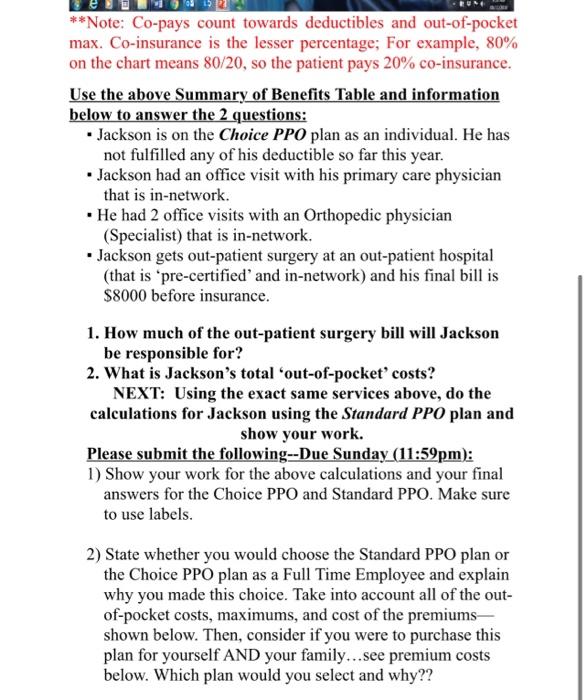

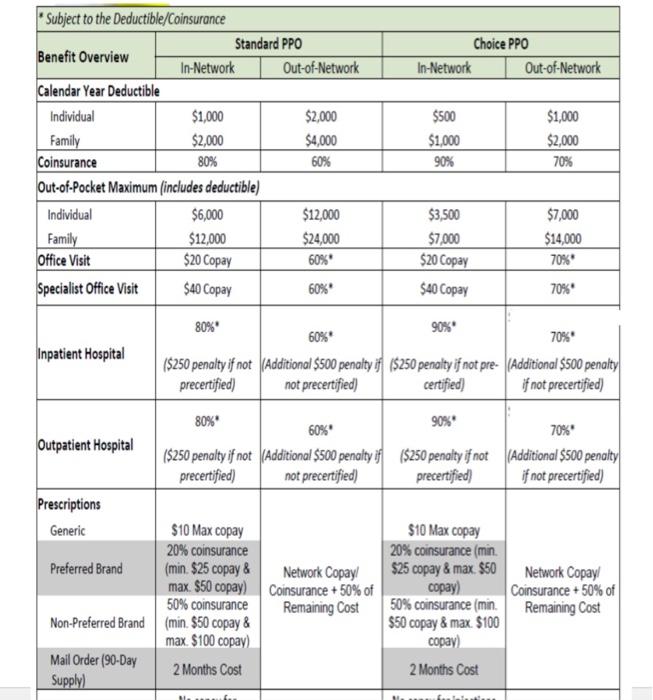

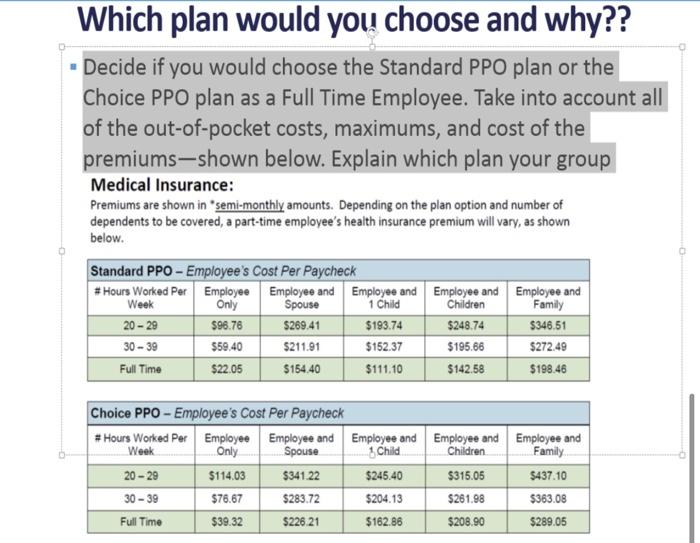

eu **Note: Co-pays count towards deductibles and out-of-pocket max. Co-insurance is the lesser percentage; For example, 80% on the chart means 80/20, so the patient pays 20% co-insurance. Use the above Summary of Benefits Table and information below to answer the 2 questions: Jackson is on the Choice PPO plan as an individual. He has not fulfilled any of his deductible so far this year. Jackson had an office visit with his primary care physician that is in-network. He had 2 office visits with an Orthopedic physician (Specialist) that is in-network. Jackson gets out-patient surgery at an out-patient hospital (that is 'pre-certified' and in-network) and his final bill is $8000 before insurance. 1. How much of the out-patient surgery bill will Jackson be responsible for? 2. What is Jackson's total 'out-of-pocket' costs? NEXT: Using the exact same services above, do the calculations for Jackson using the Standard PPO plan and show your work. Please submit the following--Due Sunday (11:59pm): 1) Show your work for the above calculations and your final answers for the Choice PPO and Standard PPO. Make sure to use labels. 2) State whether you would choose the Standard PPO plan or the Choice PPO plan as a Full Time Employee and explain why you made this choice. Take into account all of the out- of-pocket costs, maximums, and cost of the premiums- shown below. Then, consider if you were to purchase this plan for yourself AND your family...see premium costs below. Which plan would you select and why?? *Subject to the Deductible/Coinsurance Benefit Overview Calendar Year Deductible Individual Family Coinsurance Out-of-Pocket Maximum (includes deductible) Individual Family Office Visit Specialist Office Visit Inpatient Hospital Outpatient Hospital Prescriptions Generic Preferred Brand Non-Preferred Brand Mail Order (90-Day Supply) In-Network $1,000 $2,000 80% Standard PPO $6,000 $12,000 $20 Copay $40 Copay 80%* Out-of-Network $10 Max copay 20% coinsurance (min. $25 copay & max. $50 copay) 50% coinsurance (min. $50 copay & max. $100 copay) 2 Months Cost N $2,000 $4,000 60% $12,000 $24,000 60%* 60%* $3,500 $7,000 $20 Copay $40 Copay 90%* 60%* 70%* ($250 penalty if not (Additional $500 penalty if ($250 penalty if not pre- (Additional $500 penalty precertified) not precertified) certified) if not precertified) 80%* 60%* ($250 penalty if not (Additional $500 penalty if ($250 penalty if not precertified) not precertified) precertified) Network Copayl Coinsurance +50% of Remaining Cost In-Network $500 $1,000 90% Choice PPO 90%* Out-of-Network $10 Max copay 20% coinsurance (min. $25 copay & max. $50 copay) 50% coinsurance (min. $50 copay & max. $100 copay) 2 Months Cost $1,000 $2,000 70% $7,000 $14,000 70%* 70%* 70%* (Additional $500 penalty if not precertified) Network Copayl Coinsurance +50% of Remaining Cost Which plan would you choose and why?? Decide if you would choose the Standard PPO plan or the Choice PPO plan as a Full Time Employee. Take into account all of the out-of-pocket costs, maximums, and cost of the premiums-shown below. Explain which plan your group Medical Insurance: Premiums are shown in "semi-monthly amounts. Depending on the plan option and number of dependents to be covered, a part-time employee's health insurance premium will vary, as shown below. Standard PPO - Employee's Cost Per Paycheck # Hours Worked Per Employee Employee and Week Only Spouse 20-29 $96.76 $269.41 30-39 $59.40 $211.91 Full Time $22.05 $154.40 Choice PPO-Employee's Cost Per Paycheck # Hours Worked Per Employee Employee and Week Only Spouse 20-29 $114.03 $341.22 30-39 $76.67 $283.72 $39.32 $226.21 Full Time Employee and 1 Child $193.74 $152.37 $111.10 Employee and Child $245.40 $204.13 $162.86 Employee and Employee and Children Family $248.74 $346.51 $195.66 $272.49 $142.58 $198.46 Employee and Children $315.05 $261.98 $208.90 Employee and Family $437.10 $363.08 $289.05 eu **Note: Co-pays count towards deductibles and out-of-pocket max. Co-insurance is the lesser percentage; For example, 80% on the chart means 80/20, so the patient pays 20% co-insurance. Use the above Summary of Benefits Table and information below to answer the 2 questions: Jackson is on the Choice PPO plan as an individual. He has not fulfilled any of his deductible so far this year. Jackson had an office visit with his primary care physician that is in-network. He had 2 office visits with an Orthopedic physician (Specialist) that is in-network. Jackson gets out-patient surgery at an out-patient hospital (that is 'pre-certified' and in-network) and his final bill is $8000 before insurance. 1. How much of the out-patient surgery bill will Jackson be responsible for? 2. What is Jackson's total 'out-of-pocket' costs? NEXT: Using the exact same services above, do the calculations for Jackson using the Standard PPO plan and show your work. Please submit the following--Due Sunday (11:59pm): 1) Show your work for the above calculations and your final answers for the Choice PPO and Standard PPO. Make sure to use labels. 