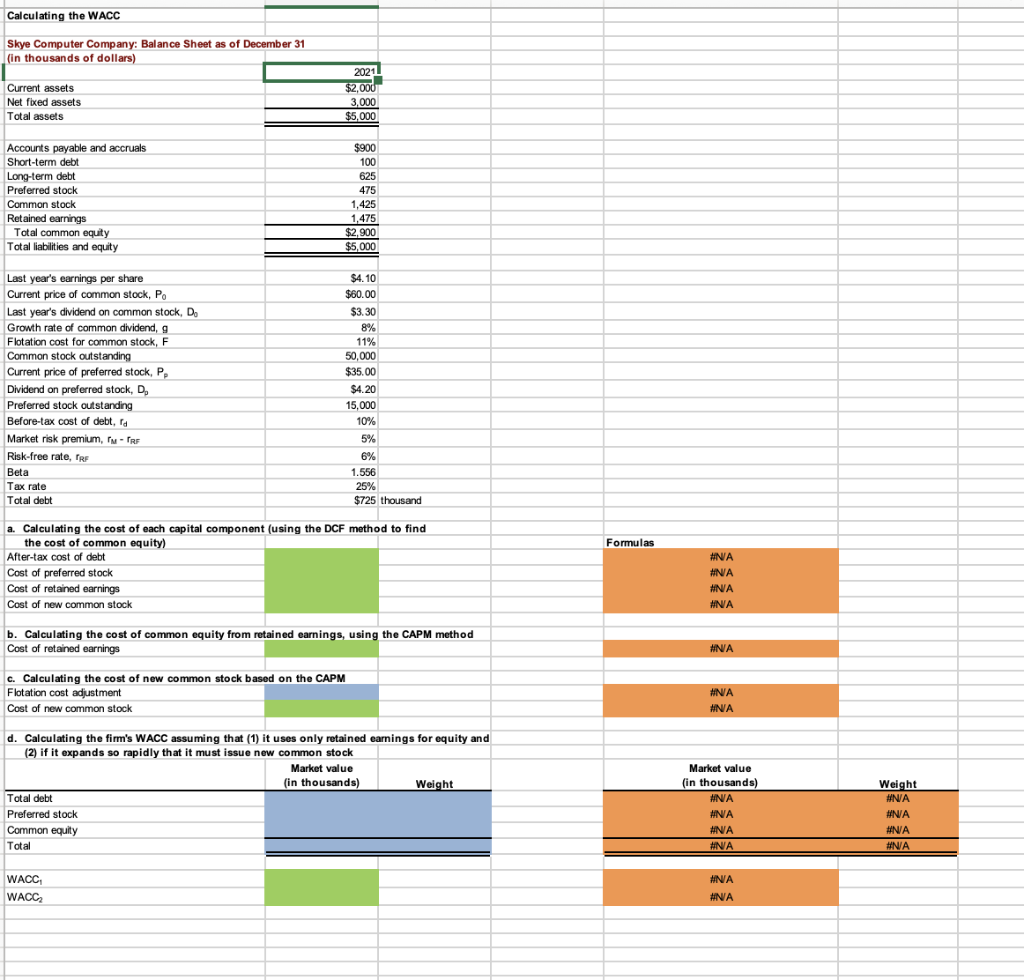

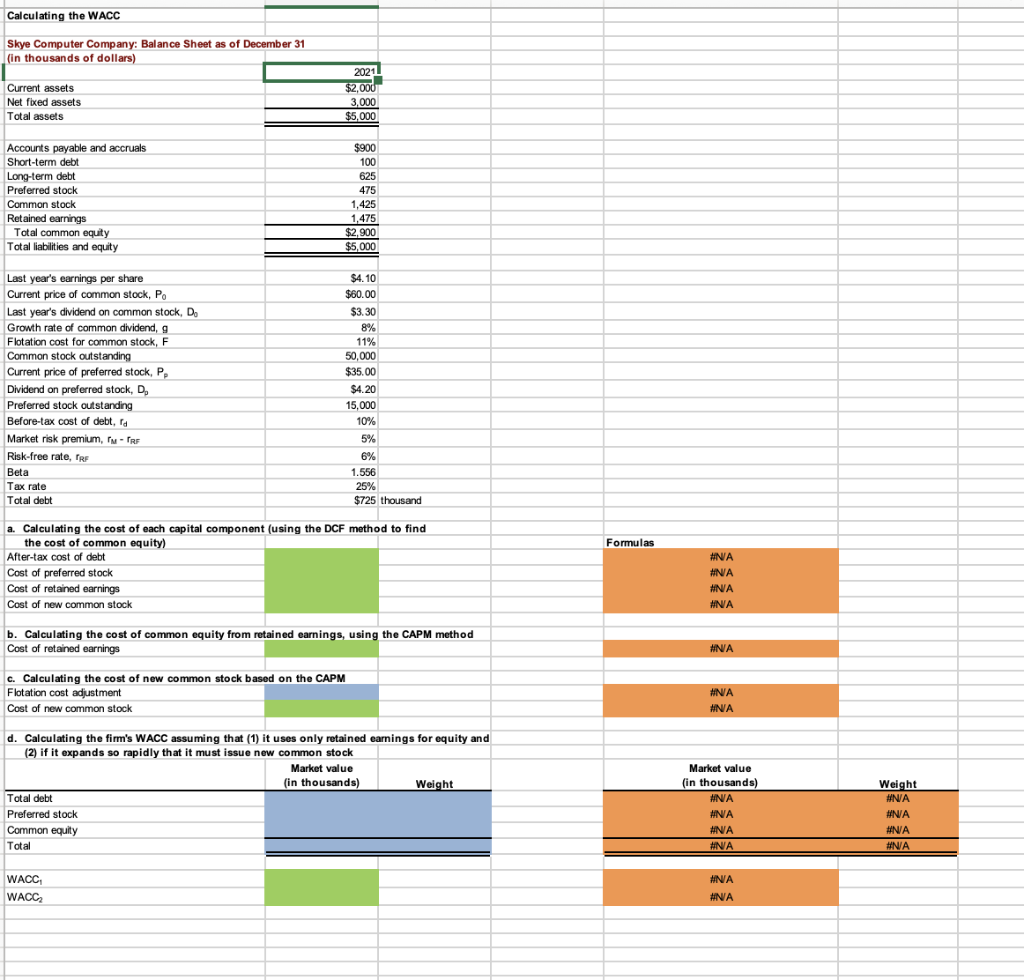

Eure that the WOO Here the conderse 202: kane sheet for Supe compuceronsard of dolari Granto 2021 53,000 3,000 $5,000 Tu Doar apable and as Bloem 100 Lowondeat Preferred stock 1500 wars Common stock 190.000 STRE) 1.423 ed eam 1 1,475 Talal 1 quy 52.500 Tardy 45001 Skye's compostarelax your vers 54.10. The color 500.00, spears to naa $3.0, and all. X. 11 wus berrod slank Security care produse Underd will grond.audis al 8. Sky'a preferral sa page et de $1.20 perstars and its preferred stocks for $95.00 per shers. The bedre-les ut fubt ks 10%, enda merginal tax rate is 23. Their currently using a Busne, m-ber detalles. The market rak gruar strikes reisend Screate ...56. There's total des, with the name of the Yeart-brim destesko-bardei, as $0.725 ian. The show been calces in the rest own below. Darba strat and perform the required to war the sea. De retouns mesclete Raard your serba has decimal plesex x Dabase WALIS. Calcul ca luchapa na Uwia, Un our darat aldatu itu ak of produrred was the auf uity from stained carpe, and the task w owy Taruck Uw Un DC mahul wind the CUTITELY Altre cat si des 7.1 Estefarmdateck: 13 Doftaned cars > od of Annar sack: . Max cauline the conta coronaty from the pamiro, erg the Chamatted c. What is thereofrecer sterk dr the CAP pict. Find the brand, es dessed by the method, and said that hit CAPM salar? c. If Skye continues to use the same narket value catar. What the WOL 2XU (L! Kes only and coming for couty 2rd (2) respons sorpcly the it must nen common stock heve the market value coal structure des Currentibes to determine the Wigs. Ass. use the sole erge of the regurod wlues obzines under the the methods in causing Wie) CL WCE Chad y Wawr 6 Phan Calculating the WACC Skye Computer Company: Balance Sheet as of December 31 (in thousands of dollars) 2021 Current assets Net fixed assets Total assets $2,000 3,000 $5,000 Accounts payable and accruals Short-term debt Long-term debt Preferred stock Common stock Retained earnings Total common equity Total liabilities and equity $900 100 625 475 1,425 1,475 $2,900 $5,000 FREE Last year's earnings per Share Current price