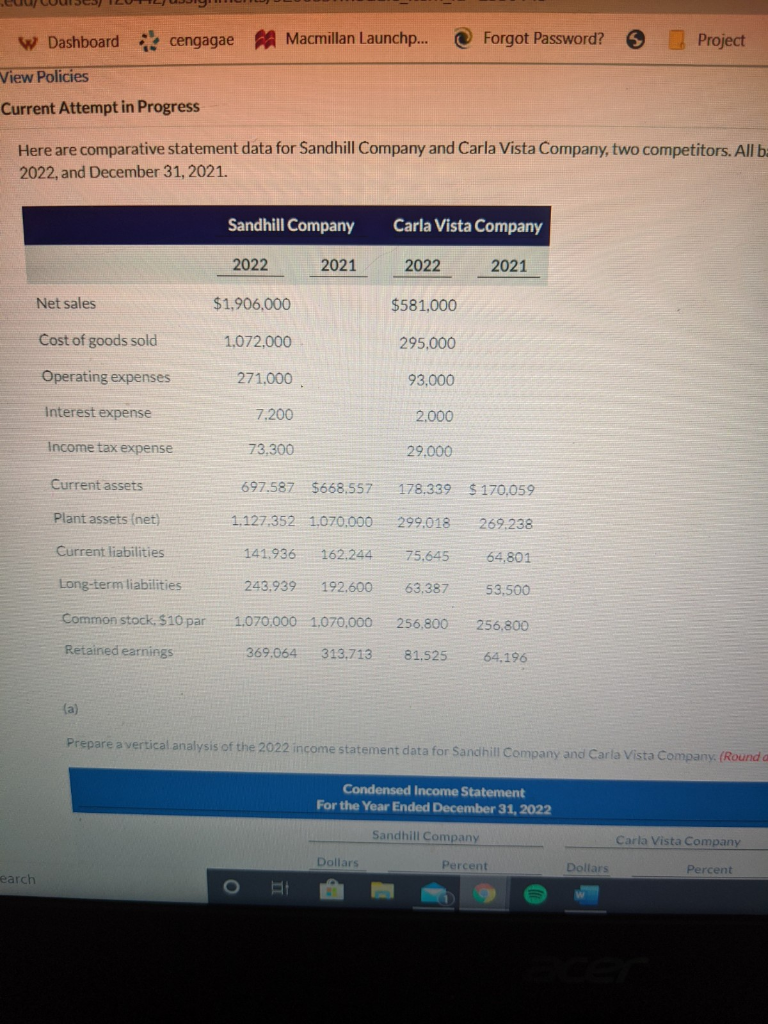

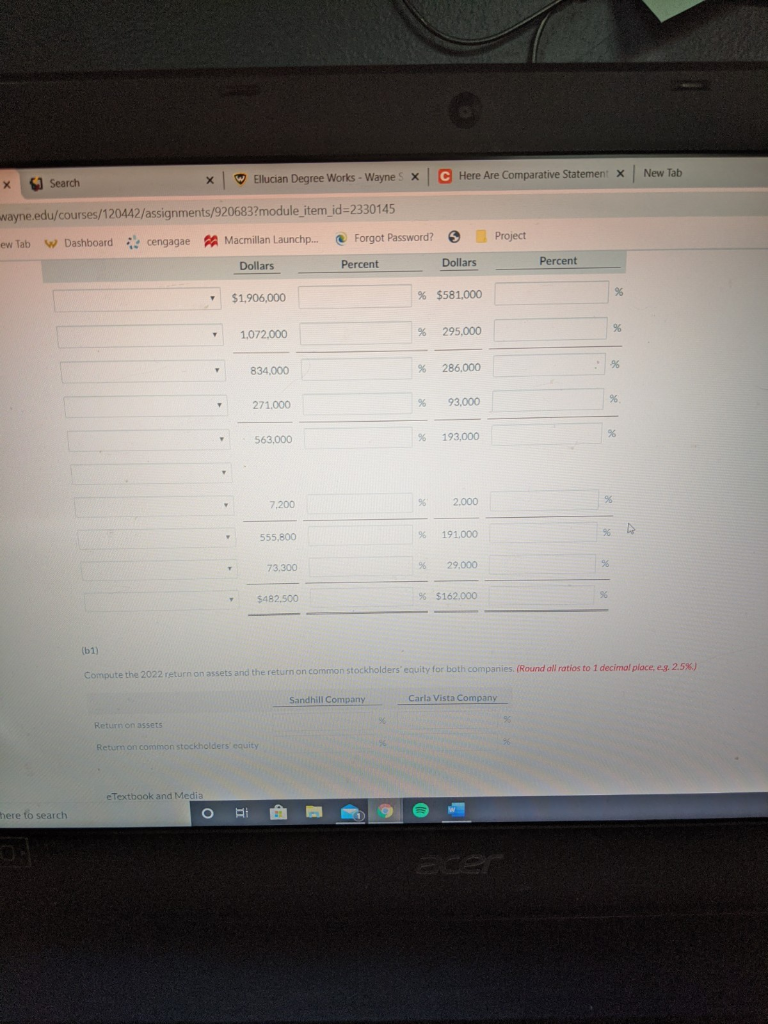

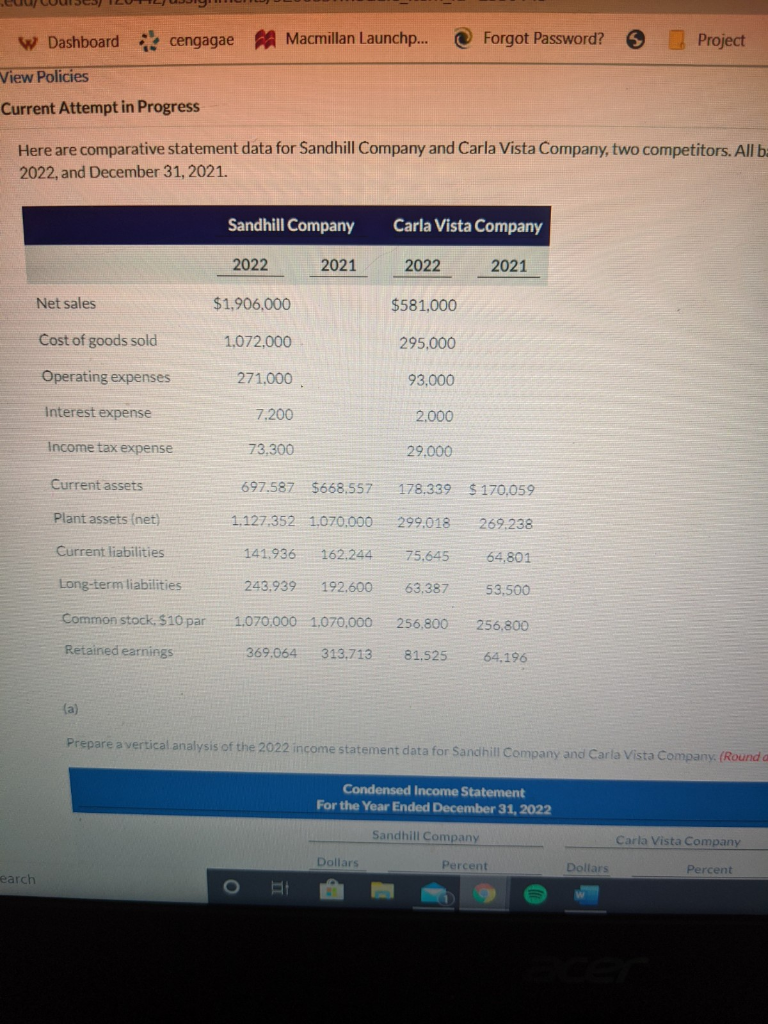

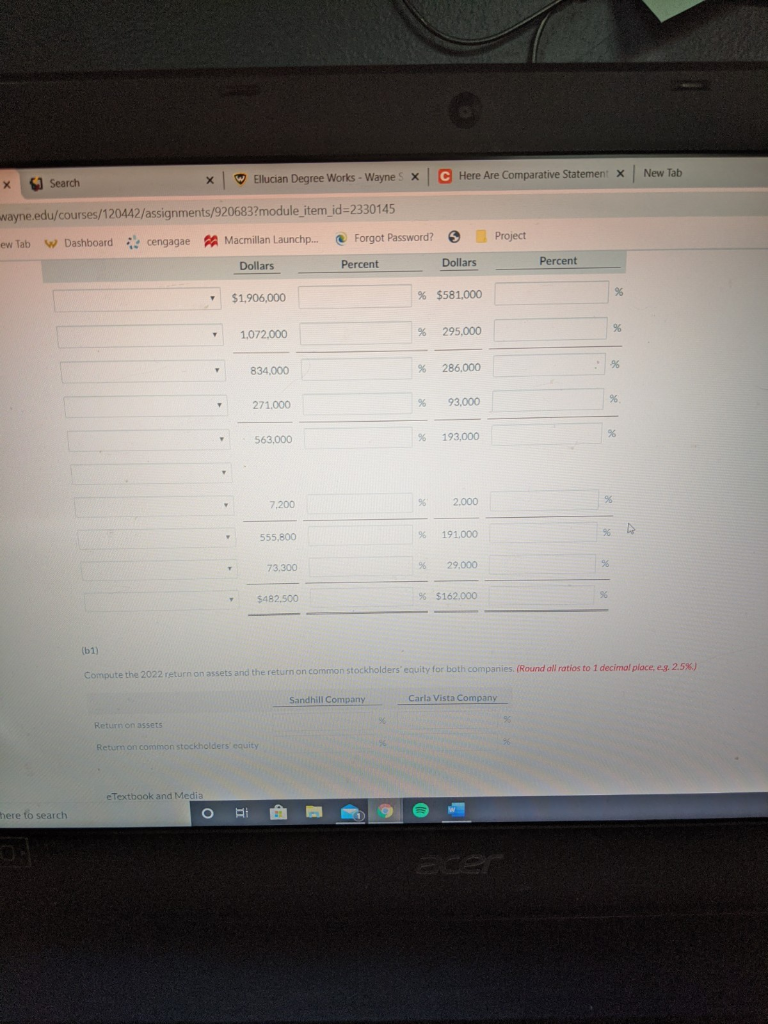

euuuuiSCS) ZULU w Dashboard cengagae Macmillan Launchp... Forgot Password? Project View Policies Current Attempt in Progress Here are comparative statement data for Sandhill Company and Carla Vista Company, two competitors. All b 2022, and December 31, 2021. Sandhill Company 2022 2021 Carla Vista Company 2022 2021 Net sales $1,906,000 $581,000 Cost of goods sold 295,000 1,072,000 271,000 Operating expenses 93,000 Interest expense 7.200 2.000 Income tax expense 73.300 29,000 Current assets 697.587 $668.557 178.339 $170,059 Plant assets (net) Current liabilities 1.127.352 1.070,000 141.936 162.244 243,939 192.600 299,018 75.645 63,387 269.238 64,801 53.500 Long-term liabilities Common stock. $10 par 1.070,000 1.070,000 369,064 313.713 256,800 81.525 Retained earnings 256,800 64.196 Prepare a vertical analysis of the 2022 income statement data for Sandhill Company and Carla Vista Company (Round a Condensed Income Statement For the Year Ended December 31, 2022 Sandhill Company Dollars Carla Vista Company Percent Percent Dollars earch x X C