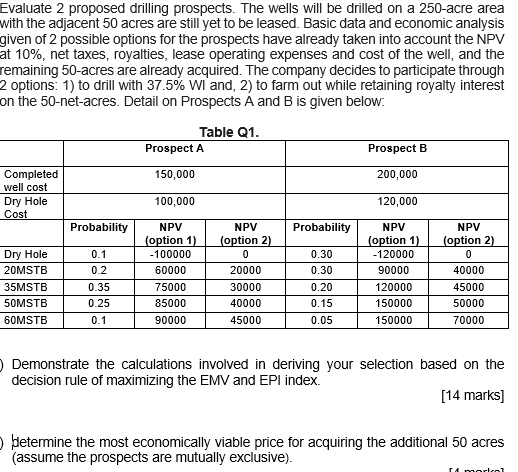

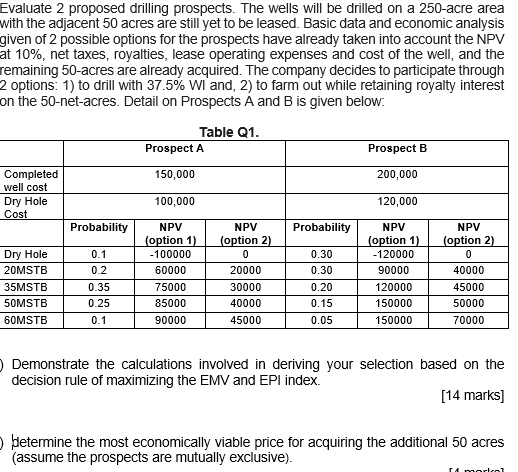

Evaluate 2 proposed drilling prospects. The wells will be drilled on a 250-acre area with the adjacent 50 acres are still yet to be leased. Basic data and economic analysis given of 2 possible options for the prospects have already taken into account the NPV at 10%, net taxes, royalties, lease operating expenses and cost of the well, and the remaining 50-acres are already acquired. The company decides to participate through 2 options: 1) to drill with 37.5% wi and, 2) to farm out while retaining royalty interest on the 50-net-acres. Detail on Prospects A and B is given below. Table Q1. Prospect A Prospect B 150,000 200,000 Completed well cost Dry Hole Cost 100,000 120,000 Probability Probability Dry Hole 20MSTB 35MSTB 50MSTB 60MSTB NPV (option 1) -100000 60000 75000 85000 90000 NPV (option 1) - 120000 90000 0.1 0.2 0.35 0.25 0.1 NPV (option 2) 0 20000 30000 40000 45000 0.30 0.30 0.20 0.15 0.05 NPV (option 2) 0 40000 45000 50000 70000 120000 150000 150000 Demonstrate the calculations involved in deriving your selection based on the decision rule of maximizing the EMV and EPI index. [14 marks] Hetermine the most economically viable price for acquiring the additional 50 acres (assume the prospects are mutually exclusive) ramacool Evaluate 2 proposed drilling prospects. The wells will be drilled on a 250-acre area with the adjacent 50 acres are still yet to be leased. Basic data and economic analysis given of 2 possible options for the prospects have already taken into account the NPV at 10%, net taxes, royalties, lease operating expenses and cost of the well, and the remaining 50-acres are already acquired. The company decides to participate through 2 options: 1) to drill with 37.5% wi and, 2) to farm out while retaining royalty interest on the 50-net-acres. Detail on Prospects A and B is given below. Table Q1. Prospect A Prospect B 150,000 200,000 Completed well cost Dry Hole Cost 100,000 120,000 Probability Probability Dry Hole 20MSTB 35MSTB 50MSTB 60MSTB NPV (option 1) -100000 60000 75000 85000 90000 NPV (option 1) - 120000 90000 0.1 0.2 0.35 0.25 0.1 NPV (option 2) 0 20000 30000 40000 45000 0.30 0.30 0.20 0.15 0.05 NPV (option 2) 0 40000 45000 50000 70000 120000 150000 150000 Demonstrate the calculations involved in deriving your selection based on the decision rule of maximizing the EMV and EPI index. [14 marks] Hetermine the most economically viable price for acquiring the additional 50 acres (assume the prospects are mutually exclusive) ramacool