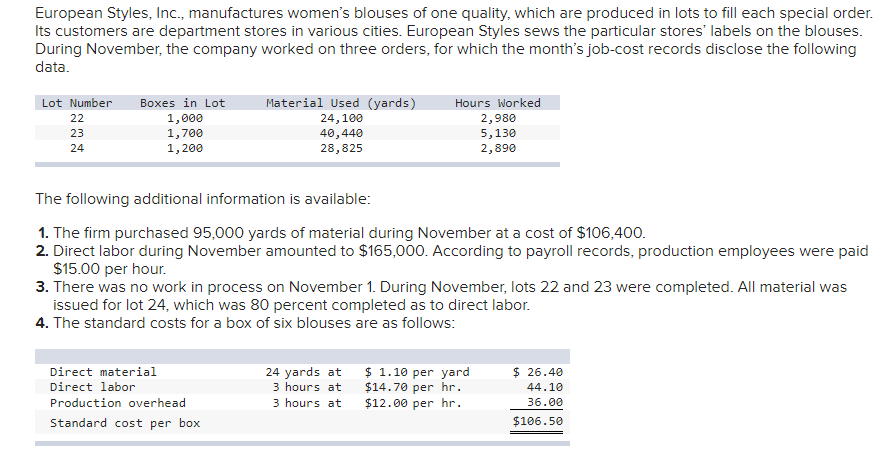

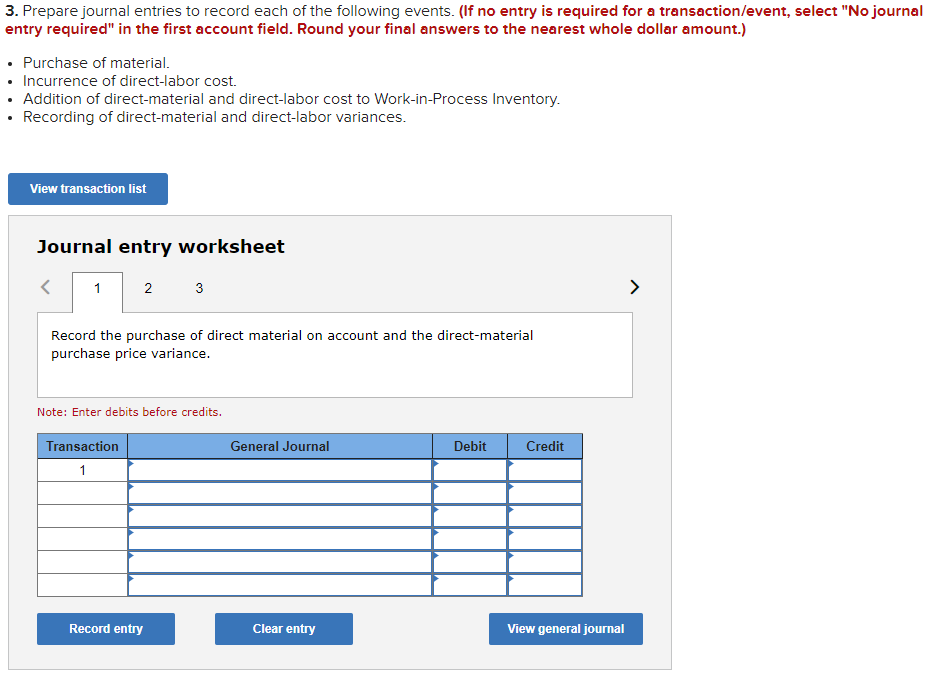

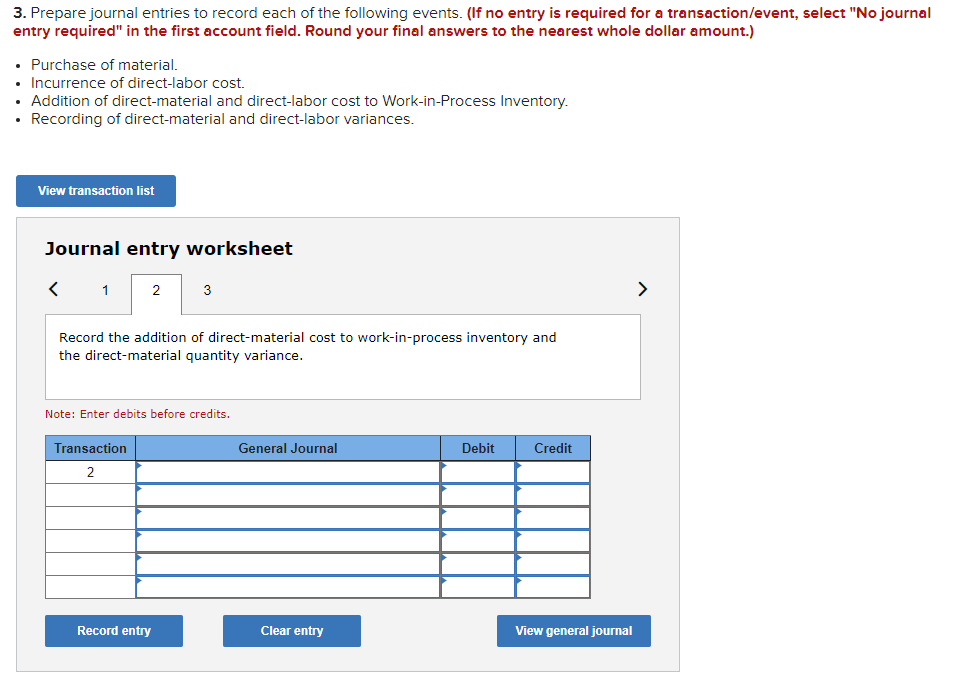

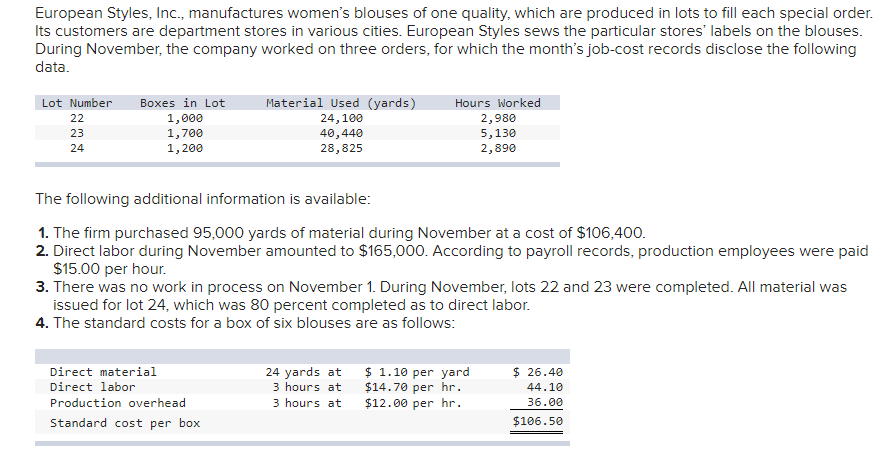

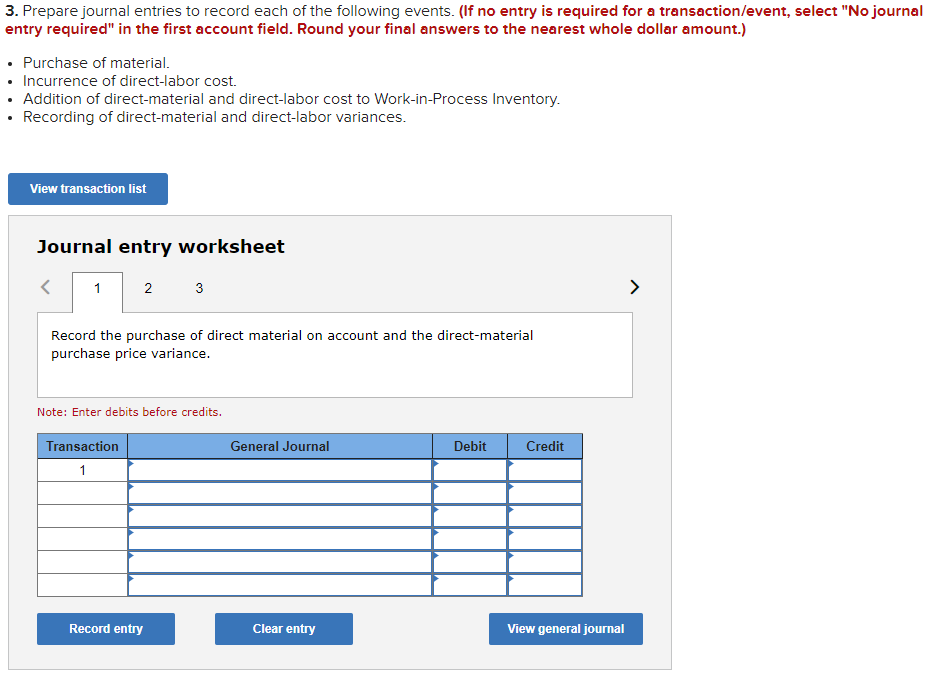

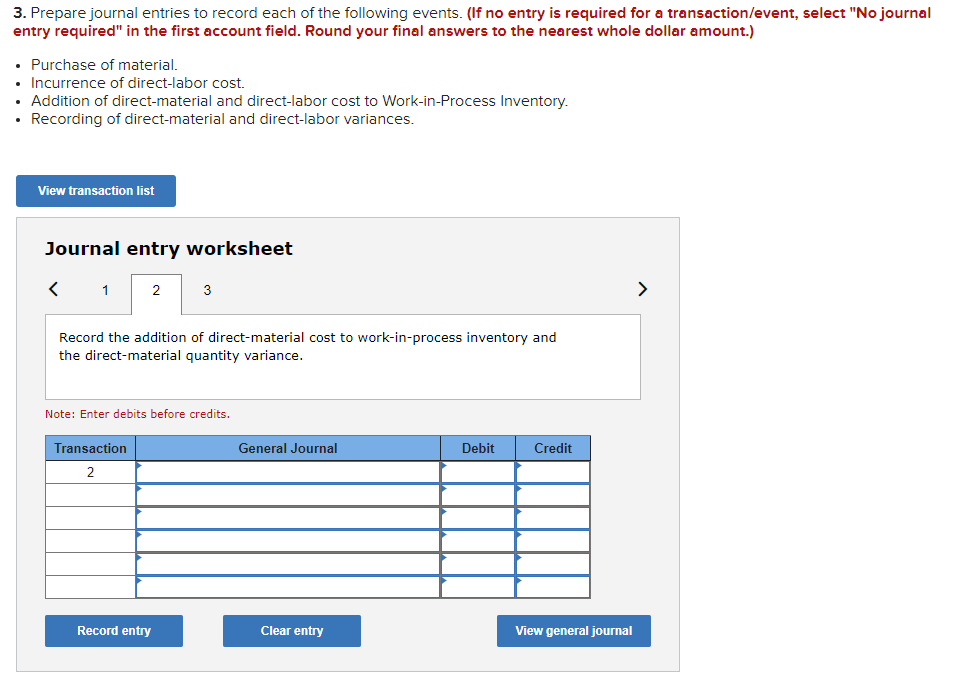

European Styles, Inc., manufactures women's blouses of one quality, which are produced in lots to fill each special order. Its customers are department stores in various cities. European Styles sews the particular stores' labels on the blouses. During November, the company worked on three orders, for which the month's job-cost records disclose the following data. The following additional information is available: 1. The firm purchased 95,000 yards of material during November at a cost of $106,400. 2. Direct labor during November amounted to $165,000. According to payroll records, production employees were paid $15.00 per hour. 3. There was no work in process on November 1 . During November, lots 22 and 23 were completed. All material was issued for lot 24 , which was 80 percent completed as to direct labor. 4. The standard costs for a box of six blouses are as follows: 3. Prepare journal entries to record each of the following events. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.) - Purchase of material. - Incurrence of direct-labor cost. - Addition of direct-material and direct-labor cost to Work-in-Process Inventory. - Recording of direct-material and direct-labor variances. Journal entry worksheet Record the purchase of direct material on account and the direct-material purchase price variance. Note: Enter debits before credits. 