Question

Evaluation of the implied price of an attached warrantDinoo Mathur wishes to determine whether the $1,000 price asked for Stanco Manufacturing's bond is fair in

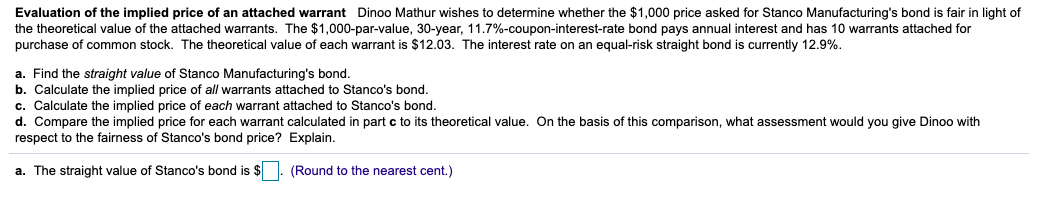

Evaluation of the implied price of an attached warrantDinoo Mathur wishes to determine whether the $1,000 price asked for Stanco Manufacturing's bond is fair in light of the theoretical value of the attached warrants. The $1,000-par-value, 30-year, 11.7%-coupon-interest-rate bond pays annual interest and has 10 warrants attached for purchase of common stock. The theoretical value of each warrant is $12.03. The interest rate on an equal-risk straight bond is currently 12.9%.

Evaluation of the implied price of an attached warrantDinoo Mathur wishes to determine whether the $1,000 price asked for Stanco Manufacturing's bond is fair in light of the theoretical value of the attached warrants. The $1,000-par-value, 30-year, 11.7%-coupon-interest-rate bond pays annual interest and has 10 warrants attached for purchase of common stock. The theoretical value of each warrant is $12.03. The interest rate on an equal-risk straight bond is currently 12.9%.

a. Find the straight value of Stanco Manufacturing's bond.

b.Calculate the implied price of all warrants attached to Stanco's bond.

c.Calculate the implied price of each warrant attached to Stanco's bond.

d.Compare the implied price for each warrant calculated in part c to its theoretical value. On the basis of this comparison, what assessment would you give Dinoo with respect to the fairness of Stanco's bond price? Explain.

Evaluation of the implied price of an attached warrant Dinoo Mathur wishes to determine whether the $1,000 price asked for Stanco Manufacturing's bond is fair in light of the theoretical value of the attached warrants. The $1,000-par-value, 30-year, 11.7%-coupon-interest-rate bond pays annual interest and has 10 warrants attached for purchase of common stock. The theoretical value of each warrant is $12.03. The interest rate on an equal-risk straight bond is currently 12.9%. a. Find the straight value of Stanco Manufacturing's bond. b. Calculate the implied price of all warrants attached to Stanco's bond. c. Calculate the implied price of each warrant attached to Stanco's bond. d. Compare the implied price for each warrant calculated in part c to its theoretical value. On the basis of this comparison, what assessment would you give Dinoo with respect to the fairness of Stanco's bond price? Explain. a. The straight value of Stanco's bond is $. (Round to the nearest cent.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started