100 30.000 3113.100 DES CH 31,460 14.00 52,400 32.32 23.2 Caut Canh ta va | | | Accounts receivable try Invest Land Didingen med depreciation count wahl Dividende pale Doods payable Praterred share Coro share tad en THE e sheets Dosbe 30 45,000 34,5 23,20 9.200 35,40 113.640 81,510 23,10 16.40 76,00 48. 446, 110 116.00 94, 950 13.700 11,400 3.00 12.000 1,700 1.200 105,640 605.10 136.40 412.5201 21.12 23.00 400 22.000 008 59,750 During 2020, the following transactions occurred During 2020, the following transactions occurred 1. Purchased equipment for $20,400 cach 2. Sold the investment on January 1, 2020, for $40,800, in investment income of $12.520 3. Sold equipment for $7320 cash that had originally cost $37920 and had $20.540 of the depreciation 4. Issued $22.000 of bonds payable at face value Other information All sales are credit sales b. All credits to accounts receivable in the period are receipts from customers c. All purchases of merchandise are on credit d. All debits to accounts payable in the period result from payments for merchandise e. Other operating expenses are cash expenses income taxes are cash expenses Required: Prepare a statement of cash flows for 2020 using the direct method to report can inflows and outflows from opening activities List any deduction in cash and cash outflows as negative amounts.) BOSTON INC Statement of Cash Flows For Year Ended December 31, 2020 Cash fows from operating activities Proceeds from sale of Pred rose of upmark Proceeds from sofinstant 41.200 10.40 11740 3 4200 Cash flows from investing a end 37 Required Prepare a statement of cash flow for 2020 using the dece method to report casinows and strows from the any deduction in cash and cash outflows us negative amounts) BOSTON of Cash For D1021 Proches from a Por sale of instant 412 104 (1760 1 34200 Caming Pocode from man Cashflows from nong at Etudy w O Help SA Bostonines comparte balance sheet information December 31, 2020 and 20% des comment for the year ended December 31, 2020, are as follows: TOE TE 0.000 5.00 Trent Sales boto pode sota Grus preti Operating Depreciation are Operatin Profit Los on le of west The in Protis fors taxes de 133,10 12.10 20,460 32.520 141.100 30,00 9113.100 The. aluse she formation Dec 31 2020 Cash 2010 14.000 19.5 21.40 Casuvate 23.119 .200 14,010 hout recevable 17.920 25,600 93,10 Inventory 113.10 32,20 thentet 23,20 (21,200 tan 78.400 26,400 haldi and quiet 423,660 486,110 12.530) Melated depreciation 216.000 Acute payable 13.700 >>.450 123,700 Divideda payable 100 600 onde pale 22.000 Preferral boce $1,200 1,106 Con whes 403.60 40. retained in 59,00 SOT 22.000 O During 2020 the following transactions occurred Seneste During 2020, the following transactions occurred 1. Purchased equipment for $20,400 cash 2. Sold the investment on January 2020. for $40,800, resulting in investment income of $12.520 3. Sold equipment for $7.320 cash that had originally cost $37920 and had $20940 et accumulated depreciation 4. Issued $22.000 of bonds payable at face value Other information: a. All sales are credit sales b. All credits to accounts receivable in the period are receipts from customers c. All purchases of merchandise are on credit d. All debits to accounts payable in the period result from payments for merchandise e. Other operating expenses are cash expenses 1. Income taxes are cash expenses Required: Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outlows bon operating activities. ILI any deduction in cash and cash outflows as negative amounts BOSTON INC Bent of Cash For Vendet ecember 11, 2020 Cash flows from operating Proceeds from sout Proceeds tromae funt Proceeds from we fine 1200 10 (17.520 S 4200 Cafows fronting active Procords from all of investment Hequired Prepare a statement of cash flows for 2020 using the direct method to report cash indows and customers as any deduction in cash and cash flows as negative amounts) 37 TONING StatCash Flow For Ye Ended Dec, 15 De 8 mm Petons Phoebron samt Proceeds from salesman 41200 10.00 (17.520 $ 200 Cashows from Procesorem Cash from frang 3749 Ned > P 7 Boston Inc.'s comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020. are as follows: Dome Tot Balea Out of de ved HHH PE f| Operatin Depreciation en Operating Pit sale otels Tweetenine Profit before te conta Prati 10LT 1384,000 190.000 10.000 12 170.04 01.26 10,660 12.13 143,100 30.000 3113.100 DES CH 31,460 14.00 52,400 32.32 23.2 Caut Canh ta va | | | Accounts receivable try Invest Land Didingen med depreciation count wahl Dividende pale Doods payable Praterred share Coro share tad en THE e sheets Dosbe 30 45,000 34,5 23,20 9.200 35,40 113.640 81,510 23,10 16.40 76,00 48. 446, 110 116.00 94, 950 13.700 11,400 3.00 12.000 1,700 1.200 105,640 605.10 136.40 412.5201 21.12 23.00 400 22.000 008 59,750 During 2020, the following transactions occurred During 2020, the following transactions occurred 1. Purchased equipment for $20,400 cach 2. Sold the investment on January 1, 2020, for $40,800, in investment income of $12.520 3. Sold equipment for $7320 cash that had originally cost $37920 and had $20.540 of the depreciation 4. Issued $22.000 of bonds payable at face value Other information All sales are credit sales b. All credits to accounts receivable in the period are receipts from customers c. All purchases of merchandise are on credit d. All debits to accounts payable in the period result from payments for merchandise e. Other operating expenses are cash expenses income taxes are cash expenses Required: Prepare a statement of cash flows for 2020 using the direct method to report can inflows and outflows from opening activities List any deduction in cash and cash outflows as negative amounts.) BOSTON INC Statement of Cash Flows For Year Ended December 31, 2020 Cash fows from operating activities Proceeds from sale of Pred rose of upmark Proceeds from sofinstant 41.200 10.40 11740 3 4200 Cash flows from investing a end 37 Required Prepare a statement of cash flow for 2020 using the dece method to report casinows and strows from the any deduction in cash and cash outflows us negative amounts) BOSTON of Cash For D1021 Proches from a Por sale of instant 412 104 (1760 1 34200 Caming Pocode from man Cashflows from nong at