Answered step by step

Verified Expert Solution

Question

1 Approved Answer

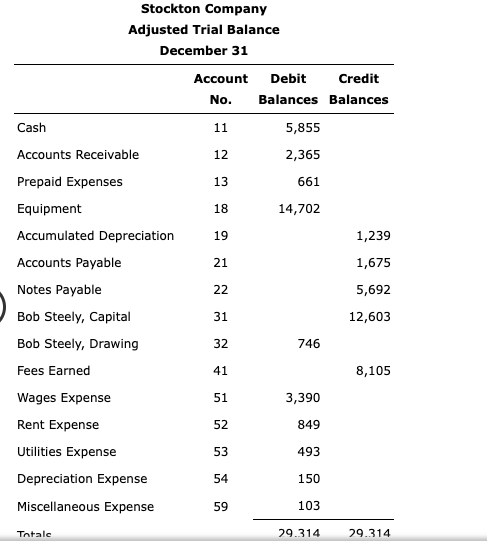

Evan Roberts owns a business, Shores Sports, that rents canoes and kayaks. The adjusted trial balance at December 31 is as follows: Stockton Company Adjusted

Evan Roberts owns a business, Shores Sports, that rents canoes and kayaks. The adjusted trial balance at December 31 is as follows:

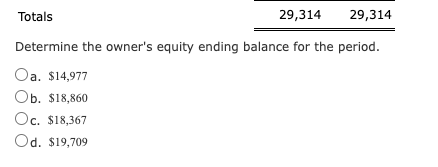

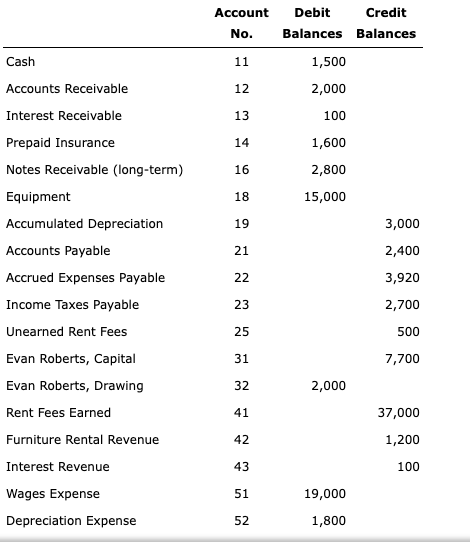

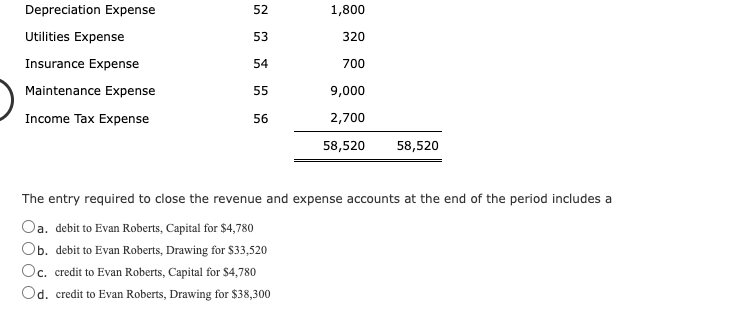

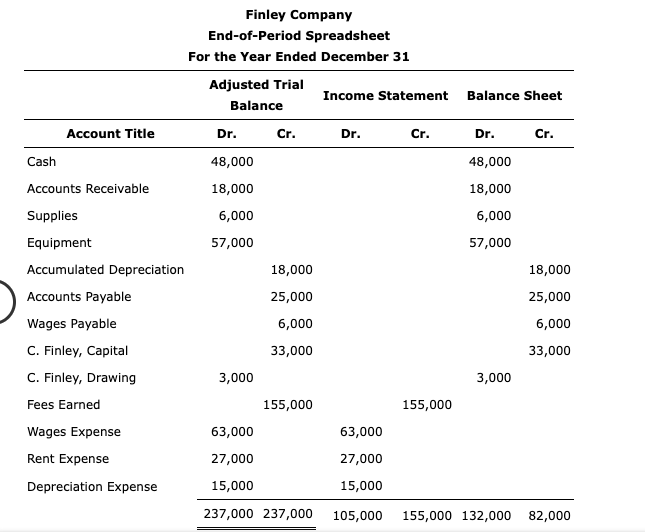

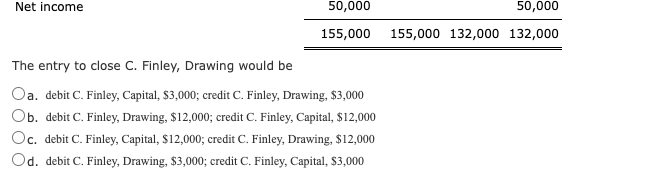

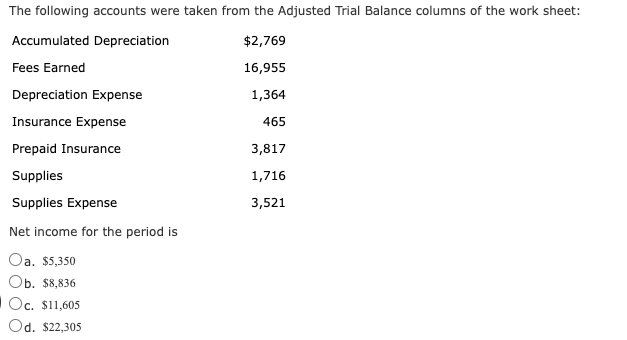

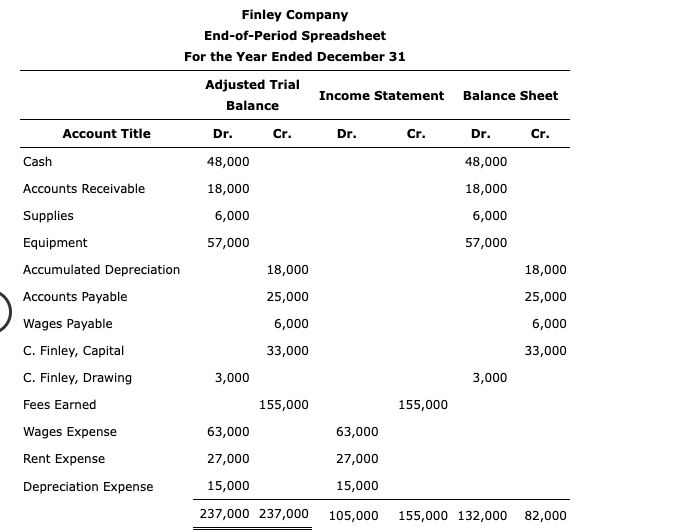

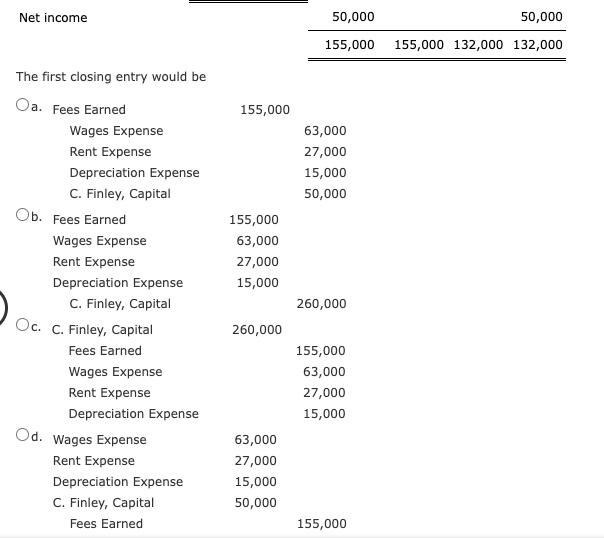

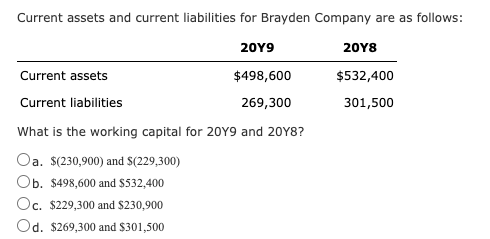

Stockton Company Adjusted Trial Balance December 31 Account No. 11 12 13 18 19 21 22 31 32 41 51 52 53 54 59 Cash Accounts Receivable Prepaid Expenses Equipment Accumulated Depreciation Accounts Payable Notes Payable Bob Steely, Capital Bob Steely, Drawing Fees Earned Wages Expense Rent Expense Utilities Expense Depreciation Expense Miscellaneous Expense Totale Debit Credit Balances Balances 5,855 2,365 661 14,702 1,239 1,675 5,692 12,603 8,105 746 3,390 849 493 150 103 29.314 29.314 29,314 29,314 Totals Determine the owner's equity ending balance for the period. Oa. $14,977 Ob. $18,860 Oc. $18,367 Od. $19,709 Cash Accounts Receivable Interest Receivable Prepaid Insurance Notes Receivable (long-term) Equipment Accumulated Depreciation Accounts Payable Accrued Expenses Payable Income Taxes Payable Unearned Rent Fees Evan Roberts, Capital Evan Roberts, Drawing Rent Fees Earned Furniture