Question

Evaluate tax credits applied in each of the prepared tax returns. Discuss applicable credits taken Explain the filing requirements for the tax position taken

Evaluate tax credits applied in each of the prepared tax returns.

Discuss applicable credits taken

Explain the filing requirements for the tax position taken in each of the prepared tax returns. Include the following:

filing status

qualifying dependents/relatives claimed, if applicable

Explain taxable and non-taxable income. Consider the following:(C1)

What were the taxable sources of income?

Did any of the profiles contain non-taxable income?

What qualified as non-taxable income?

How was non-taxable income reported, if applicable?

Justify deductions taken in each of the prepared tax returns.

Discuss standard versus itemized deduction(s).

Discuss deduction(s) taken on prepared returns.

Evaluate tax credits applied in each of the prepared tax returns.

Discuss applicable credits taken

Describe client(s) profile to assist with tax planning preparations. Include the following:

High-level points from the profile(s) to determine client's goals

Relevant factors that could impact the tax planning process

Identify research necessary to find applicable tax planning solutions for the clients in each scenario. Include the following:

Methods for assessing the client's tax situation for future tax planning

Sources applicable to tax year in question to answer tax questions for the client's scenario

Income limitations (I.e., earned income, income thresholds)

Decisions for any dependents

Evaluate benefits of tax planning for the client(s). Include the following:

How to minimize tax liability to improve clients' future tax situation

Create tax planning recommendations based on the client's profile. Include the following:

Outlined steps that will improve tax position based on each client's goals (i.e., what tax planning solutions were applicable?)

Explain how clients can do their taxes differently over the coming year to achieve their goal. (i.e., what changes could be made to implement a tax planning strategy not currently applicable?)

Examples of how clients can improve tax position for the upcoming year

use an an example from a different student with different clients.

