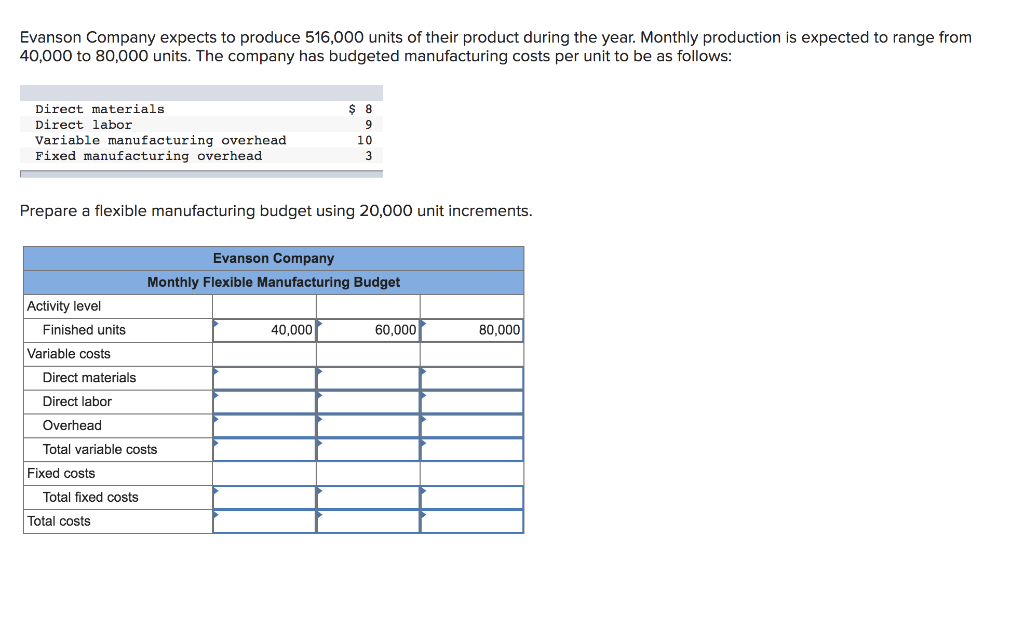

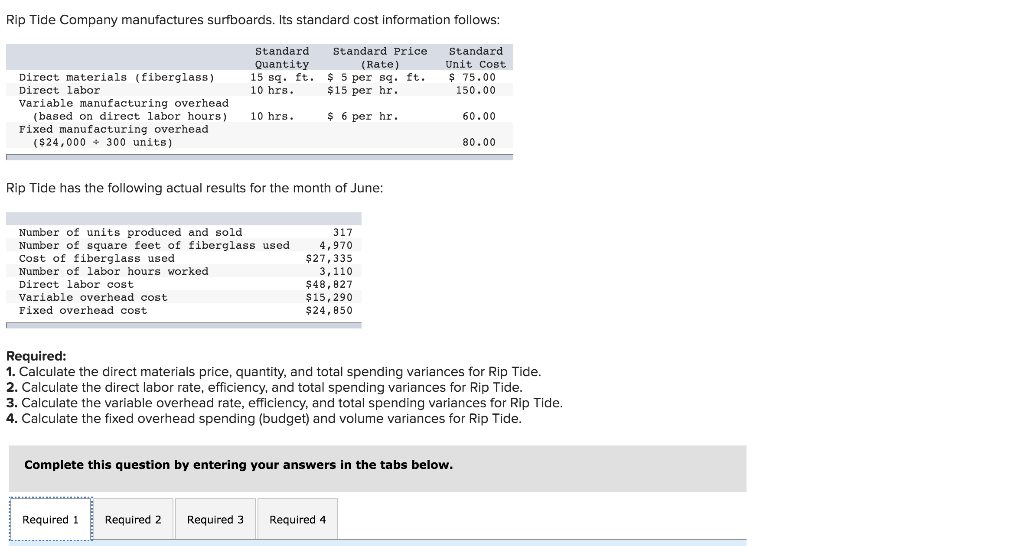

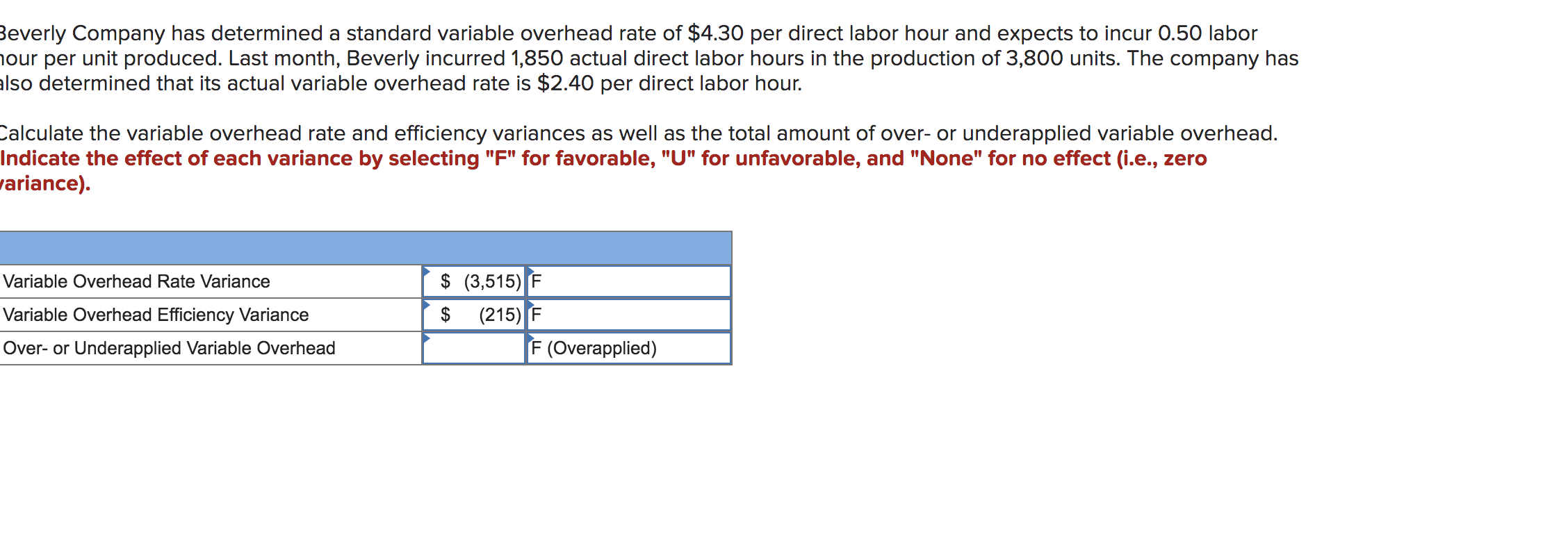

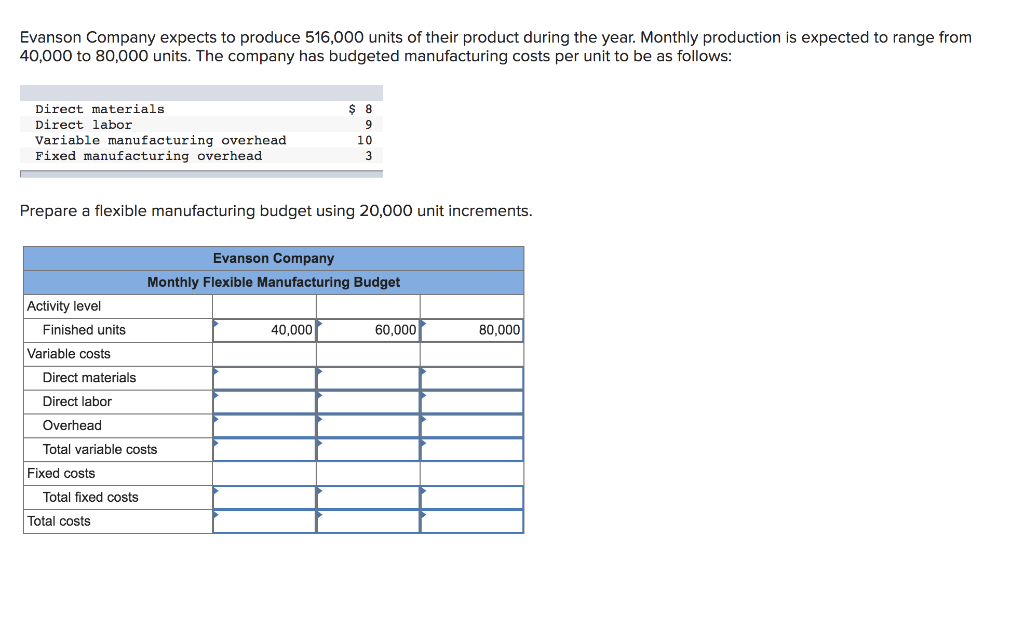

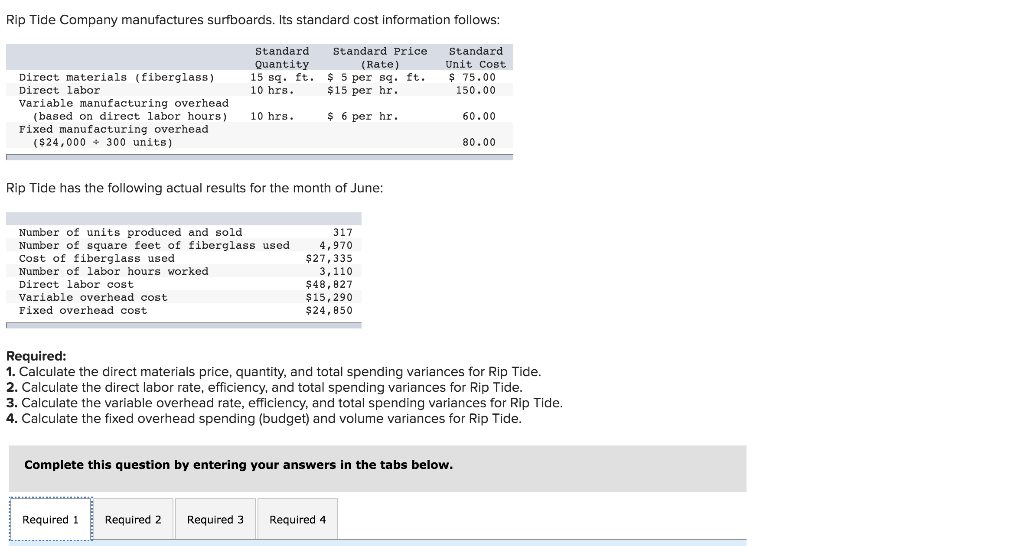

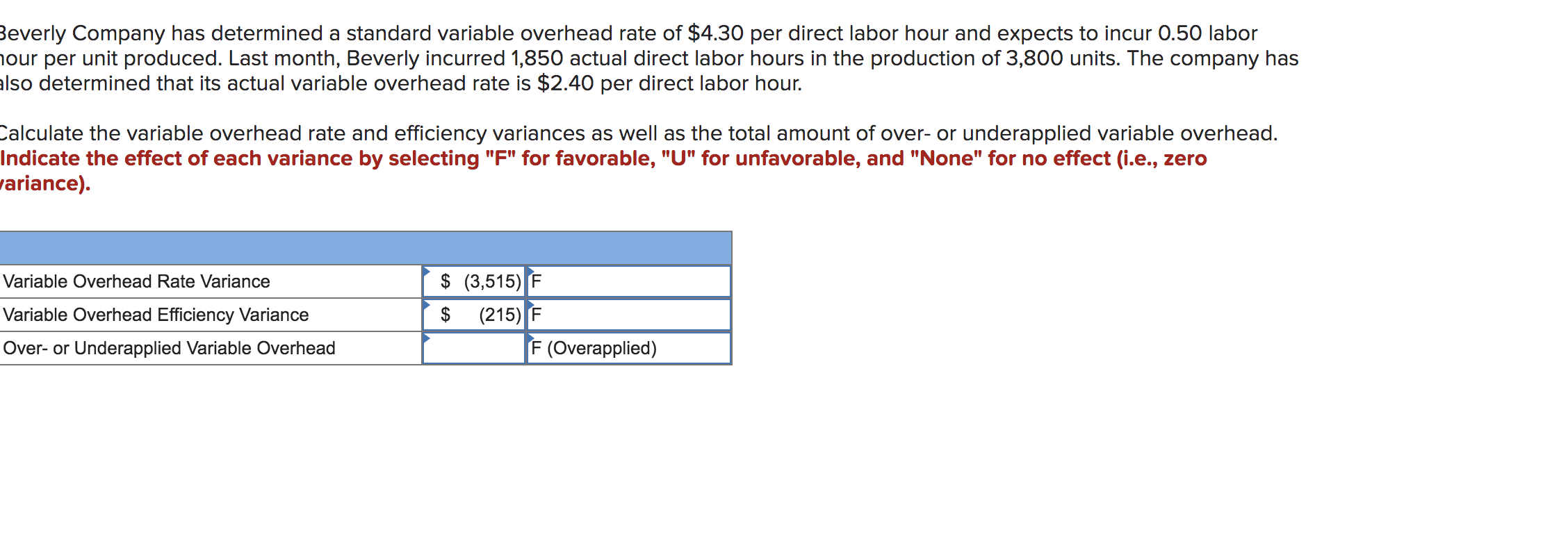

Evanson Company expects to produce 516,000 units of their product during the year. Monthly production is expected to range from 40,000 to 80,000 units. The company has budgeted manufacturing costs per unit to be as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead $ 8 9 10 3 Prepare a flexible manufacturing budget using 20,000 unit increments. Evanson Company Monthly Flexible