Rental Revenue Interest Revenue Wages Expense Depreciation Expense Account Debit Credit No. Balances Balances 11 1,500 12 2,000 13 100 14 1,600 16 2,800 18 15,000 19 21 22 23 25 31 32 41 42 43 51 52 2,000 19,000 1,800 3,000 2,400 3,920 2,700 500 7,700 37,000 1,200 100 Depreciation Expense 52 1,800 Utilities Expense 53 320 Insurance Expense 54 700 Maintenance Expense 55 9,000 Income Tax Expense 56 2,700 58,520 58,520 The entry required to close the revenue and expense accounts at the end of the period includes a Oa. debit to Evan Roberts, Capital for $4,780 Ob. debit to Evan Roberts, Drawing for $33,520 Oc. credit to Evan Roberts, Capital for $4,780 Od. credit to Evan Roberts, Drawing for $38,300 Account Title Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable C. Finley, Capital C. Finley, Drawing Fees Earned Wages Expense Rent Expense Depreciation Expense Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Dr. Cr. 48,000 18,000 6,000 57,000 18,000 25,000 6,000 33,000 155,000 3,000 63,000 27,000 15,000 237,000 237,000 Income Statement Dr. Cr. Balance Sheet Dr. Cr. 48,000 18,000 6,000 57,000 18,000 25,000 6,000 33,000 3,000 155,000 63,000 27,000 15,000 105,000 155,000 132,000 82,000 Net income 50,000 155,000 The entry to close C. Finley, Drawing would be Oa. debit C. Finley, Capital, $3,000; credit C. Finley, Drawing, $3,000 Ob. debit C. Finley, Drawing, $12,000; credit C. Finley, Capital, $12,000 Oc. debit C. Finley, Capital, $12,000; credit C. Finley, Drawing, $12,000 Od. debit C. Finley, Drawing, $3,000; credit C. Finley, Capital, $3,000 50,000 155,000 132,000 132,000 The following accounts were taken from the Adjusted Trial Balance columns of the