Here Are Comparative Statement X 3 Search Ellucian Degree Works - Wayne 5 x New Tab wwayne.edu/courses/120442/assignments/920683?module_item_id=2330145 ew Tab w Dashboard is engagae Macmillan Launch. Forgot Password? Project Dollars Percent Dollars Percent $1,906,000 % $581,000 1,072,000 % 295,000 834.000 % 286,000 271.000 % 93,000 563.000 % 193,000 7.200 2,000 555,800 % 191,000 73.300 % 29,000 $482.500 % $162,000 (61) Compute the 2022 return on assets and the return on common stockholders' equity for both companies. (Round all ratios to 1 decimal place... 2.5%) Sandhill Company Carla Vista Company Return on assets Return on common stockholders' equity eTextbook and Media there to search euuuuiSCS) ZULU w Dashboard cengagae Macmillan Launchp... Forgot Password? Project View Policies Current Attempt in Progress Here are comparative statement data for Sandhill Company and Carla Vista Company, two competitors. All b 2022, and December 31, 2021. Sandhill Company 2022 2021 Carla Vista Company 2022 2021 Net sales $1,906,000 $581,000 Cost of goods sold 295,000 1,072,000 271,000 Operating expenses 93,000 Interest expense 7.200 2.000 Income tax expense 73.300 29,000 Current assets 697.587 $668.557 178.339 $170,059 