Answered step by step

Verified Expert Solution

Question

1 Approved Answer

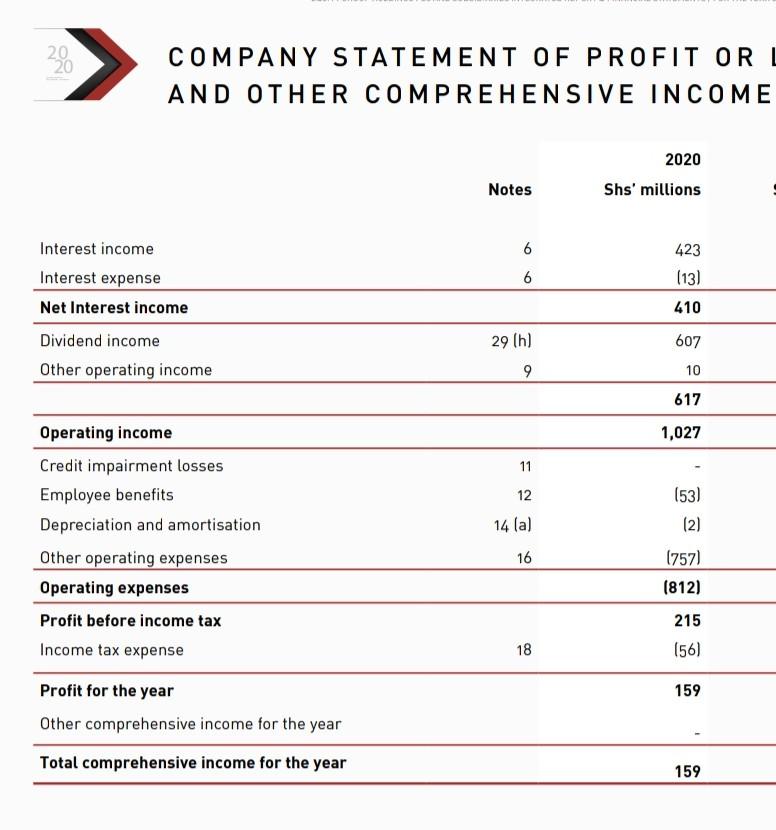

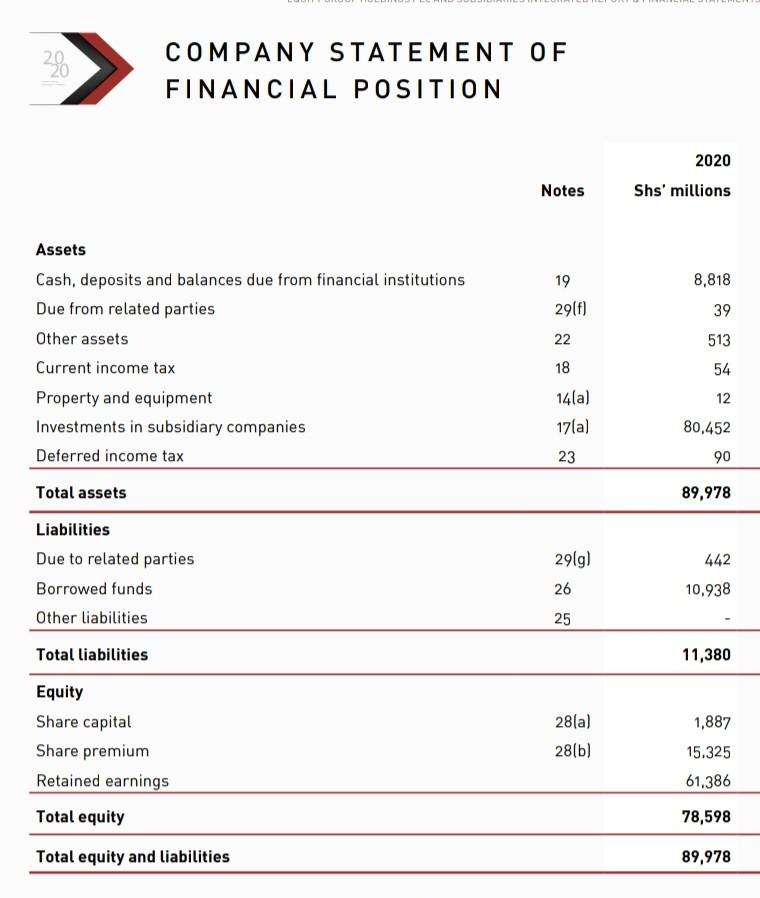

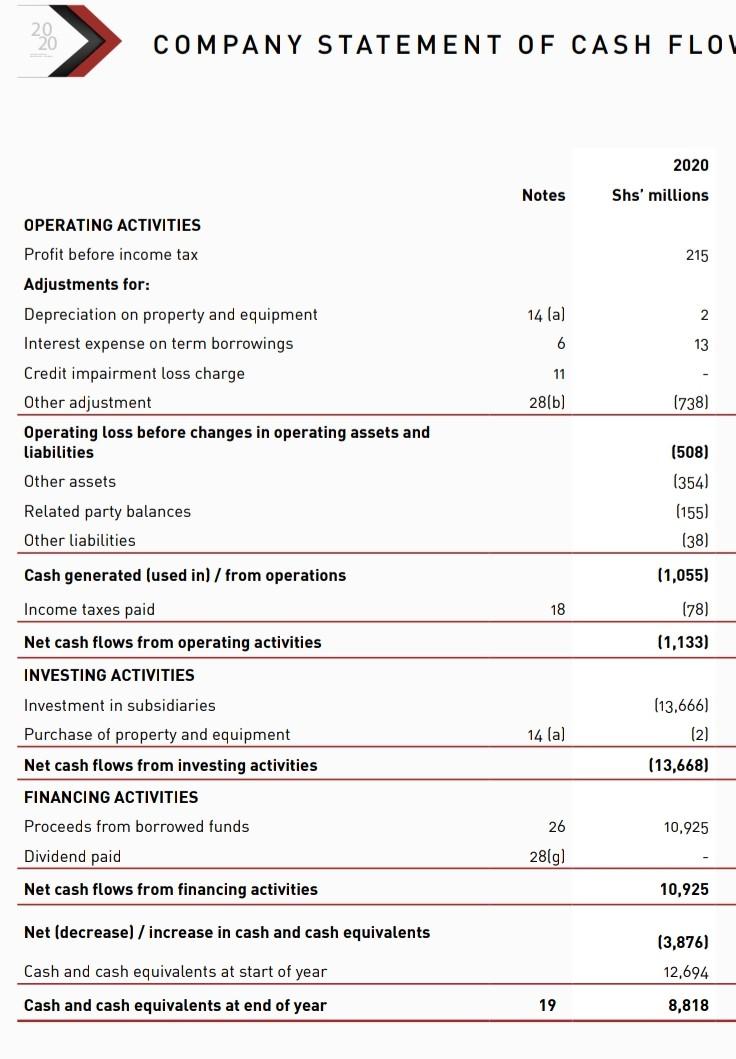

evaluate risk and performance analysis of the bank. Comment on the output of your analysis emanating from the calculations? 20 20 COMPANY STATEMENT OF PROFIT

evaluate risk and performance analysis of the bank. Comment on the output of your analysis emanating from the calculations?

20 20 COMPANY STATEMENT OF PROFIT OR AND OTHER COMPREHENSIVE INCOME 2020 Shs' millions Notes 6 6 Interest income Interest expense Net Interest income Dividend income Other operating income 423 (13) 410 29 (h) 607 9 10 617 1,027 11 12 14 (a) Operating income Credit impairment losses Employee benefits Depreciation and amortisation Other operating expenses Operating expenses Profit before income tax Income tax expense (53) (2) (757) (812) 16 215 (56) 18 159 Profit for the year Other comprehensive income for the year Total comprehensive income for the year 159 20 2 COMPANY STATEMENT OF FINANCIAL POSITION 2020 Notes Shs' millions 8,818 19 29(f) 39 22 513 18 54 12 Assets Cash, deposits and balances due from financial institutions Due from related parties Other assets Current income tax Property and equipment Investments in subsidiary companies Deferred income