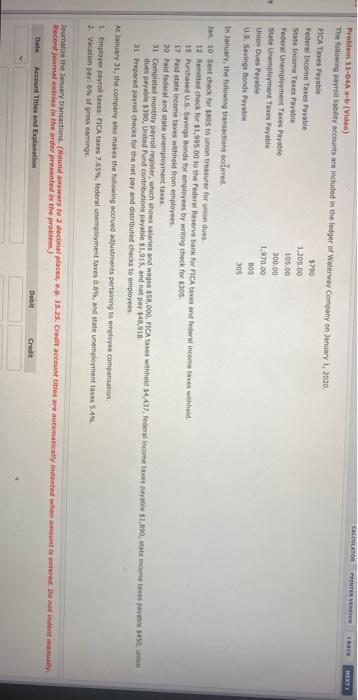

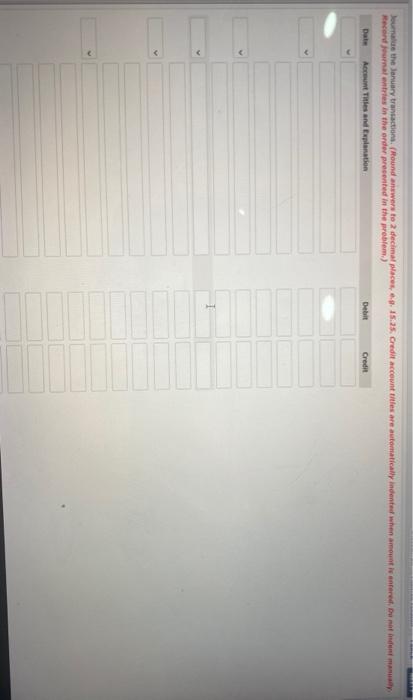

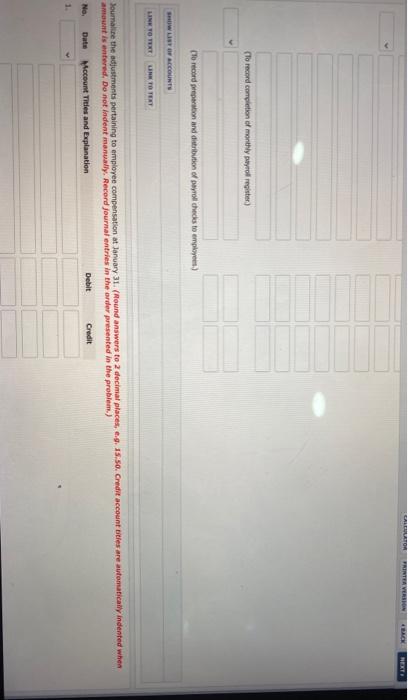

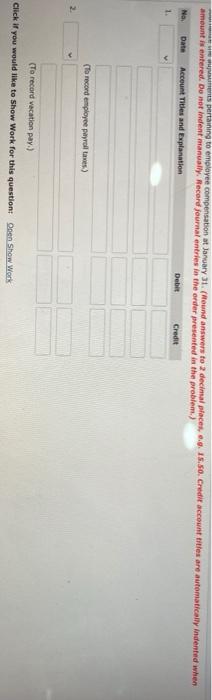

EVEN GLUCTOR Problem 11.04 - (Video) The following payroly accounts are included in the edge of Wateway Company on January 1, 2020 FICA Taxes Payable 5790 Federal Income Taxes Payable 1,205.00 State Thcome Taxes Payable 105.00 Federal Unemployment Taxes Payable 300.00 State Unemployment Taxes Payable 1,970.00 Union Dues Payable BOS U.S. Savings Bonds Payable 305 In January, the following transactions occurred a to Sant Check for 805 to union trener for de 12 Nanted check for $1,995.00 to the Federal Reserve Bank for FICA taxes and federal income taxes withheld 15 Purchased U.S. Savings Bonds for employees by writing check for $305 17 Paid state income taxes withheld from employees 20 Paid federal and state unemployment taxes 11 Completed monthly payroll register, which shows salaries and wages $58,000, FICA taxes withheld 1.437. federal income taxes payable $1,090, state income taxes payable $450 union dues payable $190, United Fund contributions payable $1,915, and net pay $40.918 Prepared payroll checks for the net pay and distributed checks to employees At January 31, the company to makes the following accrued adjust terits pertaining to employee compensation 1. Employer payroll taxes: FICA 7.65, federal unemployment taxes 0.3%, and state unemployment te 5.4% 2. Vacation par: 6% of gross earnings Journaline the January transactions, (Round answers to 2 decimal places, 15:25. Credit account titles are automatically indented when amount is entered. Do not indentat Record journal entries in the order presented in the problem) Date Account Titles and nation Debit Credit Jourrethe January transactions (Hound answers to 2 decimal places, 15:25. Credit accountitles are automatically indented when amount is entered Dundet man Record jumatates in the order presented in the problem.) Date Account this and Explanation Debit Credit GALERATOR FRINTER VERSION To record completion of monthly payrollregister) [to record preparation and distribution of payroll checks to employees) WLY ACCOUNTS LINK TO NEXT TO TEXT Journaline the adjustments pertaining to employee compensation at January 31 (Nound answers to 2 decimal places, e.g. 15.50. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem No Date Account Titles and Explanation Debit Credit 1. ens pertaining to employee compensation at January 3 (Wound answers to 2 decimal places. 15.50 Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Na Date Account Titles and Explanation Debit Credit (To record employee payrollanes) 2 (To record vacation pay.) Click if you would like to show Work for this question: Coen Show Work