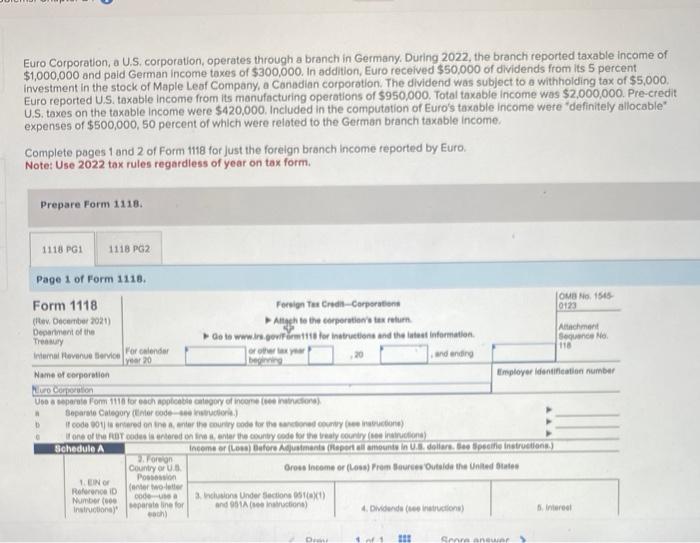

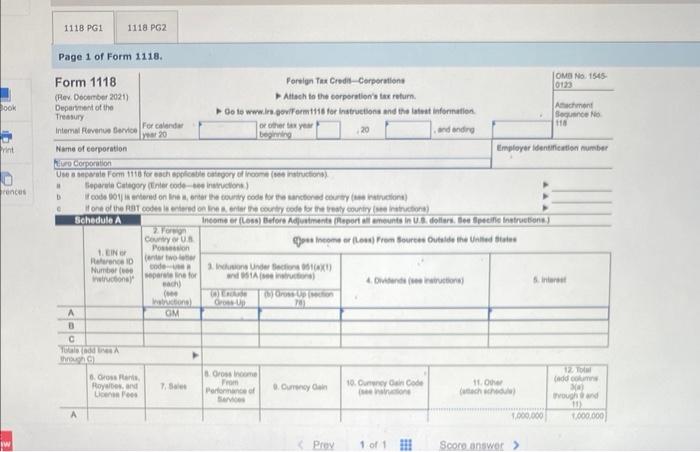

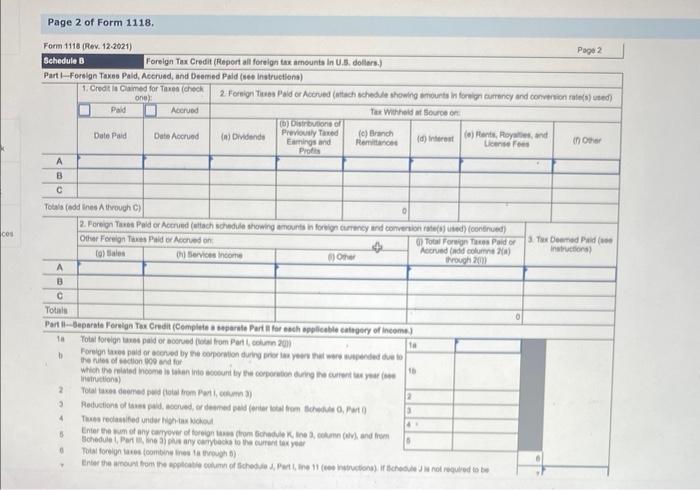

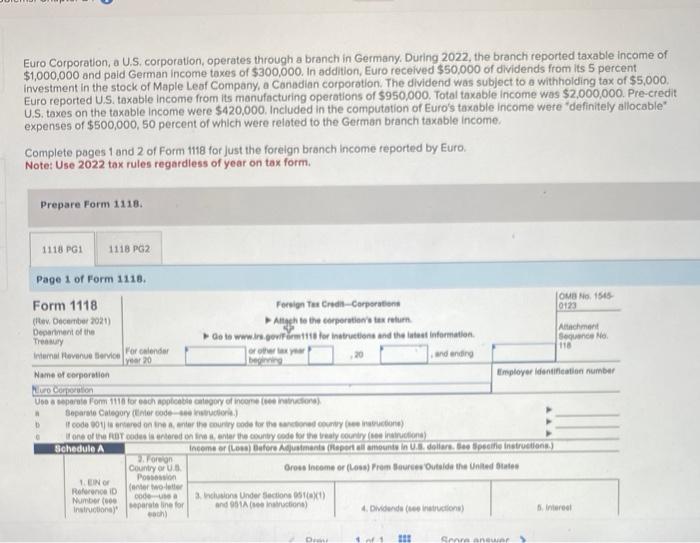

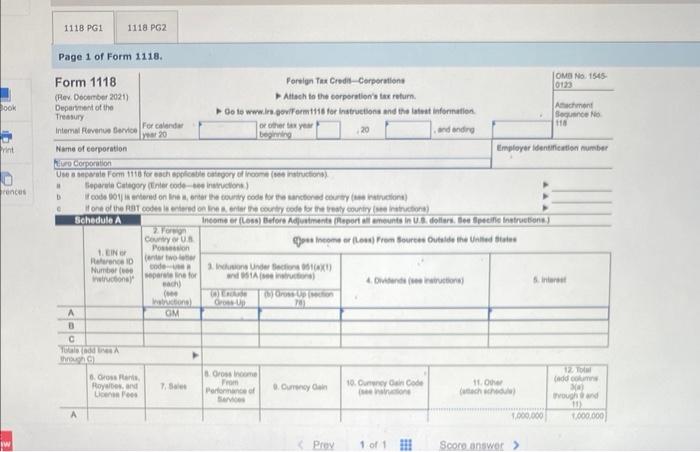

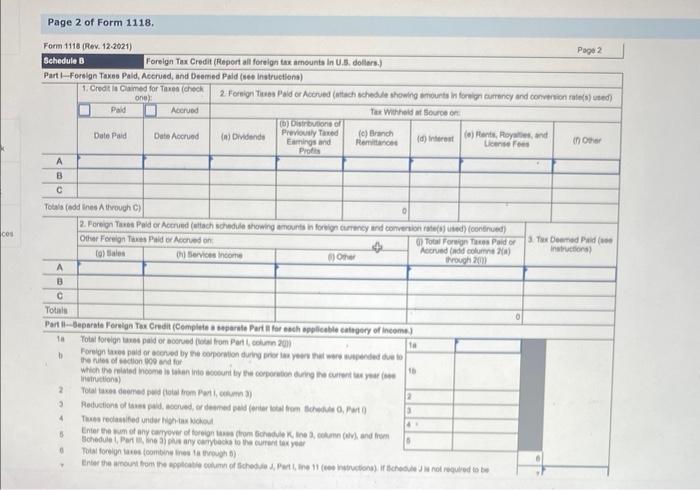

Euro Corporation, a U.S. corporation, operates through a branch in Germany. During 2022, the branch reported taxable income of $1,000,000 and paid German income taxes of $300,000. In addition, Euro received $50,000 of dividends from its 5 percent Investment in the stock of Maple Leaf Company, a Canadian corporation. The dividend was subject to a withholding tax of $5,000. Euro reported U.S. taxable income from its manufacturing operations of $950,000. Total taxable income was $2,000,000. Pre-credit U.S. taxes on the taxable income were $420,000. Included in the computation of Euro's taxable income were "definitely allocable" expenses of $500,000,50 percent of which were related to the German branch taxable income. Complete pages 1 and 2 of Form 1118 for just the forelgn branch income reported by Euro. Note: Use 2022 tax rules regardless of year on tax form. Prepare Form 1118. 1118PG11118PG2 Page 1 of Form 1118. Form 1118 (Rev. Docomber 2021) Portign Tax Credis - Cerporations Departient of the Tressury. \begin{tabular}{l|l} intemai fievenue berice & For calandar ywat 20 \\ \hline \end{tabular} Name of cerporation Attach to the corperelionis tas return. hivecomorition Page 2 of Form 1118 . Form 1118 (Rev. 12.2021) Schedule B Forelgn Tax