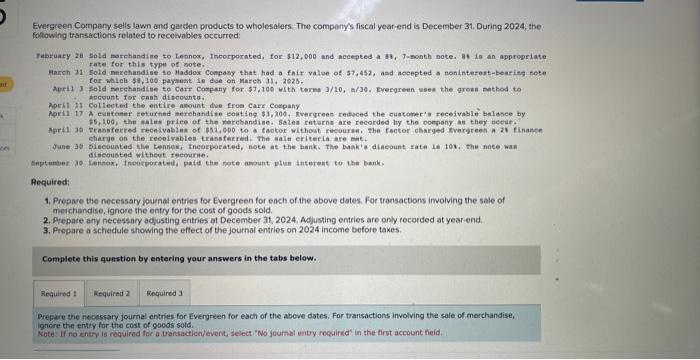

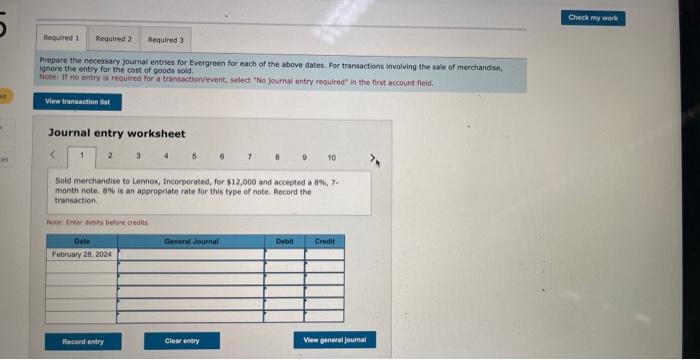

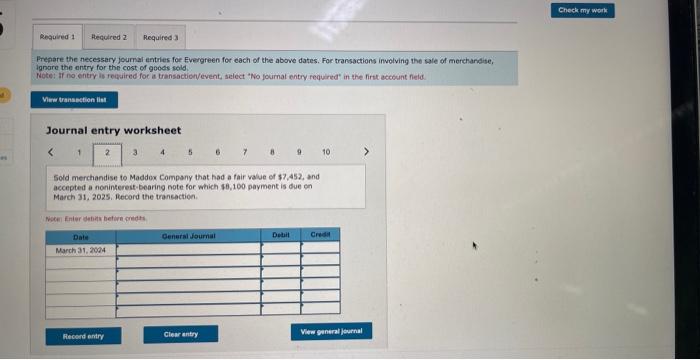

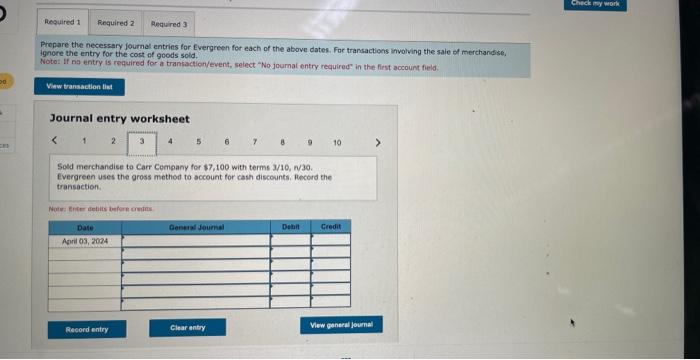

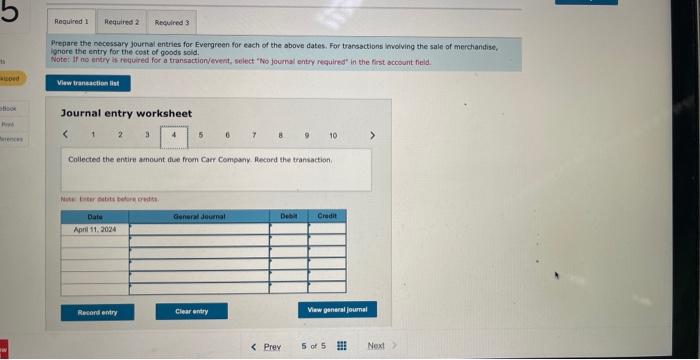

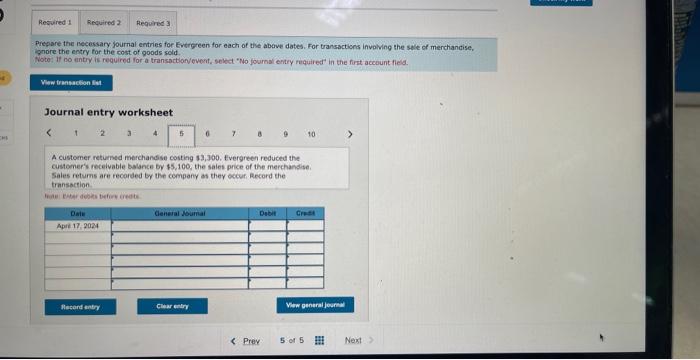

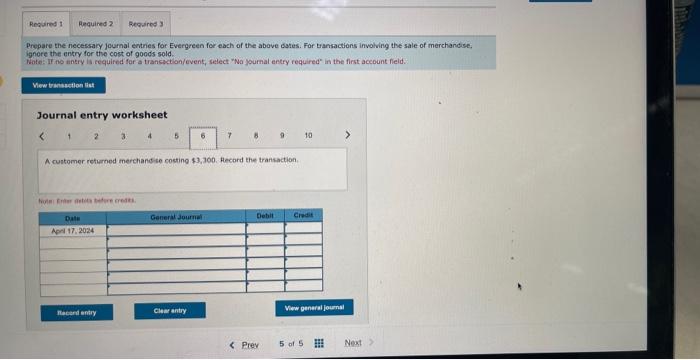

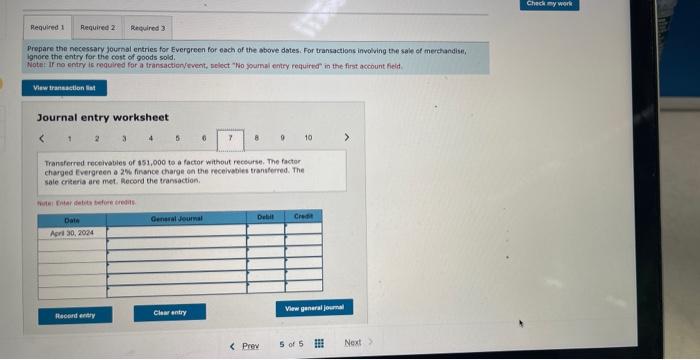

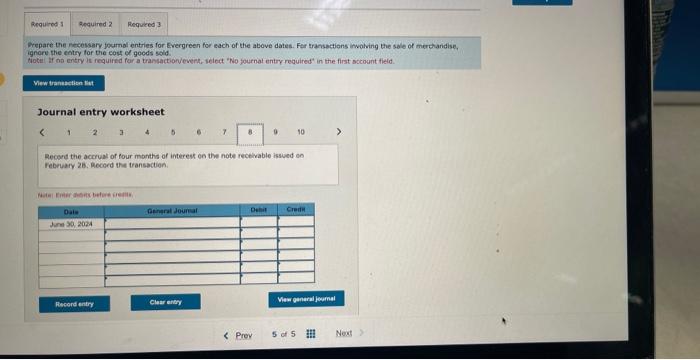

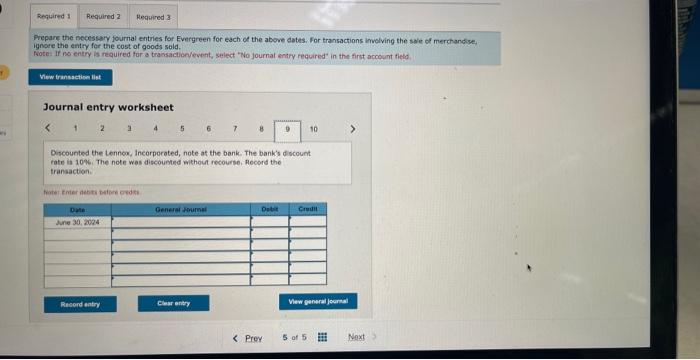

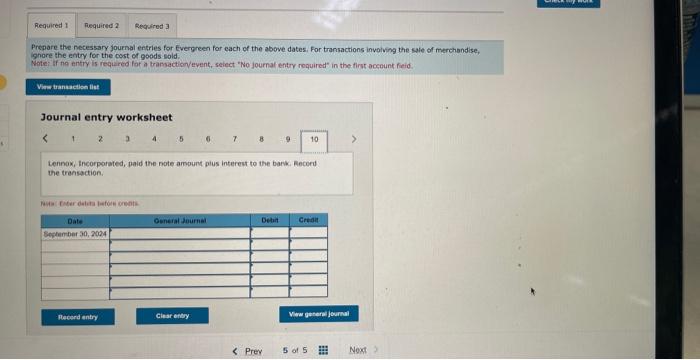

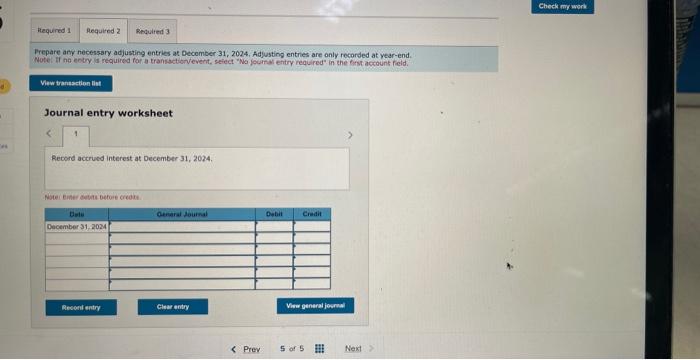

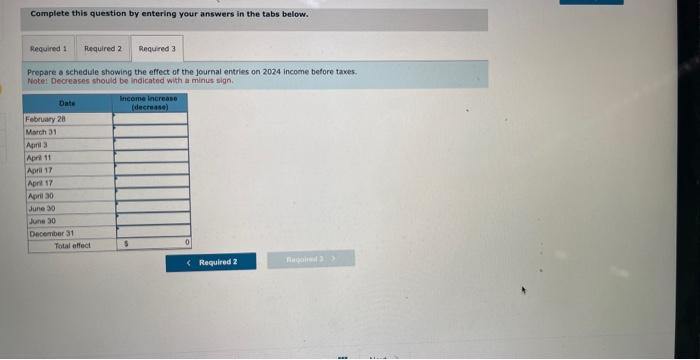

Evergreen Compory sells lawn and garden products to wholesalers. The companys fiscal yoar-end is December 31 , During 2024 , the following transactions related to receivables occurred: rate for this type of note. March 11 Sold nerchandise to Maddos Conpasy that had a fair value of 57, 452, asd aecepted a noninterest-kearieg note for waleh 99,105 payande is doe on Mareh 11, 2025. Aprit 3 Sold necehandise to Carr Coopany for 57,109 with terna 3/10, a/30. Evergreen ween the qrose nathod to account for pash dincosate. Mpeli if Coliected the entire amount doe from Cary Cospany charge on the receivables trassfecred, The Bale eritecia are ent, June 30 biacounted the Leniox, theokporated, note at the hank. The bagk'a diacount rate Is tot, The note was diseounted witheut reecurne. Reguired: 1. Prepare the necessary journal entries for Evergreen for each of the above dates. For transactions irvolving the sale of merchandise, ignore the entry for the cost of goods sold. 2. Prepare any necessary adjusting entries at December 31, 2024. Adjusting entries are only recorded at year-end. 3. Prepare a schedule showing the effect of the journal entries on 2024 income before taxes. Complete this question by entering your answers