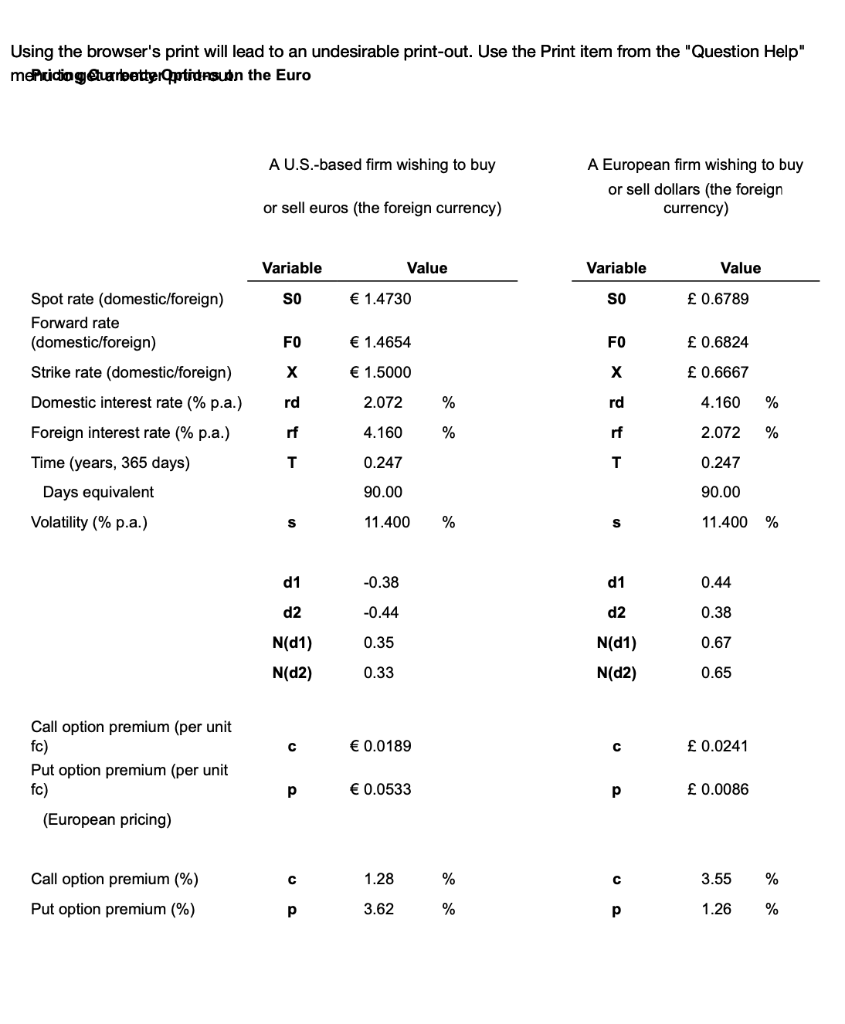

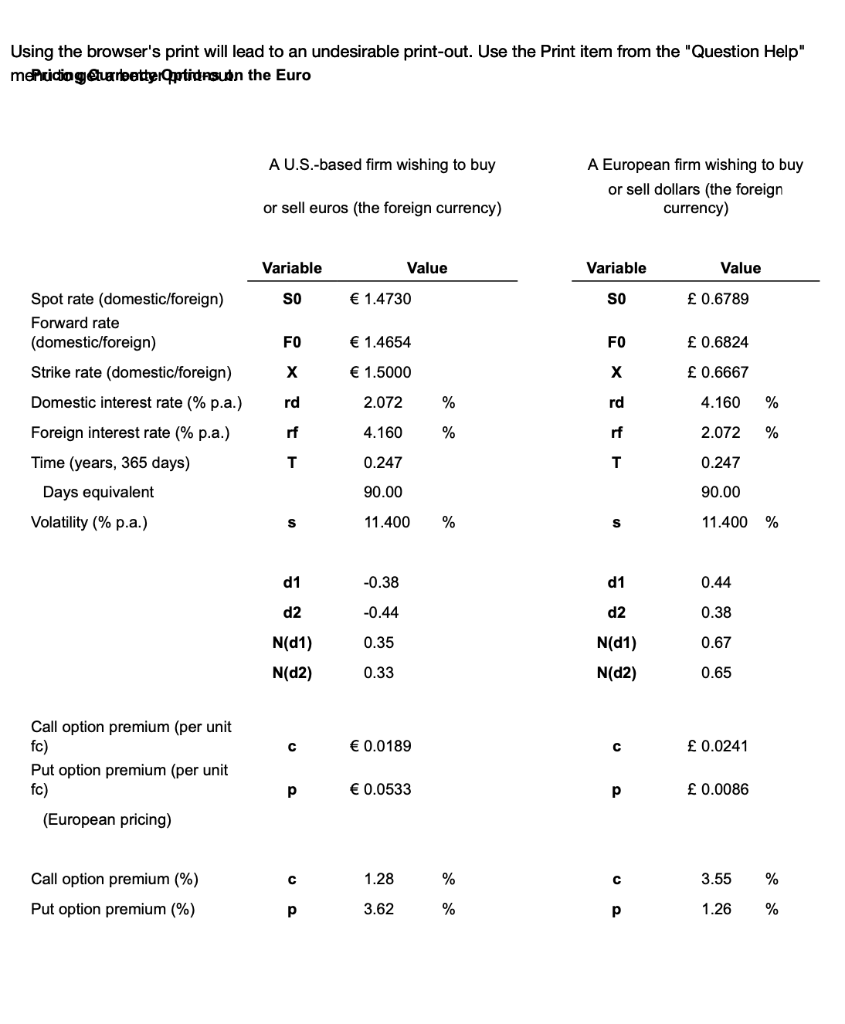

Euro/British Pound. How would the call option premium change on the right to buy pounds with euros if the euro interest rate changed to 4.22% from the initial values listed in this table: The call option on British pounds, if the euro interest rate changed to 4.22%, would be /. (Round to four decimal places.) Using the browser's print will lead to an undesirable print-out. Use the Print item from the "Question Help" meruicio geurbetter Optidesuan the Euro A U.S.-based firm wishing to buy A European firm wishing to buy or sell dollars (the foreign currency) or sell euros (the foreign currency) Variable Value Variable Value SO 1.4730 so 0.6789 FO 1.4654 FO 0.6824 1.5000 0.6667 rd 2.072 % rd Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, days) Days equivalent Volatility (% p.a.) 4.160 % 4.160 % 2.072 % T 0.247 0.247 90.00 90.00 S 11.400 % S 11.400 % d1 -0.38 d1 0.44 d2 -0.44 d2 0.38 N(1) 0.35 N(1) 0.67 N(02) 0.33 N(d2) 0.65 0.0189 0.0241 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) 0.0533 0.0086 1.28 % 3.55 % Call option premium (%) Put option premium (%) 3.62 % 1.26 % Euro/British Pound. How would the call option premium change on the right to buy pounds with euros if the euro interest rate changed to 4.22% from the initial values listed in this table: The call option on British pounds, if the euro interest rate changed to 4.22%, would be /. (Round to four decimal places.) Using the browser's print will lead to an undesirable print-out. Use the Print item from the "Question Help" meruicio geurbetter Optidesuan the Euro A U.S.-based firm wishing to buy A European firm wishing to buy or sell dollars (the foreign currency) or sell euros (the foreign currency) Variable Value Variable Value SO 1.4730 so 0.6789 FO 1.4654 FO 0.6824 1.5000 0.6667 rd 2.072 % rd Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% p.a.) Foreign interest rate (% p.a.) Time (years, days) Days equivalent Volatility (% p.a.) 4.160 % 4.160 % 2.072 % T 0.247 0.247 90.00 90.00 S 11.400 % S 11.400 % d1 -0.38 d1 0.44 d2 -0.44 d2 0.38 N(1) 0.35 N(1) 0.67 N(02) 0.33 N(d2) 0.65 0.0189 0.0241 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) 0.0533 0.0086 1.28 % 3.55 % Call option premium (%) Put option premium (%) 3.62 % 1.26 %