Question

Eugene Company has inventory it purchased for $6,000. It sells the inventory to a customer for $10,000, including installation. Installation sold separately costs $1,000

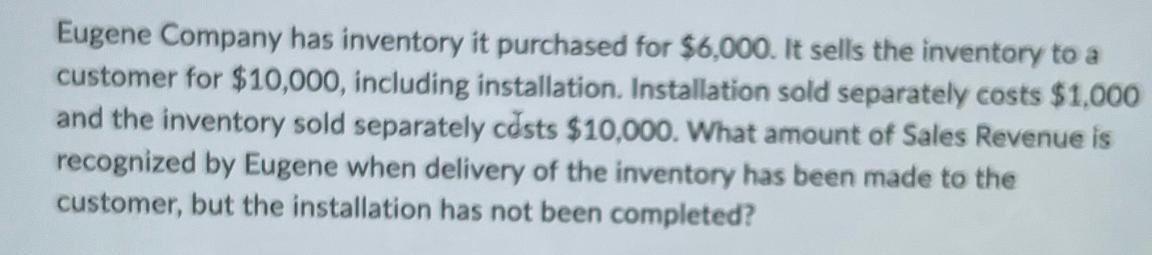

Eugene Company has inventory it purchased for $6,000. It sells the inventory to a customer for $10,000, including installation. Installation sold separately costs $1,000 and the inventory sold separately costs $10,000. What amount of Sales Revenue is recognized by Eugene when delivery of the inventory has been made to the customer, but the installation has not been completed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

When delivery of the inventory has been made to the customer b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles Part 3

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Kinnear, Joan E. Barlow

6th Canadian edition Volume 1

1118306805, 978-1118306802

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App