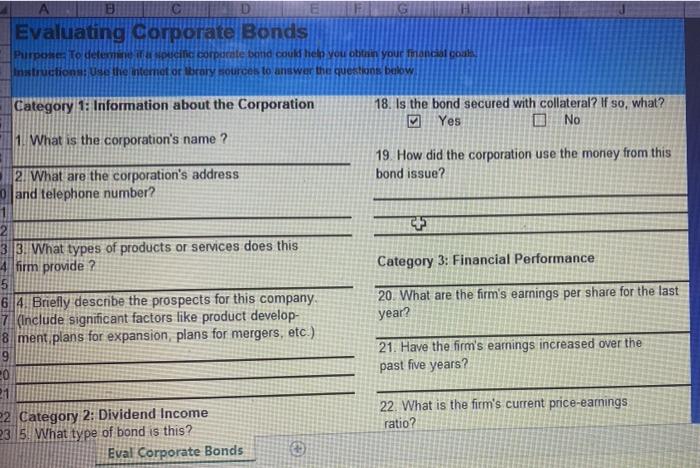

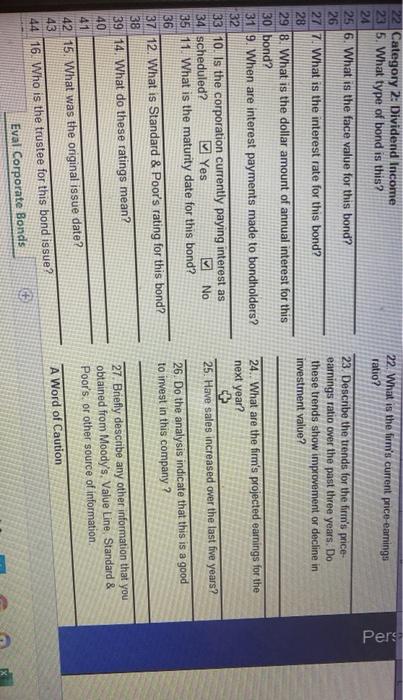

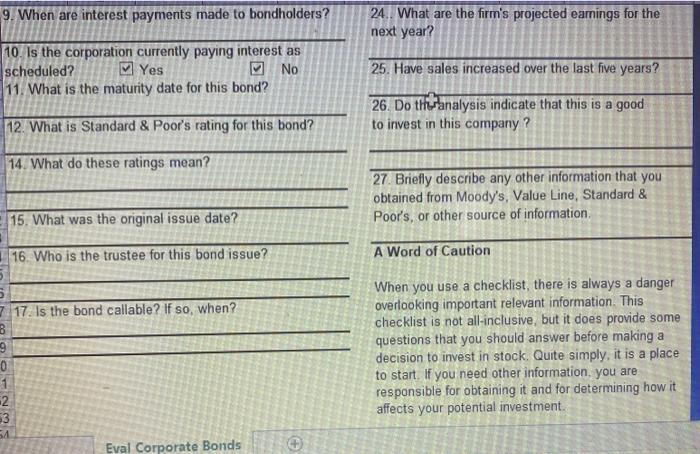

Evaluating Corporate Bonds PurposeTo defecific corpucale band could help you obtain your lancial goals Instructions: Use the internet or library sources to answer the questions below Category 1: Information about the Corporation 18. Is the bond secured with collateral? If so, what? Yes 0 No 1. What is the corporation's name? 19 How did the corporation use the money from this bond issue? 2. What are the corporation's address and telephone number? Category 3: Financial Performance 20. What are the firm's earnings per share for the last year? 2 33. What types of products or services does this 4 firm provide ? 5 64. Briefly describe the prospects for this company. 71 (Include significant factors like product develop- 8 ment plans for expansion plans for mergers, etc.) 9 0 21 22 Category 2: Dividend Income 23 5: What type of bond is this? Eval Corporate Bonds 21. Have the firm's earnings increased over the past five years? 22. What is the firm's current price-earnings ratio? 22 Category 2: Dividend Income 23 5. What type of bond is this? 24 25 6. What is the face value for this bond? 22. What is the firm's current price-earnings ratio? Pers 26 23. Describe the trends for the firm's price- earnings ratio over the past three years. Do these trends show improvement or decline in investment value? 277 What is the interest rate for this bond? 28 29 8. What is the dollar amount of annual interest for this 30 bond? 31 9. When are interest payments made to bondholders? 32 33 10. Is the corporation currently paying interest as 34 scheduled? Yes No 35 11. What is the maturity date for this bond? 36 37 12. What is Standard & Poor's rating for this bond? 24. What are the firm's projected earnings for the next year? 25. Have sales increased over the last five years? 26. Do the analysis indicate that this is a good to invest in this company ? 38 27. Briefly describe any other information that you obtained from Moody's, Value Line Standard & Poor's, or other source of information 39 14. What do these ratings mean? 40 41 42 15. What was the original issue date? 43 44 16. Who is the trustee for this bond issue? Eval Corporate Bonds A Word of Caution + 9. When are interest payments made to bondholders? 24. What are the firm's projected earnings for the next year? 10. Is the corporation currently paying interest as scheduled? No 11. What is the maturity date for this bond? M Yes 25. Have sales increased over the last five years? 26. Do the analysis indicate that this is a good to invest in this company ? 12. What is Standard & Poor's rating for this bond? 14. What do these ratings mean? 27 Briefly describe any other information that you obtained from Moody's, Value Line, Standard & Poor's, or other source of information 15. What was the original issue date? 16. Who is the trustee for this bond issue? A Word of Caution 7 17. Is the bond callable? If so, when? B 9 0 1 2 63 54 Eval Corporate Bonds When you use a checklist, there is always a danger overlooking important relevant information. This checklist is not all-inclusive, but it does provide some questions that you should answer before making a decision to invest in stock. Quite simply, it is a place to start. If you need other information, you are responsible for obtaining it and for determining how it affects your potential investment. Evaluating Corporate Bonds PurposeTo defecific corpucale band could help you obtain your lancial goals Instructions: Use the internet or library sources to answer the questions below Category 1: Information about the Corporation 18. Is the bond secured with collateral? If so, what? Yes 0 No 1. What is the corporation's name? 19 How did the corporation use the money from this bond issue? 