Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Europe, the United States and Canada have been exporters of oil historically. Iqbal, the owner of Transformers Oil Limited. This is the largest oil fuel

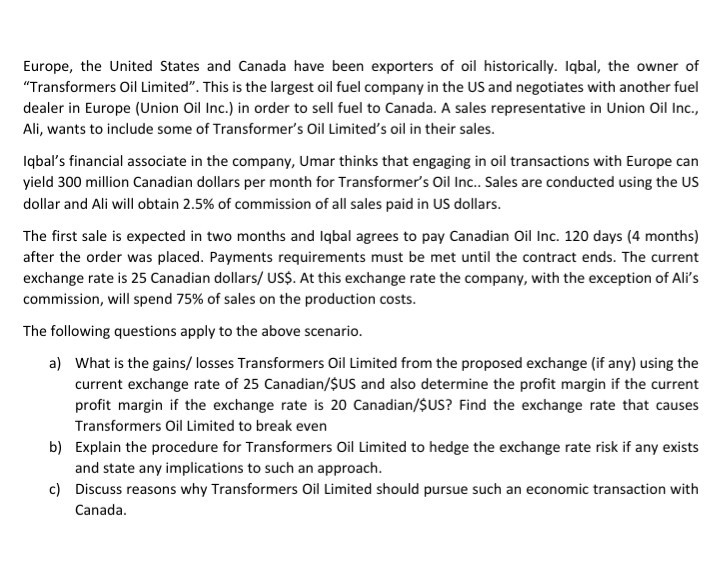

Europe, the United States and Canada have been exporters of oil historically. Iqbal, the owner of "Transformers Oil Limited". This is the largest oil fuel company in the US and negotiates with another fuel dealer in Europe (Union Oil Inc.) in order to sell fuel to Canada. A sales representative in Union Oil Inc., Ali, wants to include some of Transformer's Oil Limited's oil in their sales. Iqbal's financial associate in the company, Umar thinks that engaging in oil transactions with Europe can yield 300 million Canadian dollars per month for Transformer's Oil Inc.. Sales are conducted using the US dollar and Ali will obtain 2.5% of commission of all sales paid in US dollars. The first sale is expected in two months and Iqbal agrees to pay Canadian Oil Inc. 120 days (4 months) after the order was placed. Payments requirements must be met until the contract ends. The current exchange rate is 25 Canadian dollars/ US$. At this exchange rate the company, with the exception of Ali's commission, will spend 75% of sales on the production costs. The following questions apply to the above scenario. a) What is the gains/losses Transformers Oil Limited from the proposed exchange (if any) using the current exchange rate of 25 Canadian/$US and also determine the profit margin if the current profit margin if the exchange rate is 20 Canadian/$US? Find the exchange rate that causes Transformers Oil Limited to break even b) Explain the procedure for Transformers Oil Limited to hedge the exchange rate risk if any exists and state any implications to such an approach. c) Discuss reasons why Transformers Oil Limited should pursue such an economic transaction with Canada. Europe, the United States and Canada have been exporters of oil historically. Iqbal, the owner of "Transformers Oil Limited". This is the largest oil fuel company in the US and negotiates with another fuel dealer in Europe (Union Oil Inc.) in order to sell fuel to Canada. A sales representative in Union Oil Inc., Ali, wants to include some of Transformer's Oil Limited's oil in their sales. Iqbal's financial associate in the company, Umar thinks that engaging in oil transactions with Europe can yield 300 million Canadian dollars per month for Transformer's Oil Inc.. Sales are conducted using the US dollar and Ali will obtain 2.5% of commission of all sales paid in US dollars. The first sale is expected in two months and Iqbal agrees to pay Canadian Oil Inc. 120 days (4 months) after the order was placed. Payments requirements must be met until the contract ends. The current exchange rate is 25 Canadian dollars/ US$. At this exchange rate the company, with the exception of Ali's commission, will spend 75% of sales on the production costs. The following questions apply to the above scenario. a) What is the gains/losses Transformers Oil Limited from the proposed exchange (if any) using the current exchange rate of 25 Canadian/$US and also determine the profit margin if the current profit margin if the exchange rate is 20 Canadian/$US? Find the exchange rate that causes Transformers Oil Limited to break even b) Explain the procedure for Transformers Oil Limited to hedge the exchange rate risk if any exists and state any implications to such an approach. c) Discuss reasons why Transformers Oil Limited should pursue such an economic transaction with Canada

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started