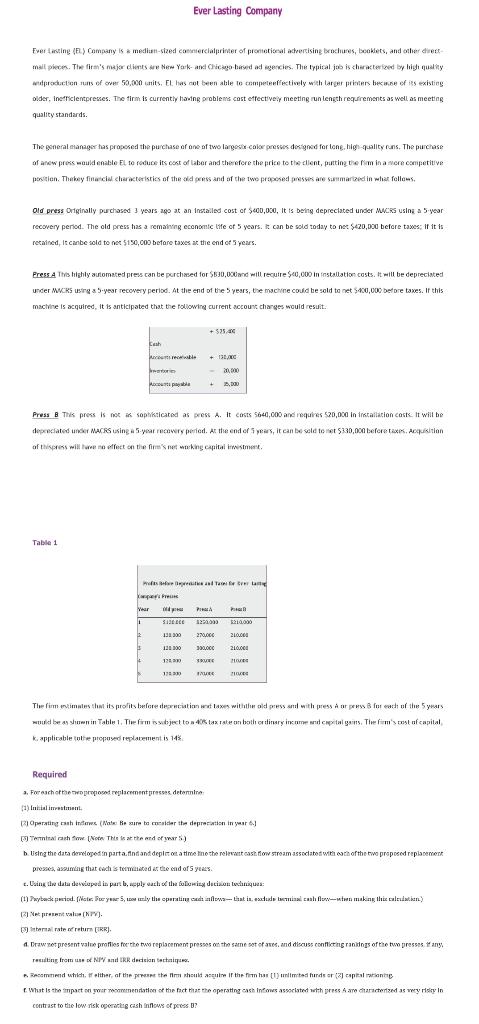

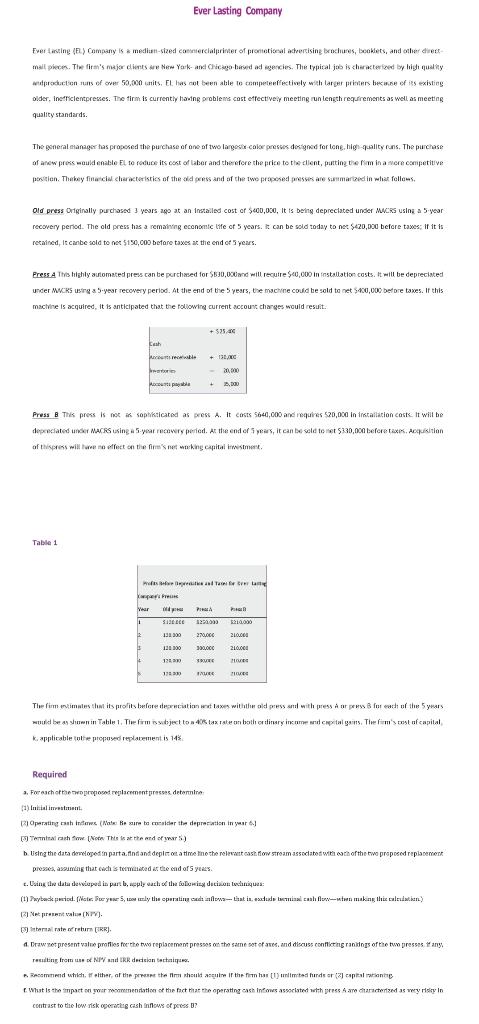

Ever Lasting Company Fverlasting (1) Company is a medium-sized commercialprinter of promotional actrertising brochures, booklets, and other direct mall pieces. The firm's major clients are New York and Chicago based ad agencies. The typical job is characterized by high quality productions of over 50,000 units. El has not been able to compet effectively with larger printers because of its existing oider, inefficientpresses. The firm is currently having problems cost effectively meeting run length requirements as well as meeting quality standards. The general manager has proposed the purchase of one of two largest calor presus designed for long higality runs. The purchase of now press would enable El teroduce its cost of labor and therefore the price to the client, putting them in a ser competitive prition. Thebey financial characteristics of the address and of the two praesed preses are summarized in what follows. Old press Originally purchased 3 years ago at an installed cost of $400,000, It is being depreciated under Mors using a 5-year recovery period. The old press has a remaining economic life of 5 years. It can be sold today to net $420,000 before taxes: if it is retained, it canbe sold to net 5150,000 before taxes at the end of years. Press A This highly automated press can be purchased for $30.000 and will require $20,000 in fnstallation costs. It will be depreciated under WRs using a 5-year recovery period. At the end of the years, the machine could be sold to net $40,000 before taxes. If this machine is acquired. It is anticipated that the following current account charges would result. +535. Leah Web + 138/C 20,000 Hot + 2,000 Press B This press is not a sophisticated as prest A. It costs 5640,000 and requires $20,000 in installation costs. It will be deprecated under MACRS using a 5-year recovery period. At the end of yes, it can be sold to met 5330,000 before taxes, Acquisition of this will no effect on the firm's networking capital inwestment Table 1 wat ander wang Yap Ver PR 1 512 BEE 1292000 210.000 131300 270CE 2 LODE 12300 LOCE 210 More 12 SWEE 17 BE TH The former maleshw its profits were detition taxes withthald press me with press or pres for each of the years would be sent in Table 1. The firm subject to tax rate on both critinery income and capital gains. The firm's most of capital as k applicable tothe proposed replacement is 145 Required 3. Fireachtwoord replacementpresser determina (1) Inicialment 11 Operating cash Intowe ( Be sure to sider the depreciation in year Terrashow (Non The sat the end of 5) 5 h Using the data deweloped in parta. findian deplo a time to the relevant cash flow stroam associated with each of the time proposed replacement preses, assuming that each stewed at the end of yes . Using the data de viaped in part beply all the lubenicy deciso di ques: (1) Payback period. Not yearssly the operating and nows-that include mi cash flow to making the talent.) 