Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate the capital project by calculating the following metrics: Net present value (NPV) Internal rate of return (IRR) Modified internal rate of return (MIRR)

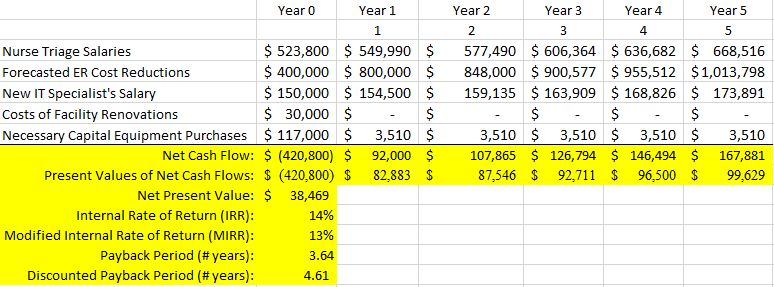

Evaluate the capital project by calculating the following metrics: Net present value (NPV) Internal rate of return (IRR) Modified internal rate of return (MIRR) Payback period Discounted payback period In a 1- to 2-page report including a supporting Excel spreadsheet to show your work, provide your recommendation with rationale, as to whether the project is acceptable, assuming Jiranna Healthcare has a corporate policy of not accepting projects that take more than 3.5 years to pay for themselves, and assuming an 11% cost of capital. Capital Project Case Study This case study considers the expected costs and benefits to Jiranna Healthcare resulting from a decision to design a centralized nurse triage line. This triage line would assist Jiranna patients in providing self-care and/or with seeking care at an urgent care facility in lieu of more expensive after-hours care in the emergency room. Summary Jiranna Healthcare's main facility is home to more than 80 onsite specialty and surgery clinics, employing over 5,000 staff. In addition to the main hospital, Jiranna Healthcare has 11 satellite clinics, which can contain healthcare services, such as pediatrics, family medicine, and mental health etc. These facilities (the hospital plus outlying clinics) serve a total enrollee population of 97,000. Currently, Jiranna Healthcare's centralized call center schedules patient appointments for each of the 11 satellite clinics, handling an average of 1,500 to 2,000 calls daily with a staff of 20. Patients routinely have difficulty obtaining urgent or acute care in a timely fashion. Additionally, in three out of four cases, the majority of Jiranna Healthcare's healthcare centers are unable to meet access standards. These access issues have a secondary effect on the call center, which experiences a much higher call rate because members have to call back multiple times to find available appointments. The existing process leads to overutilization of emergency departments for urgent care and non-emergent concerns. In addition, patient satisfaction has steadily declined as a result of the continued lack of access to healthcare services. To address this problem, there is a proposal to implement a centralized nurse triage line, an offsite phone center that would be staffed by registered nurses with a multitude of specialties, including emergency room (ER) nurses, critical care, surgical, and even some nurse practitioners. These nurses are able to offer callers medical advice encompassing the treatment of fevers, wound care, and emergent conditions, such as chest pain. The nurses are trained to triage conditions to the appropriate level of care, be that at home, at an urgent care center, or at an emergency department. The major cost impact is the increased salary requirement for the phone center staff, which will entail approximately 33 multi-discipline employees, based on workload and enrollment data. Additional elements of the proposal include hiring an information technology (IT) specialist to manage the triage line's computer system and facility renovations. The main benefit of this proposal is the projected cost reductions in patient care as a result of moving non-emergent care out of the expensive emergency-room setting. Year 0 Year 1 1 Year 2 2 Year 3 3 Year 4 4 Year 5 5 Nurse Triage Salaries Forecasted ER Cost Reductions New IT Specialist's Salary Costs of Facility Renovations Necessary Capital Equipment Purchases $ 523,800 $549,990 $ $ 400,000 $ 800,000 $ $150,000 $ 154,500 $ $ 30,000 $ $ $117,000 $ 3,510 $ Net Cash Flow: $ (420,800) $ 92,000 $ Present Values of Net Cash Flows: $ (420,800) $ 82,883 $ $ 3,510 $3,510 $ 3,510 $ 107,865 $ 126,794 $ 146,494 $ 87,546 $ 92,711 $ 96,500 $ $ 577,490 $ 606,364 $ 636,682 $ 668,516 848,000 $900,577 $955,512 $1,013,798 159,135 $163,909 $ 168,826 $ 173,891 $ 3,510 167,881 99,629 Net Present Value: $ 38,469 Internal Rate of Return (IRR): 14% Modified Internal Rate of Return (MIRR): 13% Payback Period (# years): 3.64 Discounted Payback Period (# years): 4.61

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the capital project of implementing a centralized nurse triage line for Jiranna Healthcare we need to calculate several metrics Net Presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started