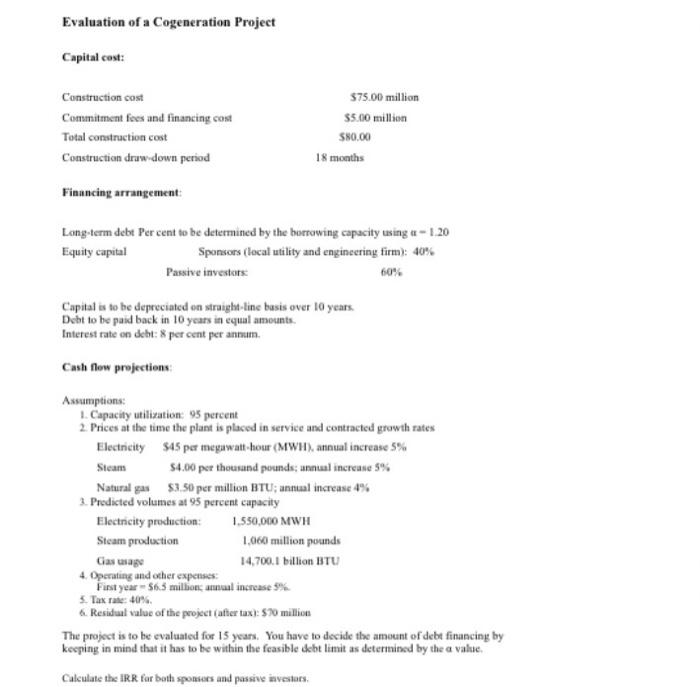

Evaluation of a Cogeneration Project Capital cost: Construction cost Commitment fees and financing cost Total construction cost Construction druw-down period $75.00 million $5.00 million $80.00 18 months Financing arrangement Long-term debt Per cent to be determined by the horrowing capacity using a - 1.20 Equity capital Sponsors (local utility and engineering firm): 40% Passive investors 60% Capital is to be depreciated on straight-line busis over 10 years Debt to be paid back in 10 years in equal amounts. Interest rate an deht: per cent per annum Cash flow projections Assumptions: 1. Capacity utilization: 95 percent 2. Prices at the time the plant is placed in service and contracted growth rates Electricity $45 per megawatt-hour (MWHI) annual increase 5% Steam 4.00 per thousand pounds; annual increase 5% Natural gas $3.50 per million BTU; annual increase 4% 3. Predicted volumes at 95 percent capacity Electricity production: 1.550,000 MWH Steam production 1.060 million pounds Gas usage 14,700.1 billion BTU 4. Operating and other expenses: First year - 56.5 million annual increase 5% Tax rate: 40% 6. Residual value of the project after tax): 570 millions The project is to be evaluated for 15 years. You have to decide the amount of debt financing by keeping in mind that it has to be within the feasible debt limit as determined by the a value Calculate the IRR for both sponsors and passive investors Evaluation of a Cogeneration Project Capital cost: Construction cost Commitment fees and financing cost Total construction cost Construction druw-down period $75.00 million $5.00 million $80.00 18 months Financing arrangement Long-term debt Per cent to be determined by the horrowing capacity using a - 1.20 Equity capital Sponsors (local utility and engineering firm): 40% Passive investors 60% Capital is to be depreciated on straight-line busis over 10 years Debt to be paid back in 10 years in equal amounts. Interest rate an deht: per cent per annum Cash flow projections Assumptions: 1. Capacity utilization: 95 percent 2. Prices at the time the plant is placed in service and contracted growth rates Electricity $45 per megawatt-hour (MWHI) annual increase 5% Steam 4.00 per thousand pounds; annual increase 5% Natural gas $3.50 per million BTU; annual increase 4% 3. Predicted volumes at 95 percent capacity Electricity production: 1.550,000 MWH Steam production 1.060 million pounds Gas usage 14,700.1 billion BTU 4. Operating and other expenses: First year - 56.5 million annual increase 5% Tax rate: 40% 6. Residual value of the project after tax): 570 millions The project is to be evaluated for 15 years. You have to decide the amount of debt financing by keeping in mind that it has to be within the feasible debt limit as determined by the a value Calculate the IRR for both sponsors and passive investors