work sheet: Accumulated Depreciation $2,769 Fees Earned 16,955 Depreciation Expense 1,364 Insurance Expense 465 Prepaid Insurance 3,817 Supplies 1,716 Supplies Expense 3,521 Net income for the period is Oa. $5,350 Ob. $8,836 Oc. $11,605 Od. $22,305 Account Title Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable C. Finley, Capital C. Finley, Drawing Fees Earned Wages Expense Rent Expense Depreciation Expense Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Dr. 48,000 18,000 6,000 57,000 Cr. 18,000 25,000 6,000 33,000 155,000 3,000 63,000 27,000 15,000 237,000 237,000 Income Statement Dr. Cr. 63,000 27,000 15,000 105,000 Balance Sheet Dr. Cr. 48,000 18,000 6,000 57,000 18,000 25,000 6,000 33,000 3,000 155,000 155,000 132,000 82,000 Net income The first closing entry would be Oa. Fees Earned Wages Expense Rent Expense Depreciation Expense C. Finley, Capital Ob. Fees Earned Wages Expense Rent Expense Depreciation Expense C. Finley, Capital Oc. C. Finley, Capital Fees Earned Wages Expense Rent Expense Depreciation Expense Od. Wages Expense Rent Expense Depreciation Expense C. Finley, Capital Fees Earned 155,000 155,000 63,000 27,000 15,000 260,000 63,000 27,000 15,000 50,000 50,000 50,000 155,000 155,000 132,000 132,000 63,000 27,000 15,000 50,000 260,000 155,000 63,000 27,000 15,000 155,000 Current assets and current liabilities for Brayden Company are as follows: 20Y9 20Y8 Current assets $498,600 $532,400 Current liabilities 269,300 301,500 What is the working capital for 20Y9 and 20Y8? Oa. $(230,900) and $(229,300) Ob. $498,600 and $532,400 Oc. $229,300 and $230,900 Od. $269,300 and $301,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started