Answered step by step

Verified Expert Solution

Question

1 Approved Answer

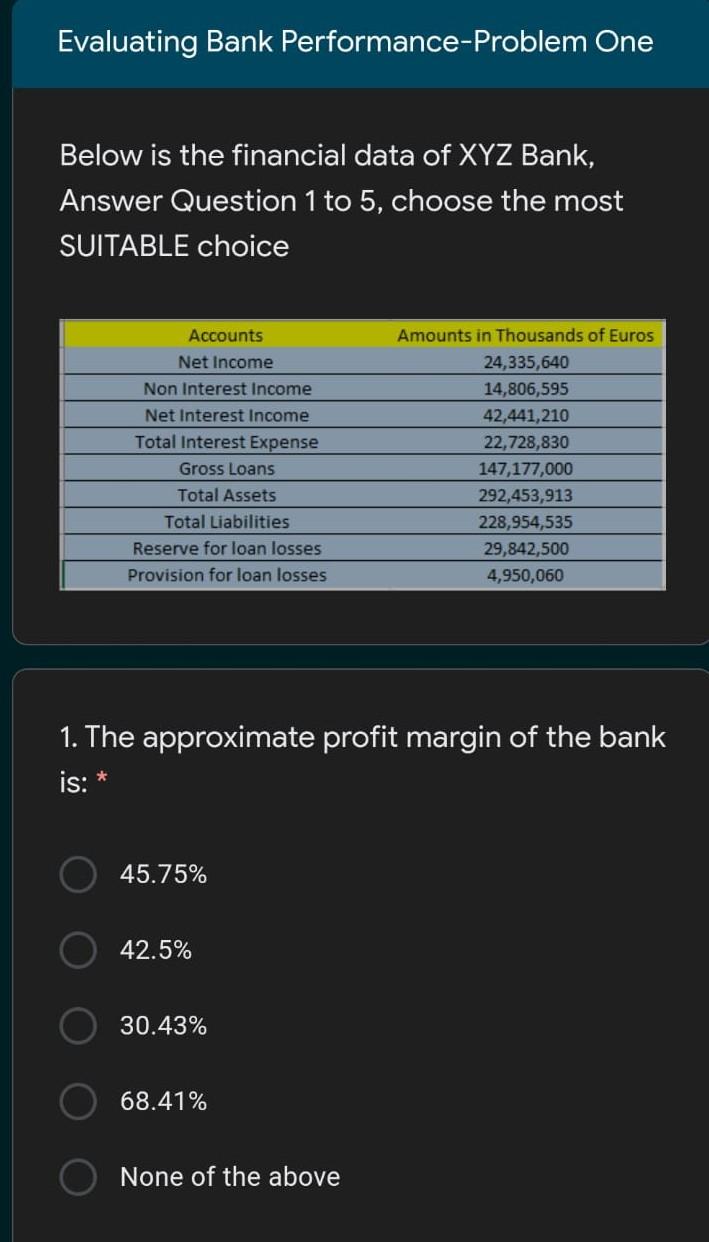

Evaluating Bank Performance-Problem One Below is the financial data of XYZ Bank, Answer Question 1 to 5, choose the most SUITABLE choice Accounts Net Income

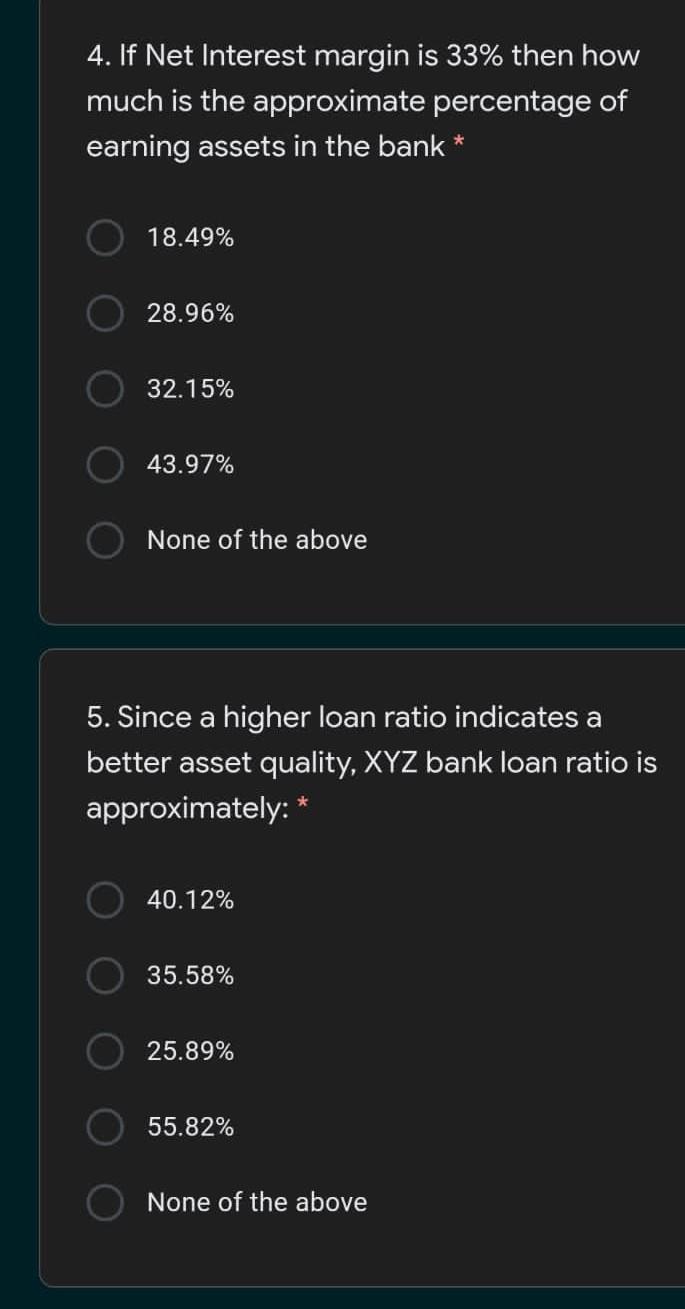

Evaluating Bank Performance-Problem One Below is the financial data of XYZ Bank, Answer Question 1 to 5, choose the most SUITABLE choice Accounts Net Income Non Interest Income Net Interest Income Total Interest Expense Gross Loans Total Assets Total Liabilities Reserve for loan losses Provision for loan losses Amounts in Thousands of Euros 24,335,640 14,806,595 42,441,210 22,728,830 147,177,000 292,453,913 228,954,535 29,842,500 4,950,060 1. The approximate profit margin of the bank is: * 45.75% 42.5% 30.43% 68.41% None of the above 4. If Net Interest margin is 33% then how much is the approximate percentage of earning assets in the bank * 18.49% 28.96% 32.15% 43.97% None of the above 5. Since a higher loan ratio indicates a better asset quality, XYZ bank loan ratio is approximately: * 40.12% 35.58% 25.89% 55.82% None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started