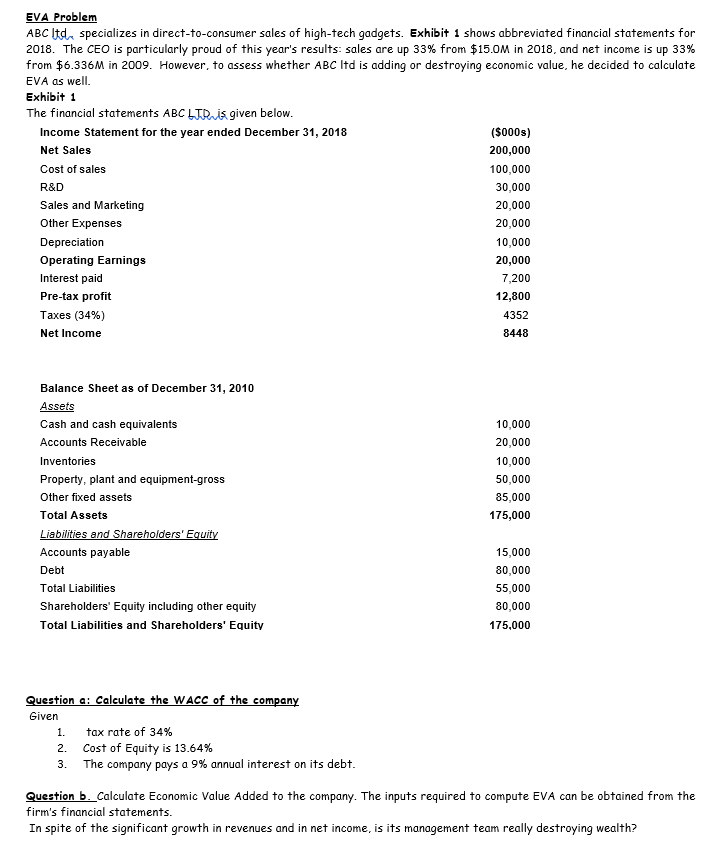

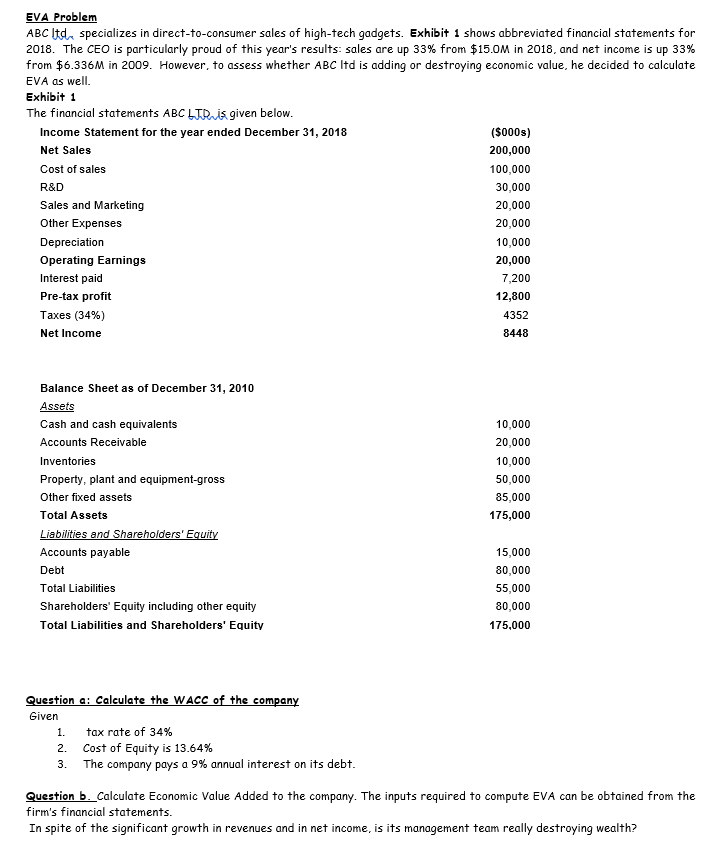

EVA Problem ABC ltd. specializes in direct-to-consumer sales of high-tech gadgets. Exhibit 1 shows abbreviated financial statements for 2018. The CEO is particularly proud of this year's results: sales are up 33% from $15.0M in 2018, and net income is up 33% from $6.336M in 2009. However, to assess whether ABC Itd is adding or destroying economic value, he decided to calculate EVA as well Exhibit 1 The financial statements ABC LIR is given below. Income Statement for the year ended December 31, 2018 ($000s) Net Sales 200,000 Cost of sales 100,000 R&D 30,000 Sales and Marketing 20,000 Other Expenses 20,000 Depreciation 10,000 Operating Earnings 20,000 Interest paid 7,200 Pre-tax profit 12,800 Taxes (34%) 4352 Net Income 8448 Balance Sheet as of December 31, 2010 Assets Cash and cash equivalents Accounts Receivable Inventories Property, plant and equipment-gross Other fixed assets Total Assets Liabilities and Shareholders' Equity Accounts payable Debt Total Liabilities Shareholders' Equity including other equity Total Liabilities and Shareholders' Equity 10,000 20,000 10,000 50,000 85,000 175,000 15,000 80,000 55,000 80,000 175,000 Question a: Calculate the WACC of the company Given 1. tax rate of 34% 2. Cost of Equity is 13.64% 3. The company pays a 9% annual interest on its debt. Question b. Calculate Economic Value Added to the company. The inputs required to compute EVA can be obtained from the firm's financial statements. In spite of the significant growth in revenues and in net income, is its management team really destroying wealth? EVA Problem ABC ltd. specializes in direct-to-consumer sales of high-tech gadgets. Exhibit 1 shows abbreviated financial statements for 2018. The CEO is particularly proud of this year's results: sales are up 33% from $15.0M in 2018, and net income is up 33% from $6.336M in 2009. However, to assess whether ABC Itd is adding or destroying economic value, he decided to calculate EVA as well Exhibit 1 The financial statements ABC LIR is given below. Income Statement for the year ended December 31, 2018 ($000s) Net Sales 200,000 Cost of sales 100,000 R&D 30,000 Sales and Marketing 20,000 Other Expenses 20,000 Depreciation 10,000 Operating Earnings 20,000 Interest paid 7,200 Pre-tax profit 12,800 Taxes (34%) 4352 Net Income 8448 Balance Sheet as of December 31, 2010 Assets Cash and cash equivalents Accounts Receivable Inventories Property, plant and equipment-gross Other fixed assets Total Assets Liabilities and Shareholders' Equity Accounts payable Debt Total Liabilities Shareholders' Equity including other equity Total Liabilities and Shareholders' Equity 10,000 20,000 10,000 50,000 85,000 175,000 15,000 80,000 55,000 80,000 175,000 Question a: Calculate the WACC of the company Given 1. tax rate of 34% 2. Cost of Equity is 13.64% 3. The company pays a 9% annual interest on its debt. Question b. Calculate Economic Value Added to the company. The inputs required to compute EVA can be obtained from the firm's financial statements. In spite of the significant growth in revenues and in net income, is its management team really destroying wealth