Question

Evergreen Activities Ltd is considering three investment project proposals. The expected pattern of cash flows is as follows Respective variable costs are 50 per cent

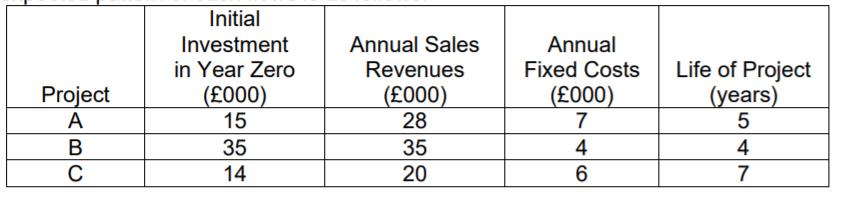

Evergreen Activities Ltd is considering three investment project proposals. The expected pattern of cash flows is as follows

Respective variable costs are 50 per cent of annual revenues. The fixed costs are directly associated with the projects and will be incurred by going ahead with the proposals. Each project can be undertaken only once and each is divisible, that is, it is possible to undertake part of a project, if required. The company has the cost of financing of 8 per cent per annum and the investment budget for Year Zero is restricted to £40,000. All cash flows occur at the year-ends. Assume no tax and inflation.

Required: Determine the optimal allocation of the investment budget among these projects.

Initial Annual Sales Revenues Investment in Year Zero (000) 15 Annual Life of Project (years) Fixed Costs Project A (000) 28 (000) 7 35 35 4 4 C 14 20 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

EXPLANATION 1 Divisible projects are those projects that can be accepted or rejected in parts or partly 2 When projects are divisible they are ranked ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started