tax Total assets Liabilities Due to related parties Borrowed funds Other liabilities 14(a) 171a) 23 80,452 90 89,978 2919) 26 442 10.938 25 Total liabilities 11,380 Equity Share capital Share premium Retained earnings Total equity 28(a) 28(b) 1,887 15.325 61.386 78,598 Total equity and liabilities 89,978 22 COMPANY STATEMENT OF CASH FLO 2020 Notes Shs' millions OPERATING ACTIVITIES Profit before income tax 215 14 (al 2 6 13 Adjustments for: Depreciation on property and equipment Interest expense on term borrowings Credit impairment loss charge Other adjustment Operating loss before changes in operating assets and liabilities 11 28(b) (738) Other assets (508) (354) (155) (38) Related party balances Other liabilities Cash generated (used in) / from operations (1,055) Income taxes paid 18 (78) (1,133) Net cash flows from operating activities INVESTING ACTIVITIES Investment in subsidiaries (13,666) (2) 14 (a) Purchase of property and equipment Net cash flows from investing activities FINANCING ACTIVITIES (13,668) Proceeds from borrowed funds 10,925 26 2819) Dividend paid Net cash flows from financing activities 10,925 Net (decrease) / increase in cash and cash equivalents (3,876) 12,694 Cash and cash equivalents at start of year Cash and cash equivalents at end of year 19 8,818

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started