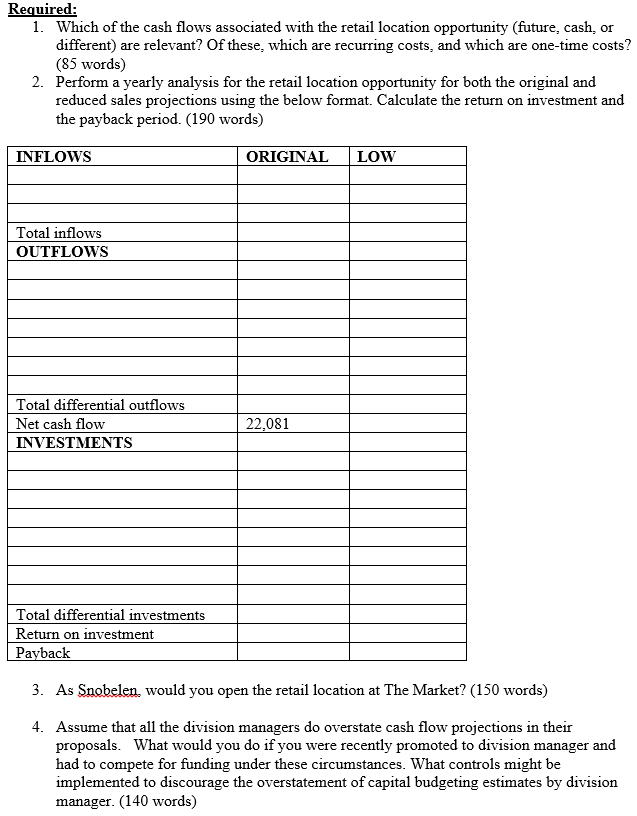

Question

Evelynn by Nicole Snobelen: The market opportunity On June 15, 2019, Nicole Snobelen, owner of Evelynn by Nicole Snobelen (Evelynn), had just been informed that

Evelynn by Nicole Snobelen: The market opportunity

On June 15, 2019, Nicole Snobelen, owner of Evelynn by Nicole Snobelen (Evelynn), had just been informed that a location at The Market in the Western Fair District (The Market) had become available for immediate occupancy. Evelynn was an e-commerce clothing company based in London, Ontario. The Market was located in London and housed a farmers market on the main floor and an artisans market on the second floor, which featured distinctive locally handcrafted products. Snobelen had been waiting for a space to become available at The Market for some time, but now that the opportunity was becoming a reality, she wanted to thoroughly assess the quantitative and qualitative aspects of the decision before deciding to jump in.

EVELYNN BY NICOLE SNOBELEN

Evelynn, named after Snobelens grandmother, was launched in 2013 as a custom clothing company that designed clothing specifically tailored to the customer. From there, Snobelen stopped producing custom clothing and began designing full clothing lines that included dresses, tops, sweaters, swimwear, and bridal robes which were sold through the companys online website. Snobelen had been interested in fashion since the age of eight, when she received a Fashion Plates toy from her aunt as a gift and immediately fell in love with fashion design. Prior to launching Evelynn, Snobelen graduated from Fanshawe Colleges Fashion Design program in 2012.

Evelynn sourced all fabrics and materials within Canada, and all of the pieces were handmade in London by either Snobelen or one of two seamstresses employed by Evelynn. Different from other clothing companies, comfort and body positivity were priorities at Evelynn. All dresses made by Evelynn used knitwear materials that were made to stretch, meaning that the fabric was more forgiving and could fit a wider variety of body types and sizes. To highlight this, customers were able to see a variety of women of different sizes modelling Evelynns products on the companys website.

THE ABBY FUND

The Abby Fund was a program launched by Evelynn in 2015 which was designed to help raise the spirits of children suffering from illnesses or disabilities. Snobelen began volunteering her time to meet with children in the hospital and asked them to draw her their dream dress or superhero cape. Snobelen would then bring the drawing to life and present the child with the dress or cape that they had designed. The Abby Funds main goal was to bring as many smiles to childrens faces as possible. Since the inception of the program, Snobelen had designed approximately 110 dresses and capes through the Abby Fund.

To help fund the program, a fashion show was held each year where the recipients of dresses and capes from the Abby Fund were invited to model their creations on the runway. All proceeds from the event were put toward covering the cost of materials and fabrics to continue the program. The program garnered attention from several media outlets, including segments on CBC, Rogers TV, and Londons CTV News.

LONDON, ONTARIO

London, Ontario was the eleventh largest city in Canada and the sixth-largest city in Ontario. Located nearly 200 kilometres west of Toronto, London had a population of over 383,000. The city was home to both Western University and Fanshawe College, both of which offered programs to help young entrepreneurs launch and grow their businesses. Evelynn was part of Western Universitys Propel Entrepreneurship program, one of southwestern Ontarios leading accelerators that provided entrepreneurs with co-working spaces, seed funding, mentorship, training programs, events, and workshops for new businesses.

