Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eva received $75,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $12,000 in business expenses relating to her work for JAZZ Corporation JAZZ

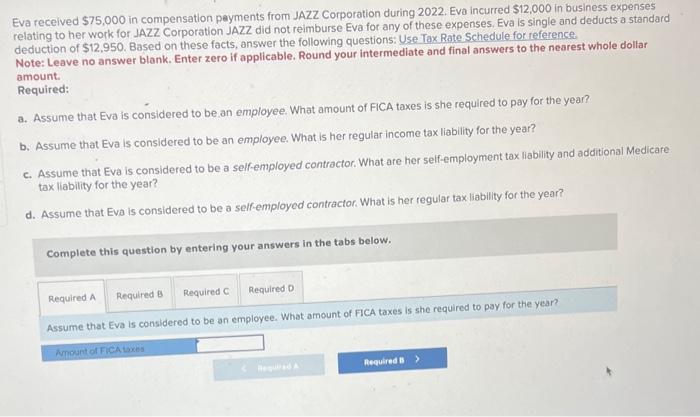

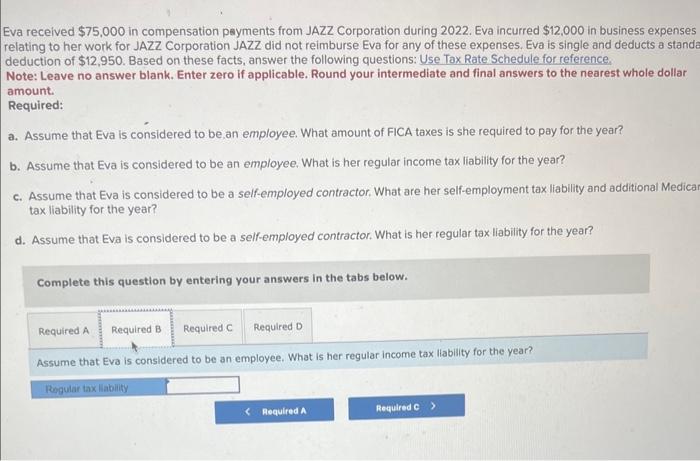

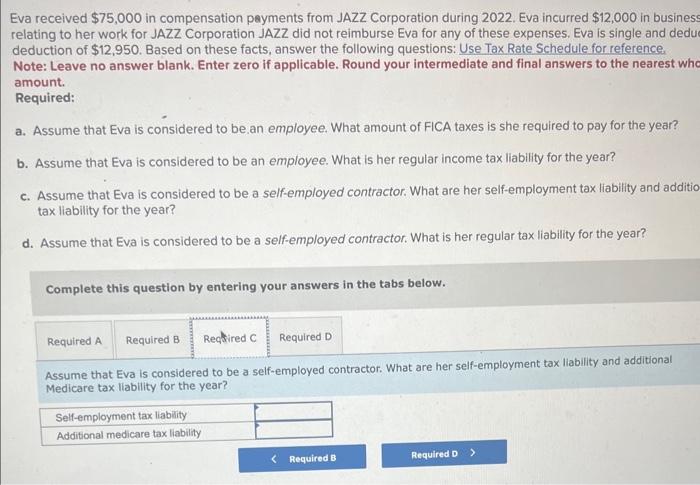

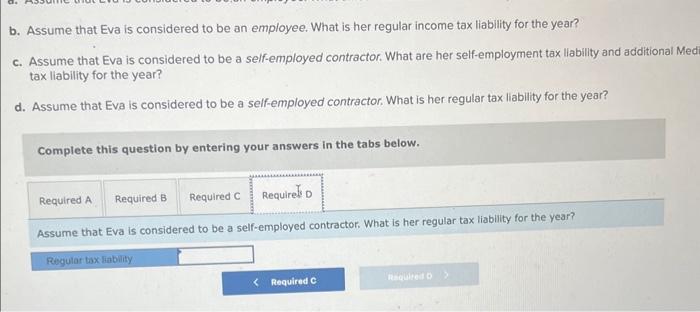

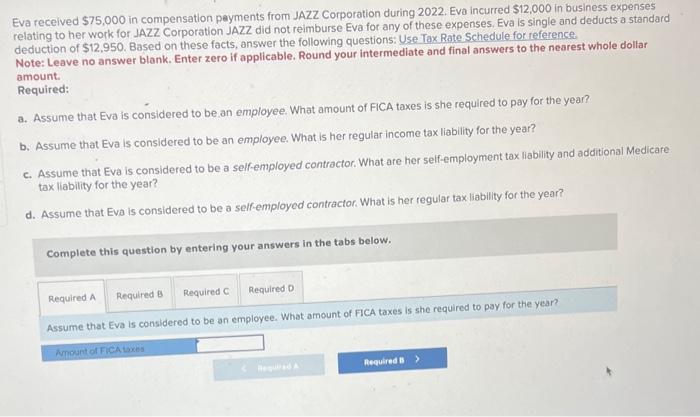

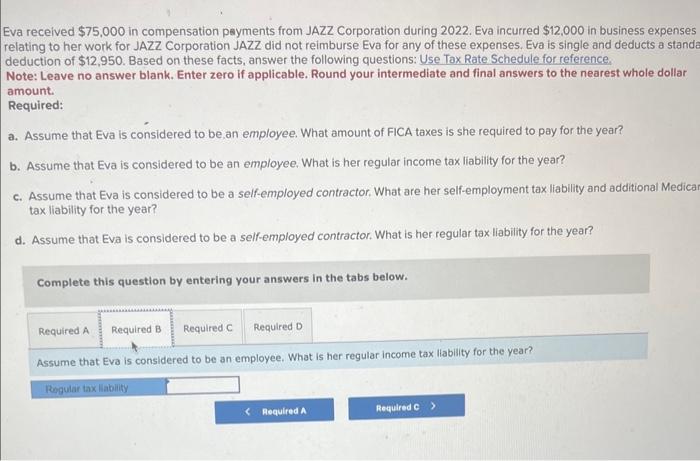

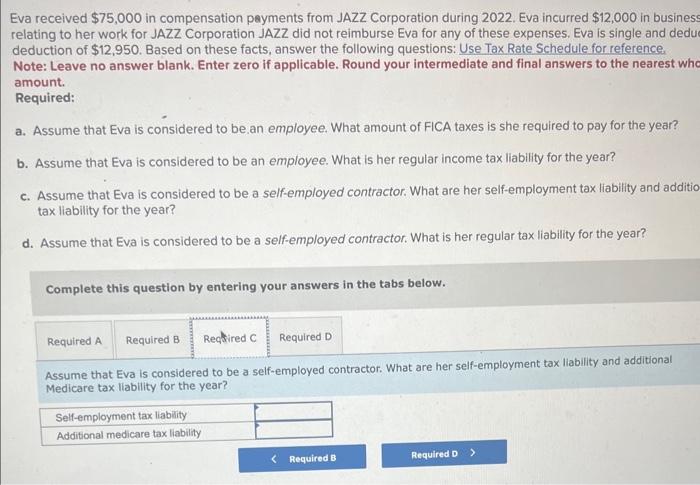

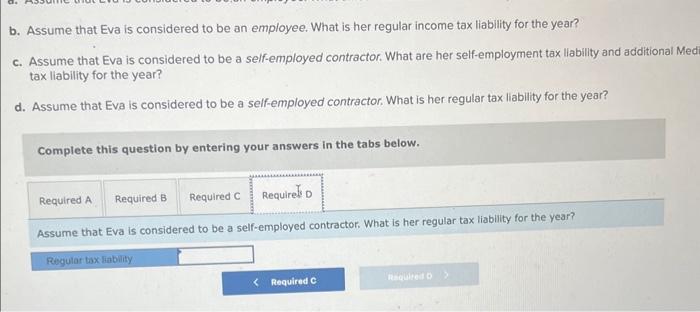

Eva received $75,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $12,000 in business expenses relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and deducts a standard deduction of $12,950. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference. Note: Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whole dollar amount. Required: a. Assume that Eva is considered to be an employee. What amount of FICA taxes is she required to pay for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her selfemployment tax liability and additional Medicare tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be an employee. What amount of ficA taxes is she required to pay for the year? Eva received $75,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $12,000 in business expenses relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and deducts a stand deduction of \$12,950. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference. Note: Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whole dollar amount. Required: a. Assume that Eva is considered to be an employee. What amount of FICA taxes is she required to pay for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liablity and additional Medica tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax llability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be an employee. What is her regular income tax llability for the year? Eva received $75,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $12,000 in business relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and dedu deduction of $12,950. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference Note: Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whe amount. Required: a. Assume that Eva is considered to be.an employee. What amount of FICA taxes is she required to pay for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liability and additio tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liability and additional Medicare tax liability for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liability and additional Mes tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year

Eva received $75,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $12,000 in business expenses relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and deducts a standard deduction of $12,950. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference. Note: Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whole dollar amount. Required: a. Assume that Eva is considered to be an employee. What amount of FICA taxes is she required to pay for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her selfemployment tax liability and additional Medicare tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be an employee. What amount of ficA taxes is she required to pay for the year? Eva received $75,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $12,000 in business expenses relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and deducts a stand deduction of \$12,950. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference. Note: Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whole dollar amount. Required: a. Assume that Eva is considered to be an employee. What amount of FICA taxes is she required to pay for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liablity and additional Medica tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax llability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be an employee. What is her regular income tax llability for the year? Eva received $75,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $12,000 in business relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and dedu deduction of $12,950. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference Note: Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whe amount. Required: a. Assume that Eva is considered to be.an employee. What amount of FICA taxes is she required to pay for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liability and additio tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liability and additional Medicare tax liability for the year? b. Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? c. Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liability and additional Mes tax liability for the year? d. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year? Complete this question by entering your answers in the tabs below. Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started