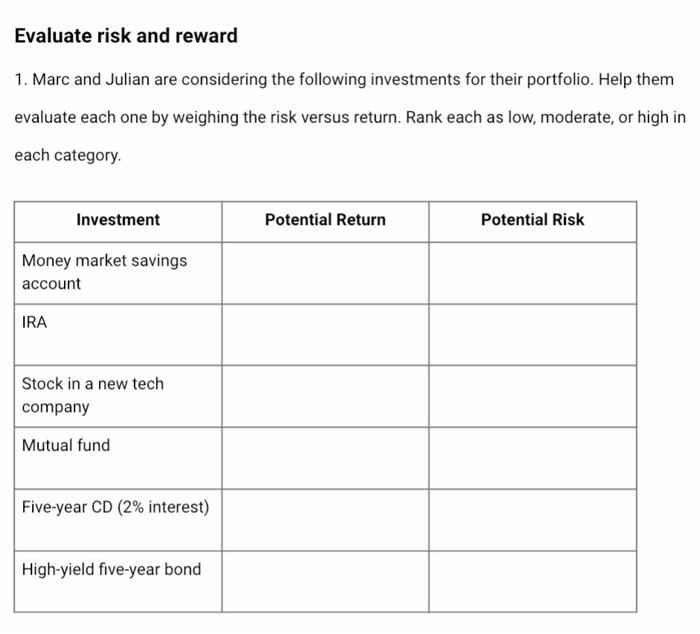

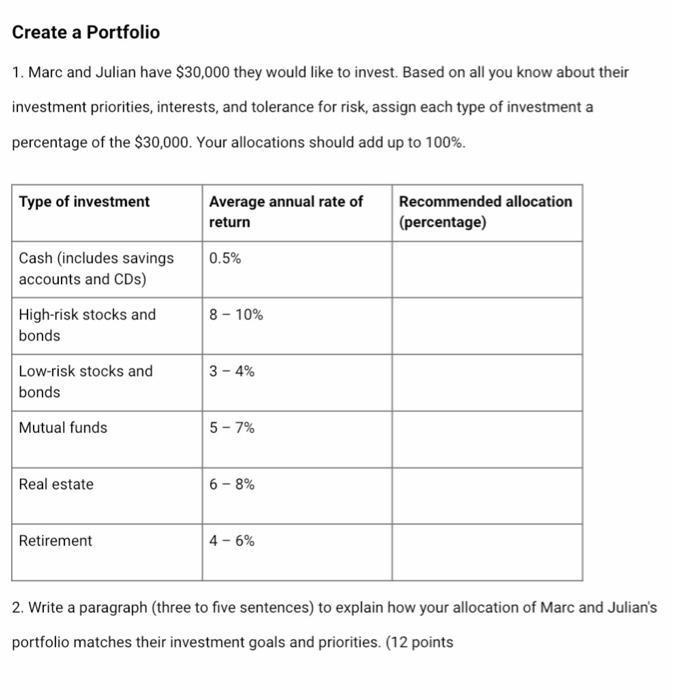

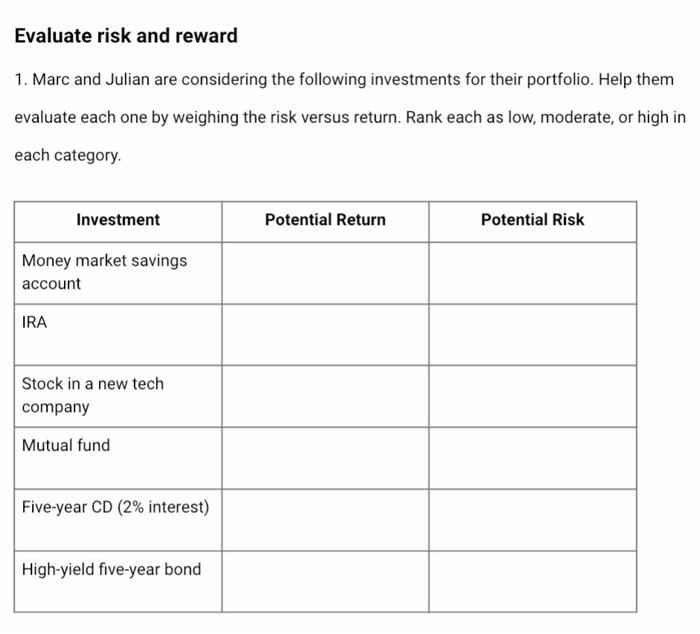

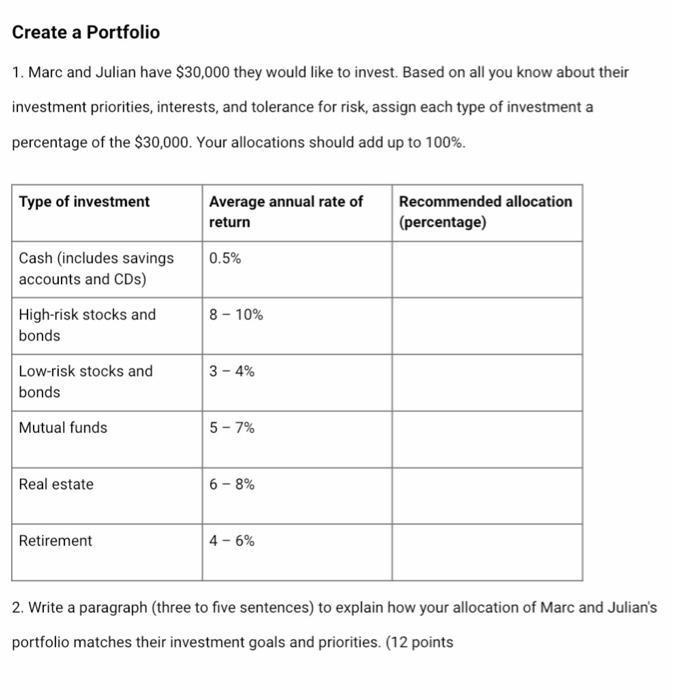

Evaluate risk and reward 1. Marc and Julian are considering the following investments for their portfolio. Help them evaluate each one by weighing the risk versus return. Rank each as low, moderate, or high in each category Investment Potential Return Potential Risk Money market savings account IRA Stock in a new tech company Mutual fund Five-year CD (2% interest) High-yield five-year bond Create a Portfolio 1. Marc and Julian have $30,000 they would like to invest. Based on all you know about their investment priorities, interests, and tolerance for risk, assign each type of investment a percentage of the $30,000. Your allocations should add up to 100%. Type of investment Average annual rate of return Recommended allocation (percentage) 0.5% Cash (includes savings accounts and CDs) High-risk stocks and bonds 8 - 10% 3-4% Low-risk stocks and bonds Mutual funds 5-7% Real estate 6-8% Retirement 4-6% 2. Write a paragraph (three to five sentences) to explain how your allocation of Marc and Julian's portfolio matches their investment goals and priorities. (12 points Evaluate risk and reward 1. Marc and Julian are considering the following investments for their portfolio. Help them evaluate each one by weighing the risk versus return. Rank each as low, moderate, or high in each category Investment Potential Return Potential Risk Money market savings account IRA Stock in a new tech company Mutual fund Five-year CD (2% interest) High-yield five-year bond Create a Portfolio 1. Marc and Julian have $30,000 they would like to invest. Based on all you know about their investment priorities, interests, and tolerance for risk, assign each type of investment a percentage of the $30,000. Your allocations should add up to 100%. Type of investment Average annual rate of return Recommended allocation (percentage) 0.5% Cash (includes savings accounts and CDs) High-risk stocks and bonds 8 - 10% 3-4% Low-risk stocks and bonds Mutual funds 5-7% Real estate 6-8% Retirement 4-6% 2. Write a paragraph (three to five sentences) to explain how your allocation of Marc and Julian's portfolio matches their investment goals and priorities. (12 points