Credit (Report all forelgn tax amounts In U.5. dollers.) Part 1-Forelgn Taxes Pald, Acerued, and Deemed Paid (ces instructiont) Euro Corporation, a U.S. corporation, operates through a branch in Germany. During 2022, the branch reported taxable income of $1,000,000 and paid German income taxes of $300,000. In addition, Euro received $50,000 of dividends from its 5 percent Investment in the stock of Maple Leaf Company, a Canadian corporation. The dividend was subject to a withholding tax of $5,000. Euro reported U.S. taxable income from its manufacturing operations of $950,000. Total taxable income was $2,000,000. Pre-credit U.S. taxes on the taxable income were $420,000. Included in the computation of Euro's taxable income were "definitely allocable" expenses of $500,000,50 percent of which were related to the German branch taxable income. Complete pages 1 and 2 of Form 1118 for just the forelgn branch income reported by Euro. Note: Use 2022 tax rules regardless of year on tax form. Prepare Form 1118. 1118PG11118PG2 Page 1 of Form 1118. Form 1118 (Rev. Docomber 2021) Portign Tax Credis - Cerporations Departient of the Tressury. \begin{tabular}{l|l} intemai fievenue berice & For calandar ywat 20 \\ \hline \end{tabular} Name of cerporation Attach to the corperelionis tas return. hivecomorition Page 2 of Form 1118 . Form 1118 (Rev. 12.2021) Schedule B Forelgn Tax Credit (Report all forelgn tax amounts In U.5. dollers.) Part 1-Forelgn Taxes Pald, Acerued, and Deemed Paid (ces instructiont)