Manufacturing Budget Activity level Finished units 40,000 60,000 80,000 Variable costs Direct materials Direct labor Overhead Total variable costs Fixed costs Total fixed costs Total costs Rip Tide Company manufactures surfboards. Its standard cost information follows: Standard Standard Price Quantity (Rate) 15 sq. ft. $ 5 per sq. ft. 10 hrs. $15 per hr. Standard Unit Cost $ 75.00 150.00 Direct materials (fiberglass) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($24,000 + 300 units) 10 hrs. $ 6 per hr. 60.00 80.00 Rip Tide has the following actual results for the month of June: Number of units produced and sold Number of square feet of fiberglass used Cost of fiberglass used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 317 4,970 $27,335 3,110 $48,827 $15,290 $24,850 Required: 1. Calculate the direct materials price, quantity, and total spending variances for Rip Tide. 2. Calculate the direct labor rate, efficiency, and total spending variances for Rip Tide. 3. Calculate the variable overhead rate, efficiency, and total spending variances for Rip Tide, 4. Calculate the fixed overhead spending (budget) and volume variances for Rip Tide. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Beverly Company has determined a standard variable overhead rate of $4.30 per direct labor hour and expects to incur 0.50 labor our per unit produced. Last month, Beverly incurred 1,850 actual direct labor hours in the production of 3,800 units. The company has also determined that its actual variable overhead rate is $2.40 per direct labor hour. Calculate the variable overhead rate and efficiency variances as well as the total amount of over- or underapplied variable overhead. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero ariance). Variable Overhead Rate Variance Variable Overhead Efficiency Variance Over- or Underapplied Variable Overhead $ (3,515) F $ (215) F F (Overapplied)