CONSUMERS

Evelynns customers were women aged 18 to 35 who enjoyed expressing themselves through art, music, and fashion. These women loved to stand out and support local businesses whenever possible. They looked for sought-after pieces that were made to last and were willing to pay a premium for a well-made article of clothing that they could expect to last a long time rather than opting for cheaper fast fashion that was not made to last. While these women had the option of purchasing clothing from countless retailers both online and in person, Evelynn was the only company in London that sold handmade clothing and had a social enterprise aspect to their business model.

One of Evelynns most popular clothing lines was their One of a Kind (OOAK) line. This clothing line used leftover materials from existing pieces in Evelynns collections to create a dress that was truly one of a kind. These dresses sold out almost instantly. Another popular collection each spring and summer was Evelynns bridal robes. A popular trend in the wedding industry was for brides and bridal parties to wear matching robes on the morning of the wedding while getting their hair and makeup done. In London, Evelynn was a popular company with brides ordering these custom robes because they had many options for fabric and sizes. This customization provided brides with the ability to pick robes that would match or complement the other colours already selected for their wedding.

To ensure she was meeting her customers wants and needs, Snobelen sent out a survey seeking feedback that could help to improve her business model. Overall, most customers were happy with Evelynn, but a large segment of her customers indicated that they would prefer to try on a piece of clothing before purchasing it.

Evelynn had been using social media and pop-up shows to promote clothing to its target market. Recently, however, the company had hired an intern from Fanshawe College to help the company improve its search engine optimization.

THE MARKET DECISION

The Market was a popular weekend destination for Londoners wanting to support local businesses. It had an excellent reputation in the city but was only open on Saturdays from 8:00 a.m. to 3:00 p.m. and Sundays from 10:00 a.m. to 2:00 p.m. Londoners flocked to The Market for breakfast or lunch and to purchase local food items; to browse through handcrafted products such as jewellery, collectibles, and clothing; or to listen to a local musician. With over 100 vendors, The Market had something for everyone in the city to enjoy.

Snobelen had considered opening a traditional brick-and-mortar retail store for many years but had been discouraged by the high costs typically associated with that type of endeavour. Depending on the location, size, and age of the building, rent for retail stores in London could be as high as several thousand dollars per month, not including the cost of utilities. In comparison, rent for the available three-metre-by-threemetre unit at The Market, including utilities, was CA$338 per month.

While Snobelen was excited about the prospect of The Market opportunity, she wondered if pursuing this venture could make it difficult to find a work-life balance. Until it became financially feasible for Evelynn to employ sales associates to run the retail store on their own, Snobelen would need to be available on weekends to run the site at The Market. Snobelen projected that she would need to hire one sales associate for six hours per weekend to assist with running the retail store when she was unable to. The sales associate would be paid $14 per hour.

After speaking with other retailers at The Market and analyzing Evelynns past sales results, Snobelen projected sales at The Market would reach $45,000 annually. On average, the cost of goods sold represented 22 per cent of sales. Evelynn planned to maintain 60 days of inventory and 45 days on accounts payable for operations at The Market.

In order to process sales in the store, a point of sale system needed to be purchased at a cost of $67. All sales were to be subject to a 5.9 per cent processing fee. The point of sale system was to be depreciated using the straight-line method with no residual value and a useful life of two years. Other annual costs associated with the Market opportunity included advertising and insurance of $800 and $1,140, respectively.

Prior to opening the retail store at The Market, Snobelen needed to renovate the available space to suit Evelynns needs. Drywall and other building materials were expected to cost $690. While Snobelen and her friends and family were able to complete many of the tasks themselves, Snobelen needed to contract a drywaller to install the drywall at a total cost of $130. To display Evelynns products, Snobelen also needed to purchase mannequins and shelving units at a cost of $1,600 and $530, respectively. These were to be depreciated using the straightline method, with no residual value and a useful life of 10 years. The finishing touch was a $50 sign displaying the companys logo that Snobelen had purchased for use at pop-up shows earlier in the year.

CONCLUSION

Snobelen was eager to determine if The Market opportunity was in the companys best interests. Since the opportunity would have required Snobelen to devote an additional amount of time to the business, she hoped to see an increase in cash flow of at least $10,000 and to recoup the initial investments required for the opportunity within six months. She wondered if this level of profit would still be feasible if sales were 25 per cent lower than her initial projections. Nevertheless, rental spaces at The Market were in high demand and did not become available often, so if Snobelen wanted to pursue this opportunity, she needed to make her decision within the next couple of days.

Source: Ivey publication, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started