Answered step by step

Verified Expert Solution

Question

1 Approved Answer

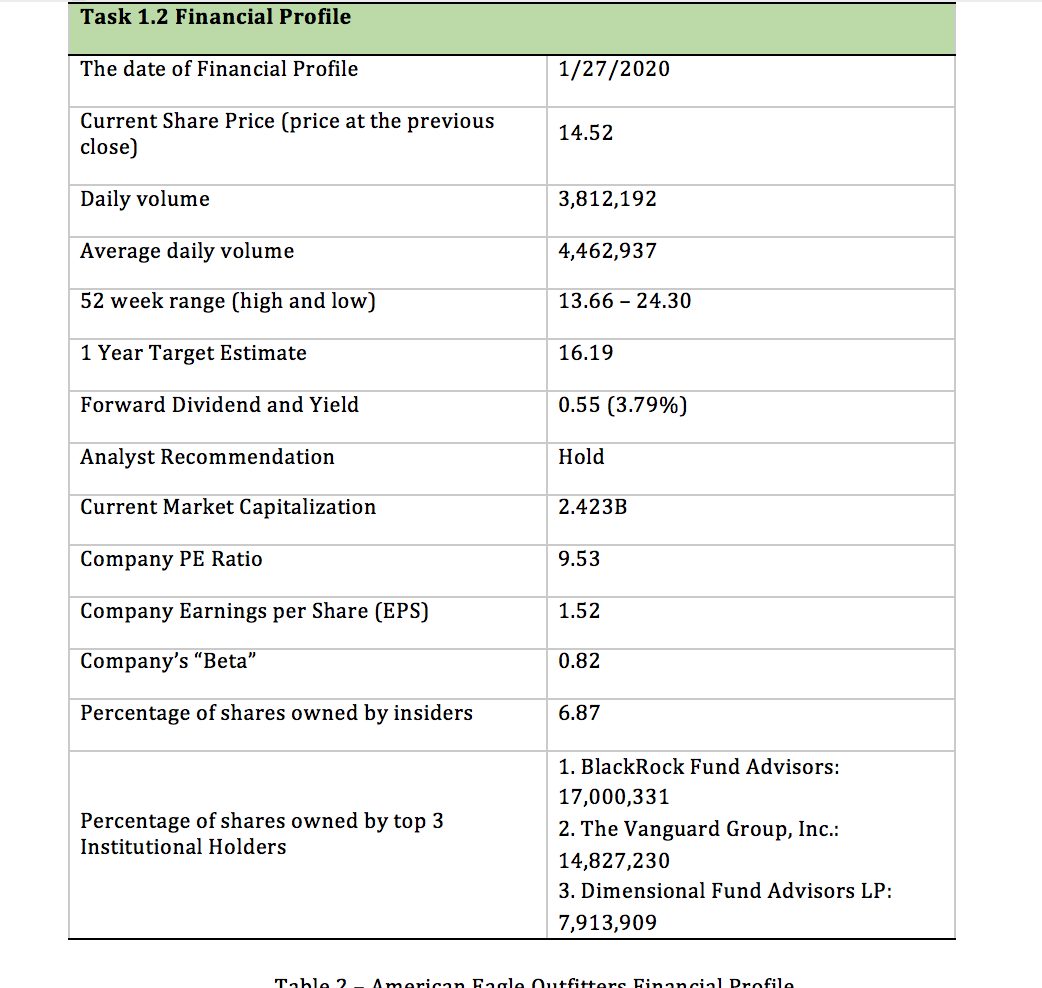

Evaluate the analyst recommendation you reported in Task 1.2. In other words, given the recent trading activity (stock price and volume), and your stocks current

Evaluate the analyst recommendation you reported in Task 1.2. In other words, given the recent trading activity (stock price and volume), and your stocks current share price relative to its 52-week price range, why do you think the analysts viewing your companys stock as a buy, sell, or hold opportunity? Be sure to provide a specific justification.

Consider any factor most significant for the firm, such as recent financial performance, product sales trends, press releases by your company, or other published news sources.

Task 1.2 Financial Profile The date of Financial Profile 1/27/2020 Current Share Price (price at the previous close) 14.52 Daily volume 3,812,192 Average daily volume 4,462,937 52 week range (high and low) 13.66 - 24.30 1 Year Target Estimate 16.19 Forward Dividend and Yield 0.55 (3.79%) Analyst Recommendation Hold Current Market Capitalization 2.423B Company PE Ratio 9.53 Company Earnings per Share (EPS) 1.52 Company's Beta" 0.82 Percentage of shares owned by insiders 6.87 Percentage of shares owned by top 3 Institutional Holders 1. BlackRock Fund Advisors: 17,000,331 2. The Vanguard Group, Inc.: 14,827,230 3. Dimensional Fund Advisors LP: 7,913,909 Table 2-American Eagle Outfitters Financial Profile Task 1.2 Financial Profile The date of Financial Profile 1/27/2020 Current Share Price (price at the previous close) 14.52 Daily volume 3,812,192 Average daily volume 4,462,937 52 week range (high and low) 13.66 - 24.30 1 Year Target Estimate 16.19 Forward Dividend and Yield 0.55 (3.79%) Analyst Recommendation Hold Current Market Capitalization 2.423B Company PE Ratio 9.53 Company Earnings per Share (EPS) 1.52 Company's Beta" 0.82 Percentage of shares owned by insiders 6.87 Percentage of shares owned by top 3 Institutional Holders 1. BlackRock Fund Advisors: 17,000,331 2. The Vanguard Group, Inc.: 14,827,230 3. Dimensional Fund Advisors LP: 7,913,909 Table 2-American Eagle Outfitters Financial ProfileStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started