Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evans Pianos is preparing its cash budget for the month of April. The companys accountant has assembled the following information: Collections from customers are anticipated

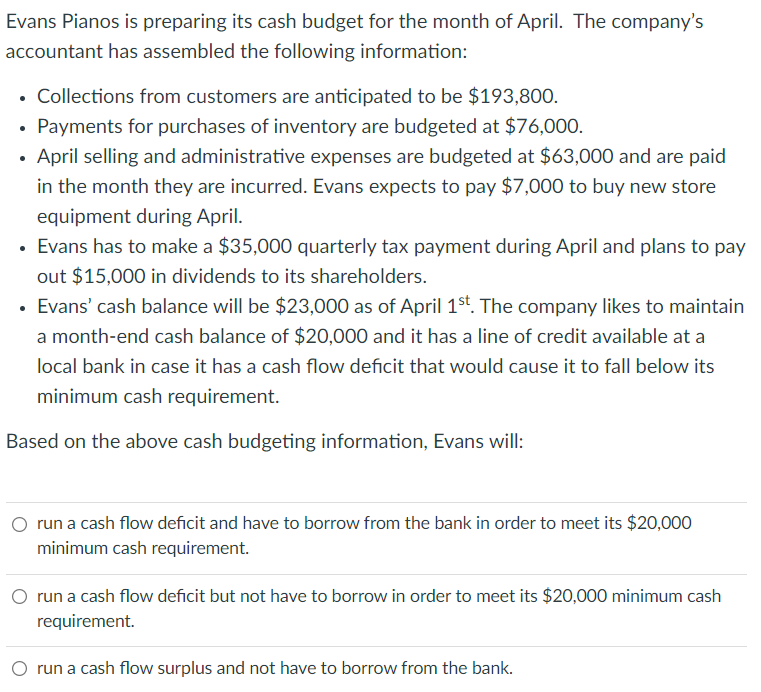

Evans Pianos is preparing its cash budget for the month of April. The companys accountant has assembled the following information:

- Collections from customers are anticipated to be $193,800.

- Payments for purchases of inventory are budgeted at $76,000.

- April selling and administrative expenses are budgeted at $63,000 and are paid in the month they are incurred. Evans expects to pay $7,000 to buy new store equipment during April.

- Evans has to make a $35,000 quarterly tax payment during April and plans to pay out $15,000 in dividends to its shareholders.

- Evans cash balance will be $23,000 as of April 1st. The company likes to maintain a month-end cash balance of $20,000 and it has a line of credit available at a local bank in case it has a cash flow deficit that would cause it to fall below its minimum cash requirement.

Based on the above cash budgeting information, Evans will:

Evans Pianos is preparing its cash budget for the month of April. The company's accountant has assembled the following information: - Collections from customers are anticipated to be $193,800. - Payments for purchases of inventory are budgeted at $76,000. - April selling and administrative expenses are budgeted at $63,000 and are paid in the month they are incurred. Evans expects to pay $7,000 to buy new store equipment during April. - Evans has to make a $35,000 quarterly tax payment during April and plans to pay out $15,000 in dividends to its shareholders. - Evans' cash balance will be $23,000 as of April 1st. The company likes to maintain a month-end cash balance of $20,000 and it has a line of credit available at a local bank in case it has a cash flow deficit that would cause it to fall below its minimum cash requirement. Based on the above cash budgeting information, Evans will: run a cash flow deficit and have to borrow from the bank in order to meet its $20,000 minimum cash requirement. run a cash flow deficit but not have to borrow in order to meet its $20,000 minimum cash requirement. run a cash flow surplus and not have to borrow from the bankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started