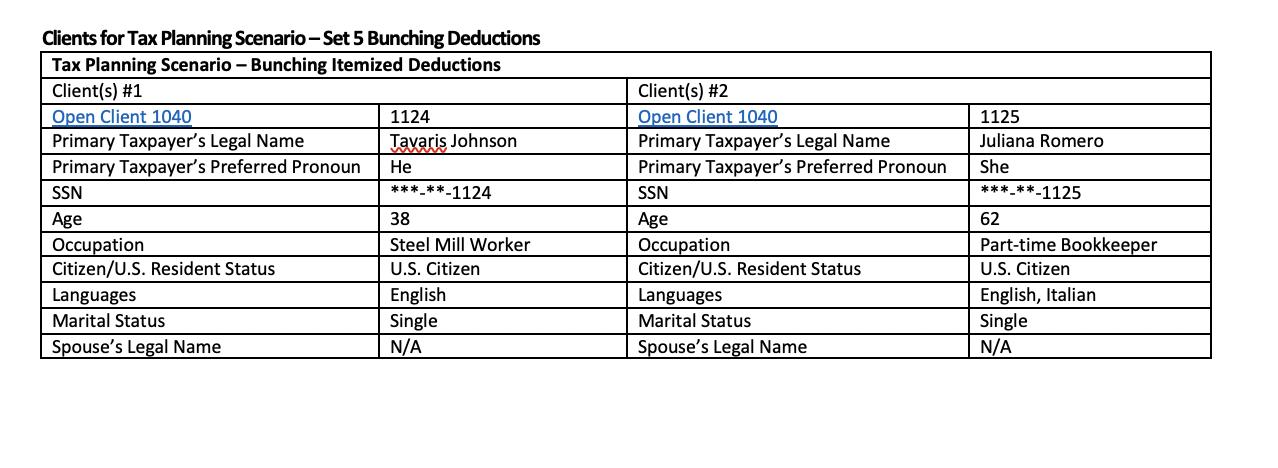

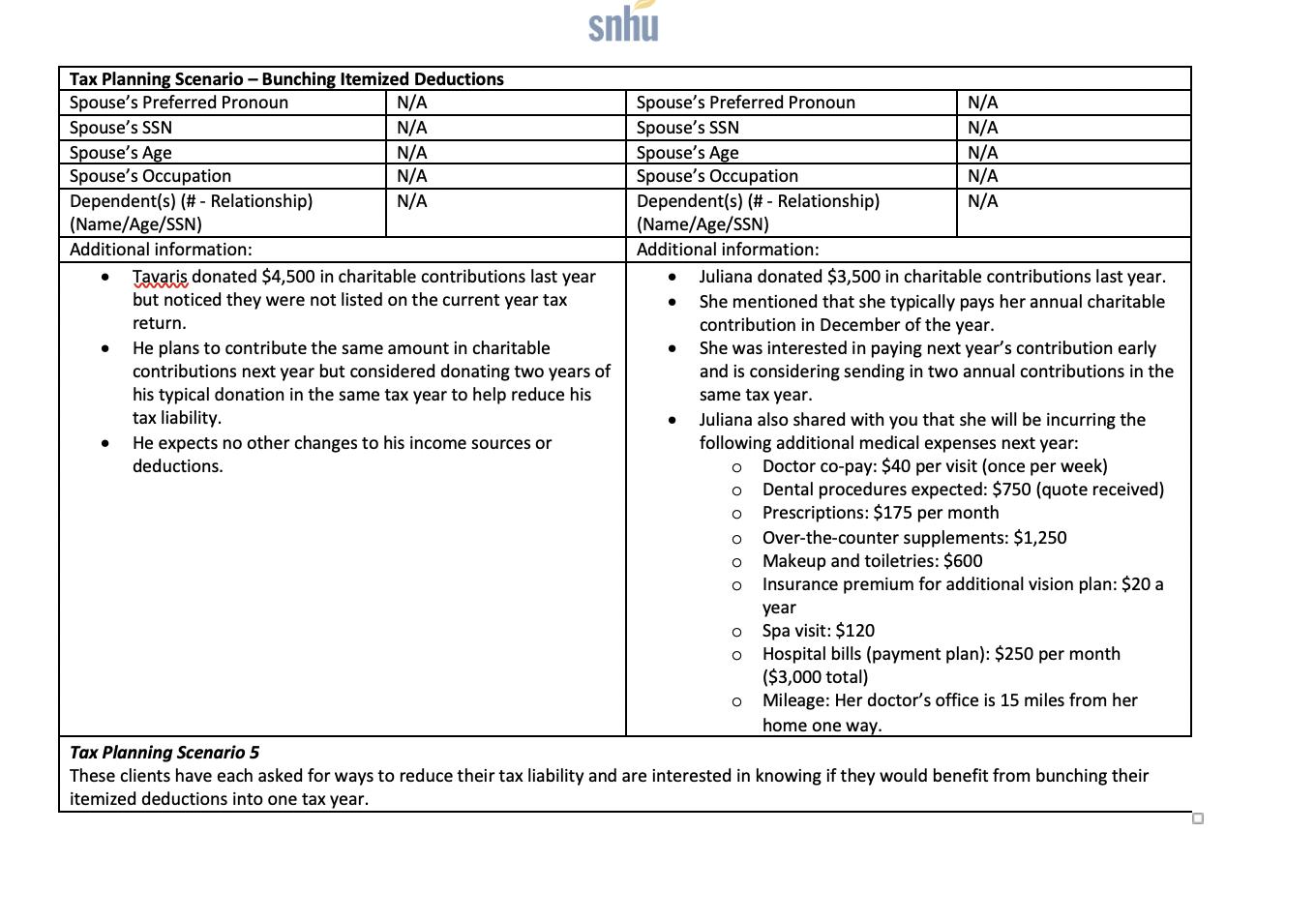

Clients for Tax Planning Scenario-Set 5 Bunching Deductions Tax Planning Scenario - Bunching Itemized Deductions Client(s) #1 Open Client 1040 Primary Taxpayer's Legal Name 1124 Tavaris Johnson Primary Taxpayer's Preferred Pronoun He SSN ***-**-1124 SSN Age 38 Age Occupation Steel Mill Worker Citizen/U.S. Resident Status U.S. Citizen Languages Marital Status Spouse's Legal Name English Single N/A Client(s) #2 Open Client 1040 Primary Taxpayer's Legal Name Primary Taxpayer's Preferred Pronoun Occupation 1125 Juliana Romero She ***-**-1125 62 Part-time Bookkeeper Citizen/U.S. Resident Status U.S. Citizen English, Italian Languages Marital Status Spouse's Legal Name Single N/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started