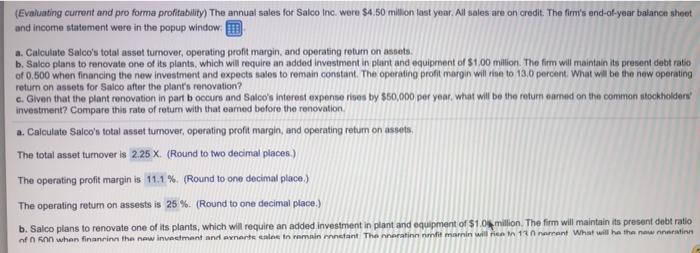

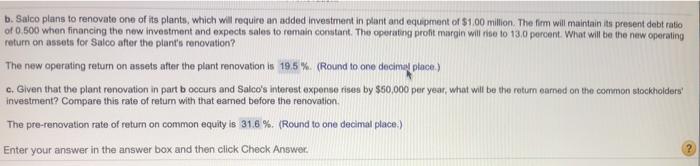

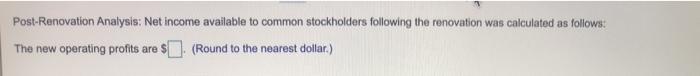

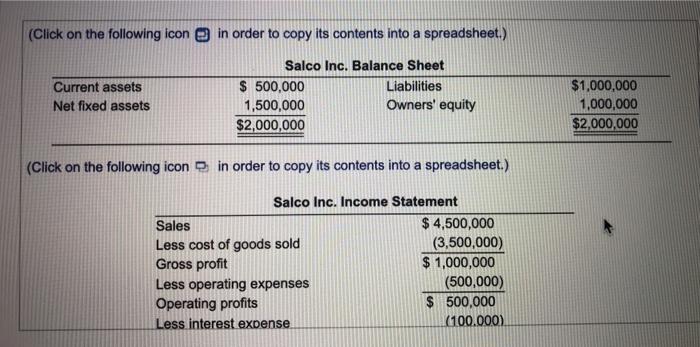

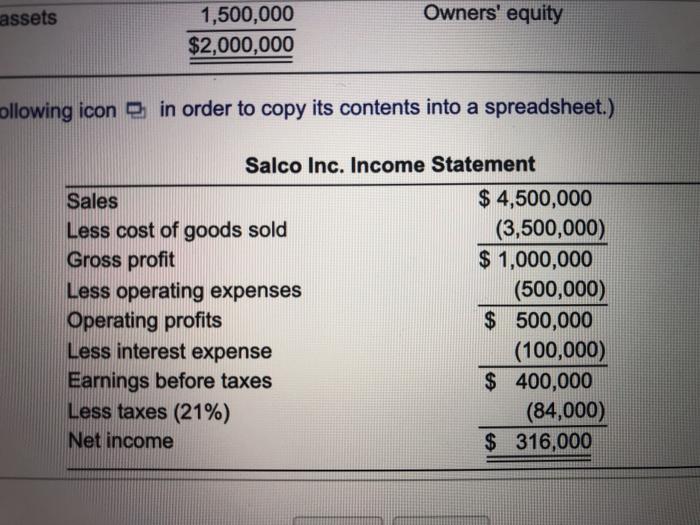

(Evaluating current and pro forma profitability) The annual sales for Salco Inc. were $4.50 million last year. All sales are on credit. The firm's end-at-year balance sheet and income statement were in the popup window: a. Calculate Salco's total asset turnover operating profit margin, and operating return on assets. b. Salco plans to renovate one of its plants, which will require an added investment in plant and equipment of $1.00 million. The firm will maintain its present debt ratio of 0.500 when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13.0 percent What will be the new operating return on assets for Salco after the plant's renovation? c. Given that the plant renovation in part boccurs and Saloo's interest expenseries by $50,000 per year, what will be the return corned on the common stockholder investment? Compare this rate of return with that earned before the renovation a. Calculate Saloo's total asset tumover, operating profit margin, and operating retum on assets, The total asset turnover is 2.25 X. (Round to two decimal places.) The operating profit margin is 11.1 % (Round to one decimal place) The operating retum on assests is 25% (Round to one decimal place) b. Salco plans to renovate one of its plants, which will require an added investment in plant and equipment of $1,0$ million. The firm will maintain its present debt ratio of non when finanrinn the new investment and events cale to main constant Thennaratinn mi marrin will fie in 11 arcent What will ha the new natin b. Salco plans to renovate one of its plants, which will require an added investment in plant and equipment of $1.00 million. The firm will maintain its present debt ratio of 0.500 when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13.0 percent. What will be the new operating return on assets for Salco after the plant's renovation? The new operating return on assets after the plant renovation is 19,5 %. (Round to one decimal place) c. Given that the plant renovation in part b occurs and Salco's interest expense rises by $60,000 per year, what will be the retur camned on the common stockholders' investment? Compare this rate of return with that eamed before the renovation The pre-renovation rate of return on common equity is 31.8 %. (Round to one decimal place:) Enter your answer in the answer box and then click Check Answer. 2 Post-Renovation Analysis: Net income available to common stockholders following the renovation was calculated as follows: The new operating profits are $ . (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.) Current assets Net fixed assets Salco Inc. Balance Sheet $ 500,000 Liabilities 1,500,000 Owners' equity $2,000,000 $1,000,000 1,000,000 $2,000,000 (Click on the following icon in order to copy its contents into a spreadsheet.) Salco Inc. Income Statement Sales $ 4,500,000 Less cost of goods sold (3,500,000) Gross profit $ 1,000,000 Less operating expenses (500,000) Operating profits $ 500,000 Less interest expense (100.000) assets Owners' equity 1,500,000 $2,000,000 ollowing icon in order to copy its contents into a spreadsheet.) Salco Inc. Income Statement Sales $ 4,500,000 Less cost of goods sold (3,500,000) Gross profit $ 1,000,000 Less operating expenses (500,000) Operating profits $ 500,000 Less interest expense (100,000) Earnings before taxes $ 400,000 Less taxes (21%) (84,000) Net income $ 316,000