2. What are the corporation's address and telephone number? Category 3: Financial Performance 20. What are the firm's earnings per share for the last year? 2 33. What types of products or services does this 4 firm provide ? 5 64. Briefly describe the prospects for this company. 71 (Include significant factors like product develop- 8 ment plans for expansion plans for mergers, etc.) 9 0 21 22 Category 2: Dividend Income 23 5: What type of bond is this? Eval Corporate Bonds 21. Have the firm's earnings increased over the past five years? 22. What is the firm's current price-earnings ratio? 22 Category 2: Dividend Income 23 5. What type of bond is this? 24 25 6. What is the face value for this bond? 22. What is the firm's current price-earnings ratio? Pers 26 23. Describe the trends for the firm's price- earnings ratio over the past three years. Do these trends show improvement or decline in investment value? 277 What is the interest rate for this bond? 28 29 8. What is the dollar amount of annual interest for this 30 bond? 31 9. When are interest payments made to bondholders? 32 33 10. Is the corporation currently paying interest as 34 scheduled? Yes No 35 11. What is the maturity date for this bond? 36 37 12. What is Standard & Poor's rating for this bond? 24. What are the firm's projected earnings for the next year? 25. Have sales increased over the last five years? 26. Do the analysis indicate that this is a good to invest in this company ? 38 27. Briefly describe any other information that you obtained from Moody's, Value Line Standard & Poor's, or other source of information 39 14. What do these ratings mean? 40 41 42 15. What was the original issue date? 43 44 16. Who is the trustee for this bond issue? Eval Corporate Bonds A Word of Caution + 9. When are interest payments made to bondholders? 24. What are the firm's projected earnings for the next year? 10. Is the corporation currently paying interest as scheduled? No 11. What is the maturity date for this bond? M Yes 25. Have sales increased over the last five years? 26. Do the analysis indicate that this is a good to invest in this company ? 12. What is Standard & Poor's rating for this bond? 14. What do these ratings mean? 27 Briefly describe any other information that you obtained from Moody's, Value Line, Standard & Poor's, or other source of information 15. What was the original issue date? 16. Who is the trustee for this bond issue? A Word of Caution 7 17. Is the bond callable? If so, when? B 9 0 1 2 63 54 Eval Corporate Bonds When you use a checklist, there is always a danger overlooking important relevant information. This checklist is not all-inclusive, but it does provide some questions that you should answer before making a decision to invest in stock. Quite simply, it is a place to start. If you need other information, you are responsible for obtaining it and for determining how it affects your potential investment