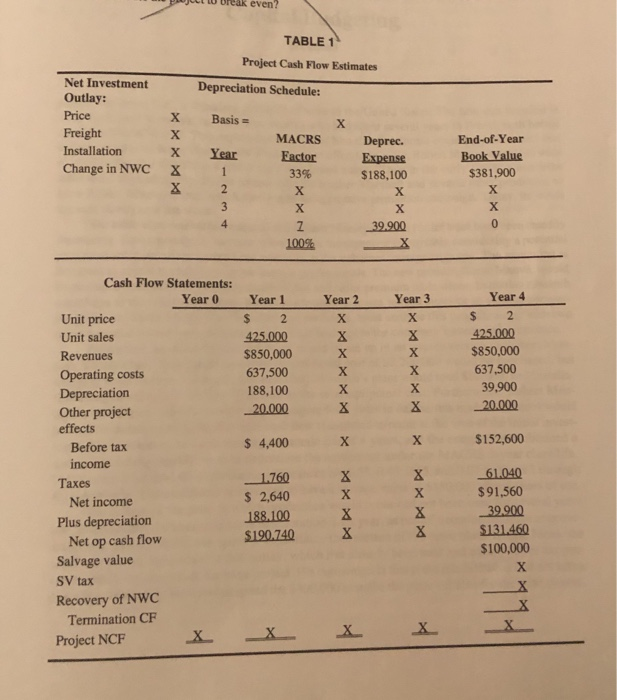

even? TABLE 1 Project Cash Flow Estimates Depreciation Schedule: Basis = Net Investment Outlay: Price Freight Installation Change in NWC X X X X Year 1 2 3 4 MACRS Factor 33% X X 7 100% Deprec. Expense $188,100 X 39.900 End-of-Year Book Value $381,900 X X 0 Year 3 X X X X X Year 4 $ 2 425.000 $850,000 637,500 39.900 20.000 $152,600 Cash Flow Statements: Year 0 Year 1 Year 2 Unit price $ 2 X Unit sales 425.000 X Revenues $850,000 X Operating costs 637,500 Depreciation 188,100 X Other project 20.000 X effects Before tax $ 4,400 income Taxes _1.760 X Net income $ 2,640 X Plus depreciation 188.100 X Net op cash flow $190.740 X Salvage value SV tax Recovery of NWC Termination CF Project NCF X X x X x X 1 114 61.040 $91,560 39.900 $131.460 $100,000 X X X X expenses? Explain. 2. Should the $100,000 that was spent to rehabilitate the plant be included in the analysis? Explain. 3. Suppose another citrus producer had expressed an interest in leasing the lite orange juice production site for $25,000 a year. If this were true in fact, it was not), how would that information be incorporated into the analysis? 4. What is Indian River's Year 0 net investment outlay on this project? What is the expected nonoperating cash flow when the project is terminated at Year 4? (Hint: Use Table 1 as a guide.) 5. Estimate the project's operating cash flows. (Hint: Again use Table 1 as a guide.) What are the project's NPV, IRR, modified IRR (MIRR), and payback? Should the project be undertaken? [Remember: The MIRR is found in three steps: (1) compound all cash inflows forward to the terminal year at the cost of capital, (2) sum the compounded cash inflows to obtain the terminal value of the inflows, and (3) find the discount rate which forces the present value of the terminal value to equal the present value of the net investment outlays. This discount rate is defined as the MIRR.) 10000 6. Now suppose the project had involved replacement rather than expansion of existing facilities. Describe briefly how the analysis would have to be changed to deal with a replacement project. Assume that inflation is expected to average 5 percent per year over the next four years