3. Prepare journal entries to record each of the following events. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.) - Purchase of material. - Incurrence of direct-labor cost. - Addition of direct-material and direct-labor cost to Work-in-Process Inventory. - Recording of direct-material and direct-labor variances. Journal entry worksheet Record the addition of direct-material cost to work-in-process inventory and the direct-material quantity variance. Note: Enter debits before credits. 3. Prepare journal entries to record each of the following events. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.) - Purchase of material. - Incurrence of direct-labor cost. - Addition of direct-material and direct-labor cost to Work-in-Process Inventory. - Recording of direct-material and direct-labor variances. Journal entry worksheet Record the addition of direct-labor cost to work-in-process inventory and the direct-labor variances. Note: Enter debits before credits. European Styles, Inc., manufactures women's blouses of one quality, which are produced in lots to fill each special order. Its customers are department stores in various cities. European Styles sews the particular stores' labels on the blouses. During November, the company worked on three orders, for which the month's job-cost records disclose the following data. The following additional information is available: 1. The firm purchased 95,000 yards of material during November at a cost of $106,400. 2. Direct labor during November amounted to $165,000. According to payroll records, production employees were paid $15.00 per hour. 3. There was no work in process on November 1 . During November, lots 22 and 23 were completed. All material was issued for lot 24 , which was 80 percent completed as to direct labor. 4. The standard costs for a box of six blouses are as follows: 3. Prepare journal entries to record each of the following events. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.) - Purchase of material. - Incurrence of direct-labor cost. - Addition of direct-material and direct-labor cost to Work-in-Process Inventory. - Recording of direct-material and direct-labor variances. Journal entry worksheet Record the purchase of direct material on account and the direct-material purchase price variance. Note: Enter debits before credits. 3. Prepare journal entries to record each of the following events. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.) - Purchase of material. - Incurrence of direct-labor cost. - Addition of direct-material and direct-labor cost to Work-in-Process Inventory. - Recording of direct-material and direct-labor variances. Journal entry worksheet Record the addition of direct-material cost to work-in-process inventory and the direct-material quantity variance. Note: Enter debits before credits. 3. Prepare journal entries to record each of the following events. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.) - Purchase of material. - Incurrence of direct-labor cost. - Addition of direct-material and direct-labor cost to Work-in-Process Inventory. - Recording of direct-material and direct-labor variances. Journal entry worksheet Record the addition of direct-labor cost to work-in-process inventory and the direct-labor variances. Note: Enter debits before credits