Answered step by step

Verified Expert Solution

Question

1 Approved Answer

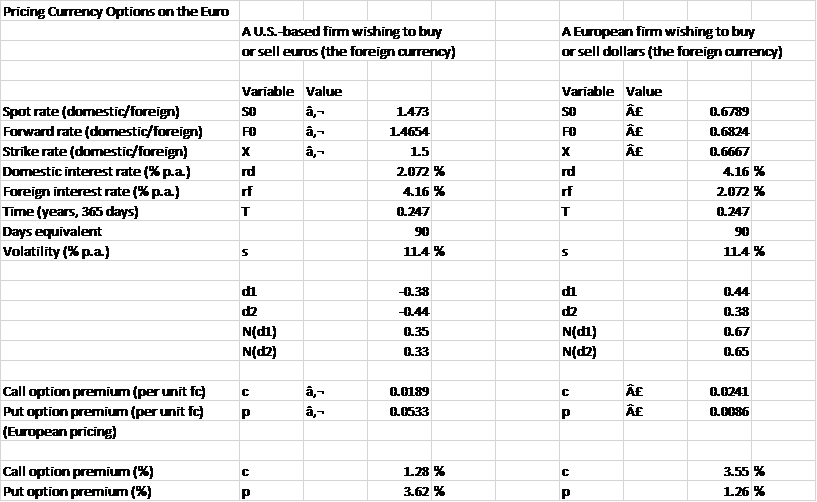

Euro/British Pound. How would the call option premium change on the right to buy pounds with euros if the euro interest rate changed to 4.12%

Euro/British Pound. How would the call option premium change on the right to buy pounds with euros if the euro interest rate changed to 4.12% from the initial values listed in this table:

The call option on British pounds, if the euro interest rate changed to 4.12%, would be: (Round to four decimal places.)

Pricing Currency Options on the Euro A U.S.-based firm wishing to buy or sell euros (the foreign arrency) A European firm wishing to buy orsell dollars (the foreign arrency) Variable Value SO 1473 0.619 Variable Value SO a- FD , X 14654 FO 6.6824 1.5 X Spot rate (domestic foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (%p.a) Foreign interest rate (%p.a) Time (years, 365 days) Days equivalent Volatility (%p.a) rd rf rd rf 0.6667 4.16 % 2.072 % 0.247 2.072 % 4.16 % 0.247 90 11.4% T T 90 5 S 5 S 114 % 6.38 0.44 0.44 0.38 di d2 Ndi) N(2) di d2 Ndi) N(2) 6.67 0.35 0.33 6.65 C Call option premium (per unit fc Put option premium (per unit fc (European pricing) ,- ,- 0.01189 0.0533 Af E 0.6241 0.0186 P C c Call option premium(%) Put option premium(%) 1.28 % 3.62 % 3.55 % 1.26% P Pricing Currency Options on the Euro A U.S.-based firm wishing to buy or sell euros (the foreign arrency) A European firm wishing to buy orsell dollars (the foreign arrency) Variable Value SO 1473 0.619 Variable Value SO a- FD , X 14654 FO 6.6824 1.5 X Spot rate (domestic foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (%p.a) Foreign interest rate (%p.a) Time (years, 365 days) Days equivalent Volatility (%p.a) rd rf rd rf 0.6667 4.16 % 2.072 % 0.247 2.072 % 4.16 % 0.247 90 11.4% T T 90 5 S 5 S 114 % 6.38 0.44 0.44 0.38 di d2 Ndi) N(2) di d2 Ndi) N(2) 6.67 0.35 0.33 6.65 C Call option premium (per unit fc Put option premium (per unit fc (European pricing) ,- ,- 0.01189 0.0533 Af E 0.6241 0.0186 P C c Call option premium(%) Put option premium(%) 1.28 % 3.62 % 3.55 % 1.26% PStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started