in the tabs below. Prepare the necessary joumal entries for Evergreen for each of the above dates. For transactions involving the sale of merchandise, ignore the entry for the cost of goods sold. Note: if no entry is required for a transadion/event, select "No joumal entry required" in the first account field, Prepare the necessary journal entries for Evergreen for each of the above dates. For tramsactions involving the sale of merchandse, ignore the entry for the cost of goods soid. fiotel if ho entry is required for a transaction/event, select "No foumal entry reguired" in the first account field. Journal entry worksheet Sold merchandise to Lennox, incorporated, for $12,000 and accepted a 11%,7. month note. ath is an appropriate rate for this trpe of note. Record the transaction. Movi freterdefirs betore credth. Prenare the necessary journal entries foe Evergreen for each of the above dates. For transactions involving the sale of merchandise, Innare the antry for the cost of gooes seld: Note: if no entry is teedired for is transactionvevent, select "No journat entry requared" in the first eccount field Journal entry worksheet 5old merchandise to Maddex Company that had a fair value of 37,452 , and accepted a noninterest-bearing note for which 38,100 payment is due on March 31, 2025. flecord the traneaction. Nisen Enier debints betwe credta Prepare the necessary fournal entries for Evergreen fot each of the above dates. For transactions involving the sale of merchandse, ignore the entry for the cost of goods sold. Notes if na entry is required for a trantactich/event, select "No journal entry required" in the first account field. Journal entry worksheet Sod merchandiee to Carr Company for $7,100 with terms 3/10, n/30. Evergreen uses the gross