Answered step by step

Verified Expert Solution

Question

1 Approved Answer

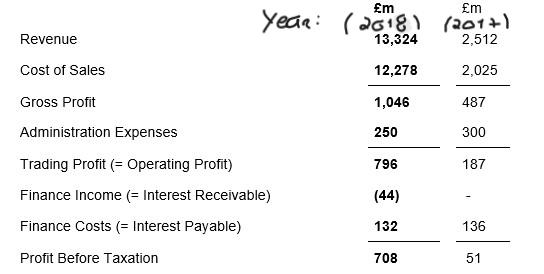

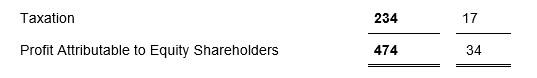

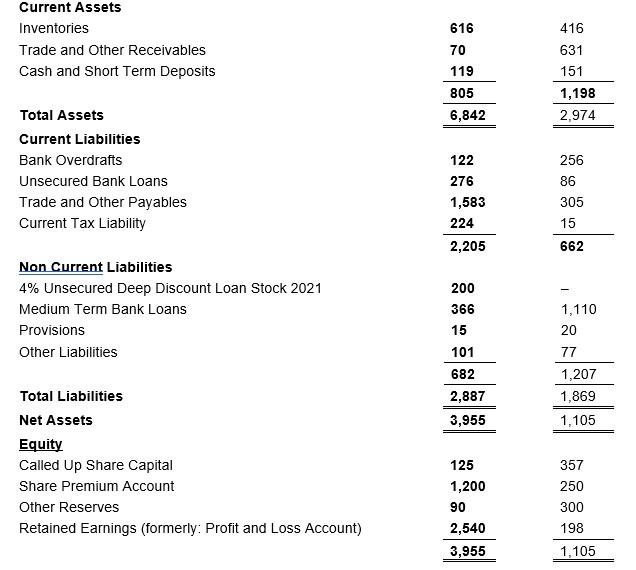

Evaluate the profitability, liquidity position and cash conversion cycle of company A for the two years. Include calculations for the two years. Assume all sales

Evaluate the profitability, liquidity position and cash conversion cycle of company A for the two years. Include calculations for the two years. Assume all sales are made on credit.

- Profitability ( Gross Profit % and Pre-tax %)

- Liquidity (Current Ratio and debt Ratio

- Cash conversion cycle

m m Year: (2018) (2017) Revenue 13,324 2,512 Cost of Sales 12,278 2,025 Gross Profit 1,046 487 Administration Expenses 250 300 796 187 Trading Profit (= Operating Profit) Finance Income (= Interest Receivable) Finance Costs (= Interest Payable) (44) 132 136 Profit Before Taxation 708 51 Taxation 234 17 Profit Attributable to Equity Shareholders 474 34 m fm Assets and Liabilities Non-Current Assets Property, Plant and Equipment Other Investments 6,022 15 6,037 1,766 10 1,776 Current Assets Inventories Trade and Other Receivables Cash and Short Term Deposits 616 70 119 805 6,842 416 631 151 1,198 2,974 Total Assets Current Liabilities Bank Overdrafts Unsecured Bank Loans Trade and Other Payables Current Tax Liability 122 276 1,583 224 2,205 256 86 305 15 662 Non Current Liabilities 4% Unsecured Deep Discount Loan Stock 2021 Medium Term Bank Loans Provisions Other Liabilities 200 366 15 101 682 2,887 3,955 1,110 20 77 1,207 1,869 1,105 Total Liabilities Net Assets Equity Called Up Share Capital Share Premium Account Other Reserves Retained Earnings (formerly: Profit and Loss Account) 125 1,200 90 2,540 3,955 357 250 300 198 1,105Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started