Answered step by step

Verified Expert Solution

Question

1 Approved Answer

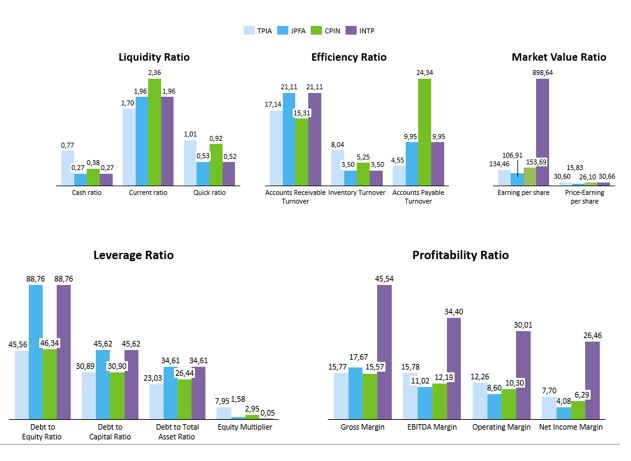

Evaluate and analyze the financial ratios comparison of the above company, TPIA, JPFA, CPIN, INTP (its differentiate by the bar colour) Compare TPIA performance based

Evaluate and analyze the financial ratios comparison of the above company, TPIA, JPFA, CPIN, INTP (its differentiate by the bar colour)

Compare TPIA performance based on financial ratios with those 3 companies

TPIA JPFA CPIN INTP Liquidity Ratio Efficiency Ratio Market Value Ratio 2.35 54 21.11 21.11 1,96 1,96 1,70 17,14 15,31 1,01 0.92 0,53 0.52 106.91 0270,822 3.50 455 154 46 153.60 1583 30.60 25 10 3066 Cash ratio Current ratio Quick ratio Accounts Receivable Inventory Turnover Accounts Payable Turnover Turnover Earning per Share Price-Earning Leverage Ratio Profitability Ratio 88,76 88,76 45.54 34.40 30,01 45,56 46,34 45,52 45,62 30,89 30,90 34,61 34,61 15.77 17,67 15,57 23,03 26.44 15,78 1102 12,19 12,26 8.60 10,30 7,70 629 4,08 795158 2.950.05 Equity Multiplier Debt to Equity Ratio Debt to Capital Ratio Debt to Total Asset Ratio Gross Margin EBITDA Margin Operating Margin Net Income Margin TPIA JPFA CPIN INTP Liquidity Ratio Efficiency Ratio Market Value Ratio 2.35 54 21.11 21.11 1,96 1,96 1,70 17,14 15,31 1,01 0.92 0,53 0.52 106.91 0270,822 3.50 455 154 46 153.60 1583 30.60 25 10 3066 Cash ratio Current ratio Quick ratio Accounts Receivable Inventory Turnover Accounts Payable Turnover Turnover Earning per Share Price-Earning Leverage Ratio Profitability Ratio 88,76 88,76 45.54 34.40 30,01 45,56 46,34 45,52 45,62 30,89 30,90 34,61 34,61 15.77 17,67 15,57 23,03 26.44 15,78 1102 12,19 12,26 8.60 10,30 7,70 629 4,08 795158 2.950.05 Equity Multiplier Debt to Equity Ratio Debt to Capital Ratio Debt to Total Asset Ratio Gross Margin EBITDA Margin Operating Margin Net Income MarginStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started