Answered step by step

Verified Expert Solution

Question

1 Approved Answer

India PharmaLtd.Is engaged in the manufacture of pharmaceuticals. The company was established in 1991 and has registered a steady growth in sales since then.

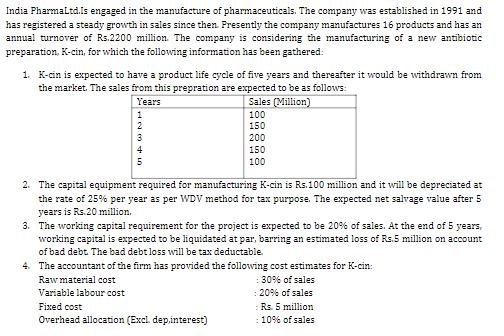

India PharmaLtd.Is engaged in the manufacture of pharmaceuticals. The company was established in 1991 and has registered a steady growth in sales since then. Presently the company manufactures 16 products and has an annual turnover of Rs.2200 million. The company is considering the manufacturing of a new antibiotic preparation, K-cin, for which the following information has been gathered: 1. K-cin is expected to have a product life cycle of five years and thereafter it would be withdrawn from the market. The sales from this prepration are expected to be as follows: Years Sales (Million) 100 150 42345 1 200 150 100 2. The capital equipment required for manufacturing K-cin is Rs.100 million and it will be depreciated at the rate of 25% per year as per WDV method for tax purpose. The expected net salvage value after 5 years is Rs.20 million. 3. The working capital requirement for the project is expected to be 20% of sales. At the end of 5 years, working capital is expected to be liquidated at par, barring an estimated loss of Rs.5 million on account of bad debt. The bad debt loss will be tax deductable. 4. The accountant of the firm has provided the following cost estimates for K-cin: Raw material cost : 30% of sales Variable labour cost : 20% of sales Fixed cost :Rs. 5 million Overhead allocation (Excl. dep.interest) : 10% of sales While the project is charged on overhead allocation, it is not likely to have any effect on overhead expenses as such. 5. The manufacture of K-cin would also require some of the common facilities of the firm. The use of these facilities would call for reduction in the production of other pharmaceutical preparations of the firm. This would entail a reduction of Rs. 15 million of contribution margin. 6. The tax rate applicable to the firm is 40%. Calculate project cash flows.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Sales Revenue The sales revenue over the five year life cycle of Kcin can be calculated as follows Year 1 2344 million Year 2 100 million Year 3 150 million Year 4 200 million Year 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started