of common stock, Po Last year's dividend on common stock, D. Growth rate of common dividend, Flotation cost for common stock, F F Common stock outstanding Current price of preferred stock, P Dividend on preferred stock, D. D Preferred stock outstanding Before-tax cost of debt, id Market risk premium, - PR Risk-free rate, rre Beta Tax rate Total debt $4.10 $60.00 $3.30 8% 11% 50,000 $35.00 $4.20 15,000 10% 5% 6% 1.556 25% $725 thousand Formulas #NA a. Calculating the cost of each capital component (using the DCF method to find the cost of common equity) After-tax cost of debt Cost of preferred stock Cost of retained earnings Cost of new common stock #NA #NA #NA b. Calculating the cost of common equity from retained earnings, using the CAPM method Cost of retained earnings #NA C. Calculating the cost of new common stock based on the CAPM Flotation cost adjustment Cost of new common stock #NA #NA d. Calculating the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock Market value (in thousands) Weight Total debt Preferred stock Common equity Total Market value (in thousands) #NA #NA #NA #NA Weight #NA #NA #NA #NA WACC WACC #NA #NA Eure that the WOO Here the conderse 202: kane sheet for Supe compuceronsard of dolari Granto 2021 53,000 3,000 $5,000 Tu Doar apable and as Bloem 100 Lowondeat Preferred stock 1500 wars Common stock 190.000 STRE) 1.423 ed eam 1 1,475 Talal 1 quy 52.500 Tardy 45001 Skye's compostarelax your vers 54.10. The color 500.00, spears to naa $3.0, and all. X. 11 wus berrod slank Security care produse Underd will grond.audis al 8. Sky'a preferral sa page et de $1.20 perstars and its preferred stocks for $95.00 per shers. The bedre-les ut fubt ks 10%, enda merginal tax rate is 23. Their currently using a Busne, m-ber detalles. The market rak gruar strikes reisend Screate ...56. There's total des, with the name of the Yeart-brim destesko-bardei, as $0.725 ian. The show been calces in the rest own below. Darba strat and perform the required to war the sea. De retouns mesclete Raard your serba has decimal plesex x Dabase WALIS. Calcul ca luchapa na Uwia, Un our darat aldatu itu ak of produrred was the auf uity from stained carpe, and the task w owy Taruck Uw Un