2) State whether you would choose the Standard PPO plan or the Choice PPO plan as a Full Time Employee and explain why you made this choice. Take into account all of the out- of-pocket costs, maximums, and cost of the premiums- shown below. Then, consider if you were to purchase this plan for yourself AND your family...see premium costs below. Which plan would you select and why?? *Subject to the Deductible/Coinsurance Benefit Overview Calendar Year Deductible Individual Family Coinsurance Out-of-Pocket Maximum (includes deductible) Individual Family Office Visit Specialist Office Visit Inpatient Hospital Outpatient Hospital Prescriptions Generic Preferred Brand Non-Preferred Brand Mail Order (90-Day Supply) In-Network $1,000 $2,000 80% Standard PPO $6,000 $12,000 $20 Copay $40 Copay 80%* Out-of-Network $10 Max copay 20% coinsurance (min. $25 copay & max. $50 copay) 50% coinsurance (min. $50 copay & max. $100 copay) 2 Months Cost N $2,000 $4,000 60% $12,000 $24,000 60%* 60%* $3,500 $7,000 $20 Copay $40 Copay 90%* 60%* 70%* ($250 penalty if not (Additional $500 penalty if ($250 penalty if not pre- (Additional $500 penalty precertified) not precertified) certified) if not precertified) 80%* 60%* ($250 penalty if not (Additional $500 penalty if ($250 penalty if not precertified) not precertified) precertified) Network Copayl Coinsurance +50% of Remaining Cost In-Network $500 $1,000 90% Choice PPO 90%* Out-of-Network $10 Max copay 20% coinsurance (min. $25 copay & max. $50 copay) 50% coinsurance (min. $50 copay & max. $100 copay) 2 Months Cost $1,000 $2,000 70% $7,000 $14,000 70%* 70%* 70%* (Additional $500 penalty if not precertified) Network Copayl Coinsurance +50% of Remaining Cost Which plan would you choose and why?? Decide if you would choose the Standard PPO plan or the Choice PPO plan as a Full Time Employee. Take into account all of the out-of-pocket costs, maximums, and cost of the premiums-shown below. Explain which plan your group Medical Insurance: Premiums are shown in "semi-monthly amounts. Depending on the plan option and number of dependents to be covered, a part-time employee's health insurance premium will vary, as shown below. Standard PPO - Employee's Cost Per Paycheck # Hours Worked Per Employee Employee and Week Only Spouse 20-29 $96.76 $269.41 30-39 $59.40 $211.91 Full Time $22.05 $154.40 Choice PPO-Employee's Cost Per Paycheck # Hours Worked Per Employee Employee and Week Only Spouse 20-29 $114.03 $341.22 30-39 $76.67 $283.72 $39.32 $226.21 Full Time Employee and 1 Child $193.74 $152.37 $111.10 Employee and Child $245.40 $204.13 $162.86 Employee and Employee and Children Family $248.74 $346.51 $195.66 $272.49 $142.58 $198.46 Employee and Children $315.05 $261.98 $208.90 Employee and Family $437.10 $363.08 $289.05