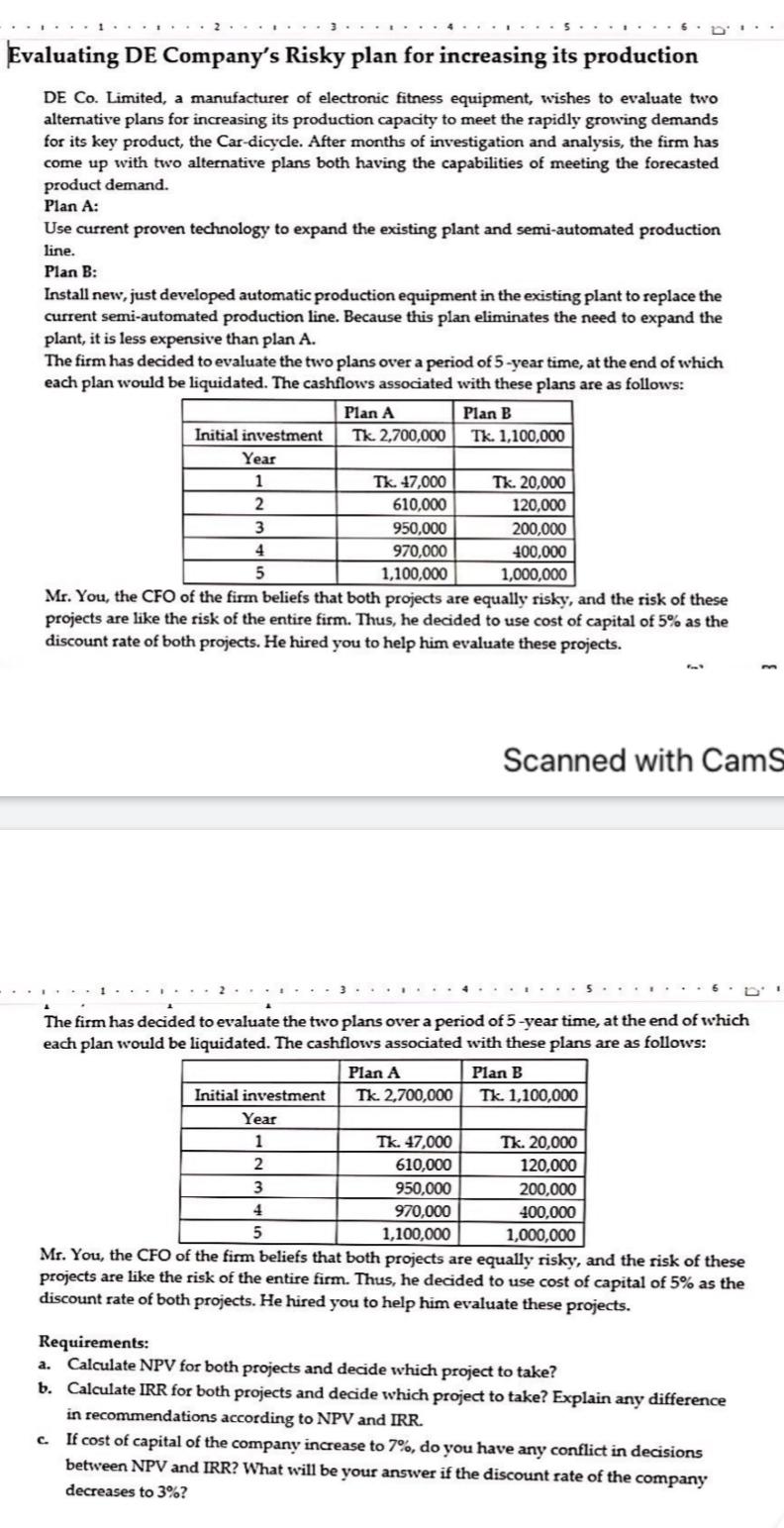

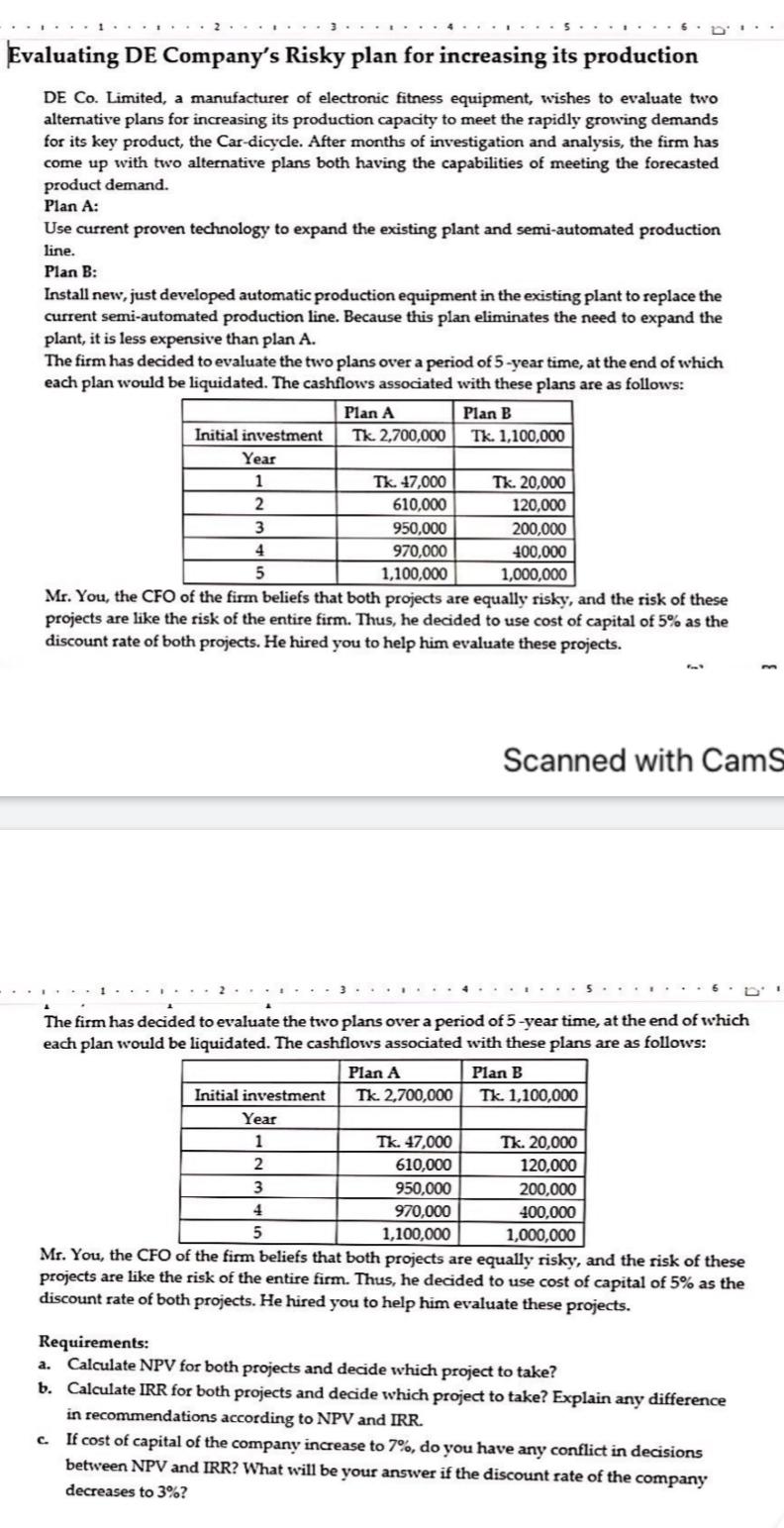

Evaluating DE Company's Risky plan for increasing its production DE Co. Limited, a manufacturer of electronic fitness equipment, wishes to evaluate two alternative plans for increasing its production capacity to meet the rapidly growing demands for its key product, the Car-dicycle. After months of investigation and analysis, the firm has come up with two alternative plans both having the capabilities of meeting the forecasted product demand. Plan A: Use current proven technology to expand the existing plant and semi-automated production line. Plan B: Install new, just developed automatic production equipment in the existing plant to replace the current semi-automated production line. Because this plan eliminates the need to expand the plant, it is less expensive than plan A. The firm has decided to evaluate the two plans over a period of 5-year time, at the end of which each plan would be liquidated. The cashflows associated with these plans are as follows: Plan A Plan B Initial investment Tk. 2,700,000 Tk. 1,100,000 Year 1 Tk. 47,000 Tk. 20,000 2 610,000 120,000 3 950,000 200,000 4 970,000 400,000 5 1,100,000 1,000,000 Mr. You, the CFO of the firm beliefs that both projects are equally risky, and the risk of these projects are like the risk of the entire firm. Thus, he decided to use cost of capital of 5% as the discount rate of both projects. He hired you to help him evaluate these projects. Scanned with Cams The firm has decided to evaluate the two plans over a period of 5-year time, at the end of which each plan would be liquidated. The cashflows associated with these plans are as follows: Plan A Plan B Initial investment Tk. 2,700,000 Tk. 1,100,000 Year 1 Tk. 47,000 Tk. 20,000 2. 610,000 120,000 3 950,000 200,000 4 970,000 400,000 5 1,100,000 1,000,000 Mr. You, the CFO of the firm beliefs that both projects are equally risky, and the risk of these projects are like the risk of the entire firm. Thus, he decided to use cost of capital of 5% as the discount rate of both projects. He hired you to help him evaluate these projects. a. Requirements: Calculate NPV for both projects and decide which project to take? b. Calculate IRR for both projects and decide which project to take? Explain any difference in recommendations according to NPV and IRR. c. If cost of capital of the company increase to 7%, do you have any conflict in decisions between NPV and IRR? What will be your answer if the discount rate of the company decreases to 3%