DC mahul wind the CUTITELY Altre cat si des 7.1 Estefarmdateck: 13 Doftaned cars > od of Annar sack: . Max cauline the conta coronaty from the pamiro, erg the Chamatted c. What is thereofrecer sterk dr the CAP pict. Find the brand, es dessed by the method, and said that hit CAPM salar? c. If Skye continues to use the same narket value catar. What the WOL 2XU (L! Kes only and coming for couty 2rd (2) respons sorpcly the it must nen common stock heve the market value coal structure des Currentibes to determine the Wigs. Ass. use the sole erge of the regurod wlues obzines under the the methods in causing Wie) CL WCE Chad y Wawr 6 Phan Calculating the WACC Skye Computer Company: Balance Sheet as of December 31 (in thousands of dollars) 2021 Current assets Net fixed assets Total assets $2,000 3,000 $5,000 Accounts payable and accruals Short-term debt Long-term debt Preferred stock Common stock Retained earnings Total common equity Total liabilities and equity $900 100 625 475 1,425 1,475 $2,900 $5,000 FREE Last year's earnings per Share Current price of common stock, Po Last year's dividend on common stock, D. Growth rate of common dividend, Flotation cost for common stock, F F Common stock outstanding Current price of preferred stock, P Dividend on preferred stock, D. D Preferred stock outstanding Before-tax cost of debt, id Market risk premium, - PR Risk-free rate, rre Beta Tax rate Total debt $4.10 $60.00 $3.30 8% 11% 50,000 $35.00 $4.20 15,000 10% 5% 6% 1.556 25% $725 thousand Formulas #NA a. Calculating the cost of each capital component (using the DCF method to find the cost of common equity) After-tax cost of debt Cost of preferred stock Cost of retained earnings Cost of new common stock #NA #NA #NA b. Calculating the cost of common equity from retained earnings, using the CAPM method Cost of retained earnings #NA C. Calculating the cost of new common stock based on the CAPM Flotation cost adjustment Cost of new common stock #NA #NA d. Calculating the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock Market value (in thousands) Weight Total debt Preferred stock Common equity Total Market value (in thousands) #NA #NA #NA #NA Weight #NA #NA #NA #NA WACC WACC #NA #NA