12 Nepresenta PV). amal rate return (IRR) 1.Draw et present valne profiles for the two replacement presses on the same set of ates, and discuss conflictingrandings of the two presses any rating from NIVIRR decision testais Band whildether of the theme should If the firm har med ude arte What is the impact on the of the fact that the operating each Infows associated with press caracterized as wysy In contrast to the low risk operatg cash flow of per Ever Lasting Company Fverlasting (1) Company is a medium-sized commercialprinter of promotional actrertising brochures, booklets, and other direct mall pieces. The firm's major clients are New York and Chicago based ad agencies. The typical job is characterized by high quality productions of over 50,000 units. El has not been able to compet effectively with larger printers because of its existing oider, inefficientpresses. The firm is currently having problems cost effectively meeting run length requirements as well as meeting quality standards. The general manager has proposed the purchase of one of two largest calor presus designed for long higality runs. The purchase of now press would enable El teroduce its cost of labor and therefore the price to the client, putting them in a ser competitive prition. Thebey financial characteristics of the address and of the two praesed preses are summarized in what follows. Old press Originally purchased 3 years ago at an installed cost of $400,000, It is being depreciated under Mors using a 5-year recovery period. The old press has a remaining economic life of 5 years. It can be sold today to net $420,000 before taxes: if it is retained, it canbe sold to net 5150,000 before taxes at the end of years. Press A This highly automated press can be purchased for $30.000 and will require $20,000 in fnstallation costs. It will be depreciated under WRs using a 5-year recovery period. At the end of the years, the machine could be sold to net $40,000 before taxes. If this machine is acquired. It is anticipated that the following current account charges would result. +535. Leah Web + 138/C 20,000 Hot + 2,000 Press B This press is not a sophisticated as prest A. It costs 5640,000 and requires $20,000 in installation costs. It will be deprecated under MACRS using a 5-year recovery period. At the end of yes, it can be sold to met 5330,000 before taxes, Acquisition of this will no effect on the firm's networking capital inwestment Table 1 wat ander wang Yap Ver PR 1 512 BEE 1292000 210.000 131300 270CE 2 LODE 12300 LOCE 210 More 12 SWEE 17 BE TH The former maleshw its profits were detition taxes withthald press me with press or pres for each of the years would be sent in Table 1. The firm subject to tax rate on both critinery income and capital gains. The firm's most of capital as k applicable tothe proposed replacement is 145 Required 3. Fireachtwoord replacementpresser determina (1) Inicialment 11 Operating cash Intowe ( Be sure to sider the depreciation in year Terrashow (Non The sat the end of 5) 5 h Using the data deweloped in parta. findian deplo a time to the relevant cash flow stroam associated with each of the time proposed replacement preses, assuming that each stewed at the end of yes . Using the data de viaped in part beply all the lubenicy deciso di ques: (1) Payback period. Not yearssly the operating and nows-that include mi cash flow to making the talent.) 12 Nepresenta PV). amal rate return (IRR) 1.Draw et present valne profiles for the two replacement presses on the same set of ates, and discuss conflictingrandings of the two presses any rating from NIVIRR decision testais Band whildether of the theme should If the firm har med ude arte What is the impact on the of the fact that the operating each Infows associated with press caracterized as wysy In contrast to the low risk operatg cash flow of per