EV/EBITDA multiples can be used to benchmark or determine the potential acquisition price (where Enterprise Value= Net Debt + Market Equity Value). What is the

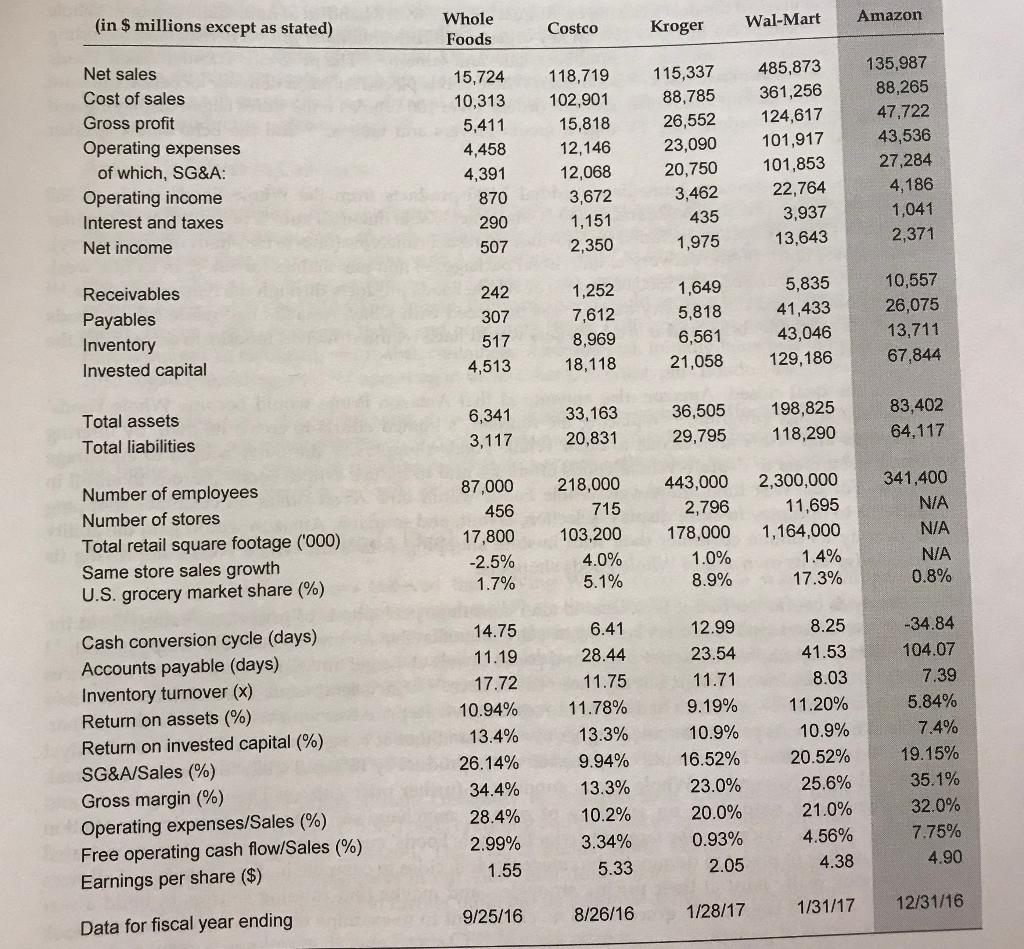

EV/EBITDA multiples can be used to benchmark or determine the potential acquisition price (where Enterprise Value= Net Debt + Market Equity Value). What is the implied enterprise value for Whole Foods using the industry average EV/EBITDA for fiscal year 2016? Use the data from Exhibit for a top down EBITDA calculation (Starting from EBIT not Net Income). Assumptions: Depreciation & Amortization in fiscal 2016 of $498 million, net debt at fiscal 2016 year end of $300 million, EV/EBITDA grocery industry average multiple of 7x.

a. $10.7 bln

b. $9.6 bln

c. $13.7 bln

d. $13.4 bln

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started