Plant assets (net) Current liabilities 1.127.352 1.070,000 141.936 162.244 243,939 192.600 299,018 75.645 63,387 269.238 64,801 53.500 Long-term liabilities Common stock. $10 par 1.070,000 1.070,000 369,064 313.713 256,800 81.525 Retained earnings 256,800 64.196 Prepare a vertical analysis of the 2022 income statement data for Sandhill Company and Carla Vista Company (Round a Condensed Income Statement For the Year Ended December 31, 2022 Sandhill Company Dollars Carla Vista Company Percent Percent Dollars earch x X C Here Are Comparative Statement X 3 Search Ellucian Degree Works - Wayne 5 x New Tab wwayne.edu/courses/120442/assignments/920683?module_item_id=2330145 ew Tab w Dashboard is engagae Macmillan Launch. Forgot Password? Project Dollars Percent Dollars Percent $1,906,000 % $581,000 1,072,000 % 295,000 834.000 % 286,000 271.000 % 93,000 563.000 % 193,000 7.200 2,000 555,800 % 191,000 73.300 % 29,000 $482.500 % $162,000 (61) Compute the 2022 return on assets and the return on common stockholders' equity for both companies. (Round all ratios to 1 decimal place... 2.5%) Sandhill Company Carla Vista Company Return on assets Return on common stockholders' equity eTextbook and Media there to search