Answered step by step

Verified Expert Solution

Question

1 Approved Answer

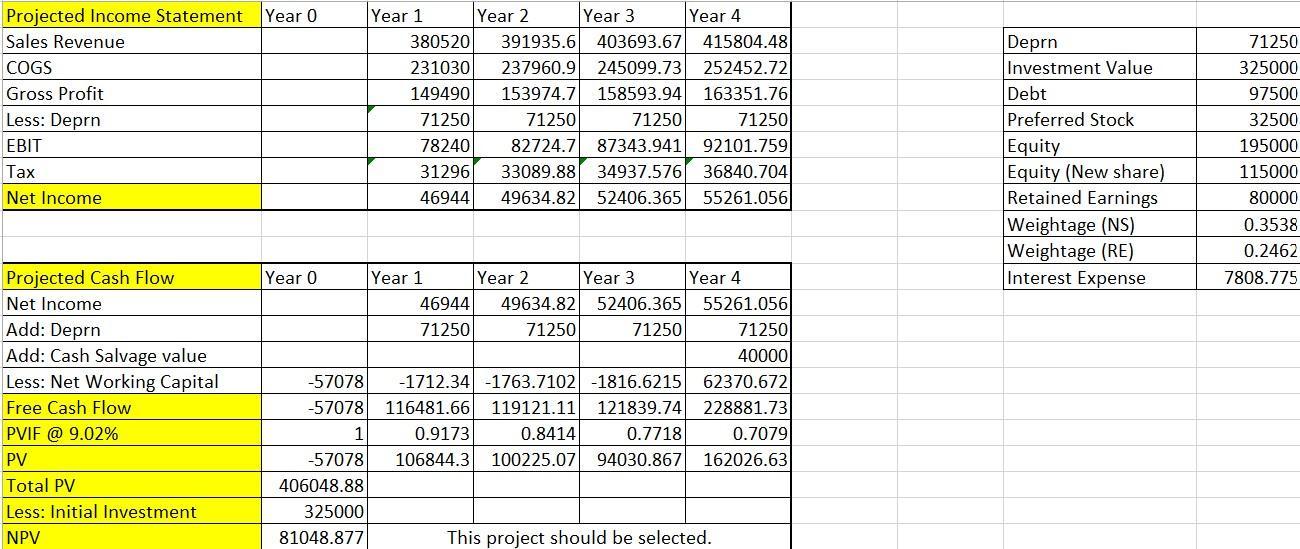

Evaluate the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods. Is the project acceptable? Briefly explain.

Evaluate the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods. Is the project acceptable? Briefly explain. Why is the NPV method superior to the other methods of capital budgeting? Briefly explain.

Projected Income Statement Year 0 Sales Revenue COGS Gross Profit Less: Deprn EBIT Tax Net Income Projected Cash Flow Net Income Add: Deprn Add: Cash Salvage value Less: Net Working Capital Free Cash Flow PVIF @ 9.02% PV Total PV Less: Initial Investment. NPV Year 0 -57078 -57078 1 -57078 406048.88 325000 81048.877 Year 2 Year 3 Year 4 380520 391935.6 403693.67 415804.48 231030 237960.9 245099.73 252452.72 149490 153974.7 158593.94 163351.76 71250 71250 71250 71250 82724.7 87343.941 92101.759| 78240 31296 33089.88 34937.576 36840.704 46944 49634.82 52406.365 55261.056 Year 1 Year 1 46944 71250 Year 2 49634.82 71250 Year 3 Year 4 52406.365 55261.056 71250 71250 40000 -1712.34 -1763.7102 -1816.6215 62370.672 116481.66 119121.11 121839.74 228881.73 0.9173 0.7079 0.8414 0.7718 106844.3 100225.07 94030.867 162026.63 This project should be selected. Deprn Investment Value Debt Preferred Stock Equity Equity (New share) Retained Earnings Weightage (NS) Weightage (RE) Interest Expense 71250 325000 97500 32500 195000 115000 80000 0.3538 0.2462 7808.775

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The project is acceptable based on the NPV IRR MIRR simple payback period and discounted payback per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started