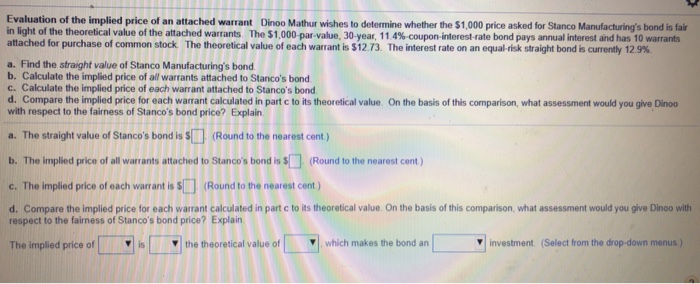

Evaluation of the implied price of an attached warrant Dinoo Mathur wishes to determine whether the $1,000 price asked for Stanco Manufacturing's bond is fair in ght o the theoretical value of the attached warrants The $ attached for purchase of common stock The theoretical value of each warrant is S1273 The interest rate on an equal risk straight bond is amen y 129 1,000 par-value, 30-year, 1 1 4%-coupon interest-rate bond pays annual interest and has 10 warrants a. Find the straight value of Stanco Manufacturing's bond b. Calculate the implied price of all warrants attached to Stanco's bond c. Calculate the implied price of each warrant attached to Stanco's bond d. Compare the implied price for each warrant calculated in part c to its theoretical value On the basis of this comparison, what assessment would you give Dinoo with respect to the fairness of Stanco's bond price? Explain a. The straight value of Stanco's bond is (Round to the nearest cent) b. The implied price of all warrants attached to Stanco's bond is (Round to the nearest cent) c. The implied price of each warrant is s (Round to the nearest cent) d. Compare the implied price for each warrant calculated in part c to its theoretical value. On the basis of this comparison, what assessment would you give Dinoo with respect to the fairness of Stanco's bond price? Explain which makes the bond an the theoretical value of investment. (Select from the drop-down menus.) The implied price of Evaluation of the implied price of an attached warrant Dinoo Mathur wishes to determine whether the $1,000 price asked for Stanco Manufacturing's bond is fair in ght o the theoretical value of the attached warrants The $ attached for purchase of common stock The theoretical value of each warrant is S1273 The interest rate on an equal risk straight bond is amen y 129 1,000 par-value, 30-year, 1 1 4%-coupon interest-rate bond pays annual interest and has 10 warrants a. Find the straight value of Stanco Manufacturing's bond b. Calculate the implied price of all warrants attached to Stanco's bond c. Calculate the implied price of each warrant attached to Stanco's bond d. Compare the implied price for each warrant calculated in part c to its theoretical value On the basis of this comparison, what assessment would you give Dinoo with respect to the fairness of Stanco's bond price? Explain a. The straight value of Stanco's bond is (Round to the nearest cent) b. The implied price of all warrants attached to Stanco's bond is (Round to the nearest cent) c. The implied price of each warrant is s (Round to the nearest cent) d. Compare the implied price for each warrant calculated in part c to its theoretical value. On the basis of this comparison, what assessment would you give Dinoo with respect to the fairness of Stanco's bond price? Explain which makes the bond an the theoretical value of investment. (Select from the drop-down menus.) The implied price of