Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluating alternative notes A borrower has two alternatives for a loan: (1) issue a $390,000, 30-day, 5% note or (2) issue a $390,000, 30-day

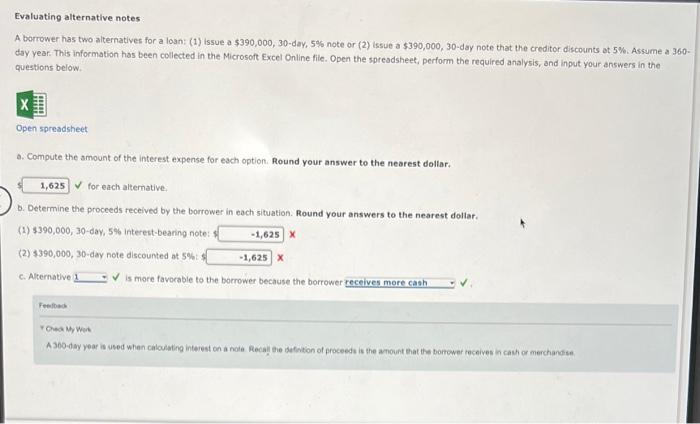

Evaluating alternative notes A borrower has two alternatives for a loan: (1) issue a $390,000, 30-day, 5% note or (2) issue a $390,000, 30-day note that the creditor discounts at 5%. Assume a 360- day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Compute the amount of the interest expense for each option. Round your answer to the nearest dollar. 1,625 for each alternative. b. Determine the proceeds received by the borrower in each situation. Round your answers to the nearest dollar. (1) $390,000, 30-day, 5% interest-bearing note: (2) $390,000, 30-day note discounted at 5%: s c. Alternative 1 -1,625 X -1,625 X is more favorable to the borrower because the borrower receives more cash Feedback Check My Work A 300-day year is used when calculating interest on a note. Recall the definition of proceeds is the amount that the borrower receives in cash or merchandise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started