Question

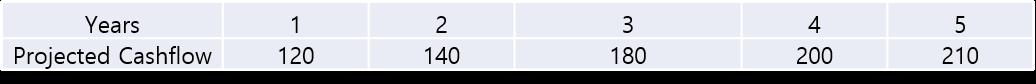

Evaluating the market and AdTec, you assume that AdTec is going to produce the following cash-flows in the coming years (figures in mn):

Evaluating the market and AdTec, you assume that AdTec is going to produce the following cash-flows in the coming years (figures in mn€):

*Ref) the risk-free rate is 1.08%

*Ref) acquisition price of 450mn EUR

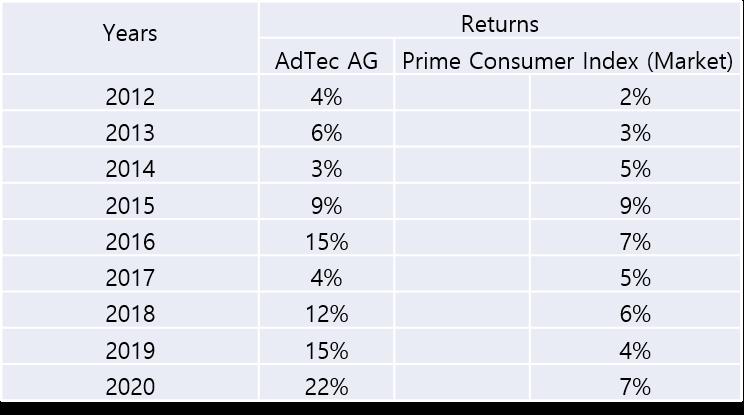

Question) Given the fact that the current asset beta of A company is 0.9, what are impacts of the acquisition on the systematic risk of Company A if the company A plans on acquiring AdTec?

What about the unsystematic risk that the new company is exposed to?

Years Projected Cashflow 1 120 2 140 3 180 4 200 5 210 Years Projected Cashflow 1 120 2 140 3 180 4 200 5 210

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Impact of Acquisition on AdTec and Company As Risk Systematic Risk Market Risk The acquisition of AdTec is likely to have a minimal impact on the syst...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Principles of Economics

Authors: Tyler Cowen, Alex Tabarrok

3rd edition

1429278390, 978-1429278416, 1429278412, 978-1429278393

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App