methor to account for cash discounts, flecord the transoction. Prepare the necessary journal entries for Evergreen for each of the obove dates. For trarsactions involving the sale of merchandise, Whore the entry for the cost of goods sold. Notet if no entry it required for a transactionyeverat, select "No journal entry required" in the fist account field Journal entry worksheet 125078910> Collected the entire anount due froen Caer Company. Aecord the transactioni, Prepare the Mecessary yournal entries for Evergreen for each of the abave dates. For transactions involving the sule of merchancise, ignore the entry tor the cost of goods sold. Notel if co ititiy is required for a transactionvevent, seked "Wo journal entry required" in the first account fleds. Journal entry worksheet A customer returned merchandse costing 33,300 . Evergreen reduced the customer's recelyable balance by 45,100 , the sales price of the merchandise. Sales retums are recorded by the company as they cccur. Record the transaction Prepare the necessary journal entries for Evergreen for each of the above cates. For transactions involving the sale of merchandse, ignere the entry for the cost of goods sold. Wotes If no tintry is required for a transection/event, select "Na journal entry required" in the first account field. Journal entry worksheet 123458910 A runtomer returned merchand se costing 43,700 . Hecord the transaction. thisi Eriter deted tedere eresat. Prepare the necessary journal entries for Everoreen for each of the obeve dates. For transactions involving the sale of merthandist, ignoce the entry for the cost of goods sold. Notes if no entry is required for a transactionvevent, select "Wo youmai entry required in the first account fieint. Journal entry worksheet