Every group for this assignment is required to select a COMPANY listed on the ASX but does not include a - Bank - Another type

Every group for this assignment is required to select a COMPANY listed on the ASX but does not include a

- Bank

- Another type of Financial Services Company, OR a

- Trust

You are required to write a report to evaluate the company’s performance as an external business analyst, by using relevant resources (latest financial statements (annual reports), the company’s website, and relevant research materials). The prescribed textbook of this unit should also be utilized.

• Hint: You have to be clever and pragmatic in selecting the company. It has to be large, and substantial and must have the available information for desk research. You are required to explore and collect information on the company to complete this assignment.

Then, answer ALL the following questions in your written group report:

a) Company background and mission

b) Common size & horizontal analysis of key financial statements. Various types of trends, bars & pie charts can be useful in the presentation of the analyzed results in your assessment submission. Students are expected to make pertinent comments regarding the findings. Comments could be related to the causes and significance of the increase or decrease of important variables such as PPE assets, intangibles, sales, EBIT, and net income as

well as explaining material changes in capital structure of the firm.

c) Cash Flow analysis. You would need to provide some commentary around what trends are emerging in the part of the Cash Flow Statement called cash flow from operations as a lot of the good news and bad news of a company is revealed there. Investors often look at this section before they bother with an income statement.

You may want to take cash flow analysis further by including Free Cash flow to the Firm (FCFF) and Free Cash flow to Equity (FCFE) numbers. Have a look at Appendix A.

If you look at page 248 of your textbook, you will see Palepu referring to FCFF as free cash flow to debt and equity claim holders. He articulates FCFE as free cash flow to equity claim holders.

d) Liquidity Analysis. This would entail as a minimum a current ratio and a liquid ratio together with relevant commentary on receivables and payables and stock management, etc.

e) Income Analysis. This would include an EBIT margin analysis, a gross profit margin analysis (if applicable), net income analysis and EPS. You would also be advised to incorporate ROA analysis. ROA analysis can take many forms.

f) Capital Structure Analysis (and Solvency). This is all about ascertaining the level to which the company uses financial leverage to finance its operations and activities. The analysis should cover bonds, other forms of debt, hybrid instruments such as preference shares and convertible notes as well as finance (or capital) leases.

g) Coverage (and Solvency). These ratios examine the extent a company can cover its interest payments and other fixed financial commitments e.g. lease payments.

h) Growth and Risk analysis. It would be normal in this section to include business risk analysis. Business risk is the standard deviation of EBIT ROA (see Appendix B) and has nothing to do with the financial (or bankruptcy) risk of a company. Other pertinent analyses would include the company’s sustainable growth rate.

i) Prospective analysis: Prospective analysis involves forecasting of future consolidated balance sheet and income statement. Some concluding commentary on the company and maybe its prospects for growth, prospects as a takeover target, high risk of failure, or whatever you see. Do not be afraid to track the share price and see if you can use that to understand where the company has come from and where the market thinks it might be going. You may want to even come up with a first thought on whether an investor should consider buying the stock, selling, or holding the stock – without getting very technical.

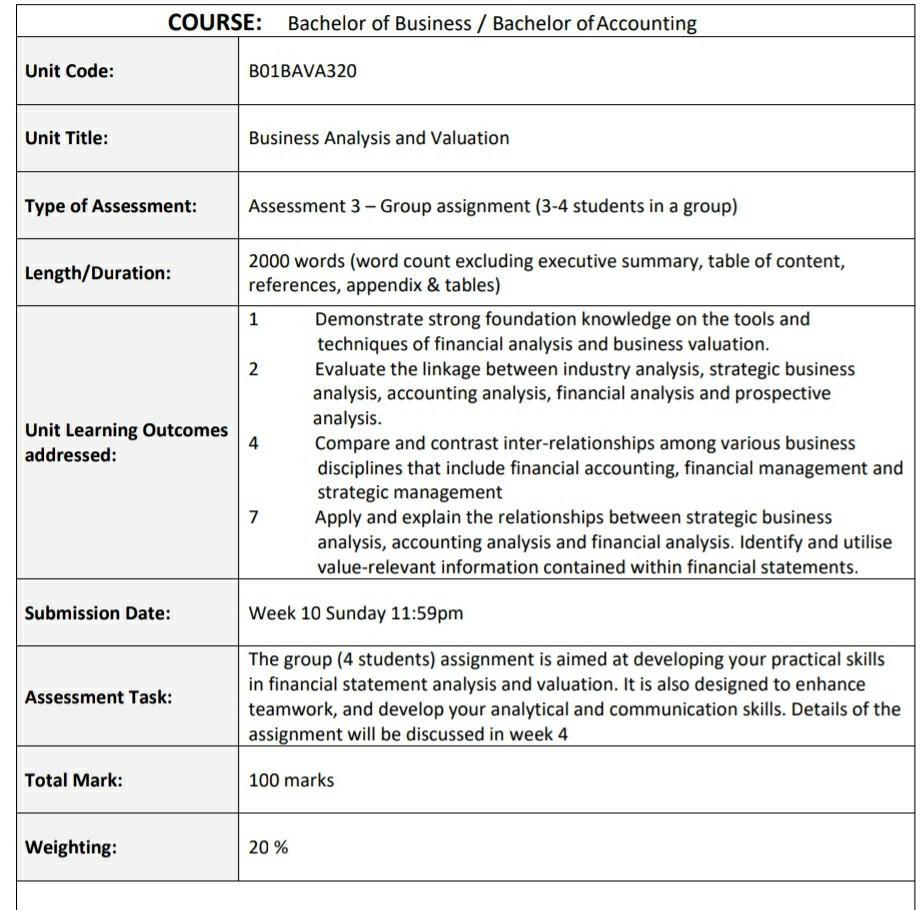

Unit Code: Unit Title: Type of Assessment: COURSE: Bachelor of Business / Bachelor of Accounting Length/Duration: Unit Learning Outcomes addressed: Submission Date: Assessment Task: Total Mark: Weighting: B01BAVA320 Business Analysis and Valuation Assessment 3 - Group assignment (3-4 students in a group) 2000 words (word count excluding executive summary, table of content, references, appendix & tables) 1 2 4 7 Demonstrate strong foundation knowledge on the tools and techniques of financial analysis and business valuation. Evaluate the linkage between industry analysis, strategic business analysis, accounting analysis, financial analysis and prospective analysis. Compare and contrast inter-relationships among various business disciplines that include financial accounting, financial management and strategic management Apply and explain the relationships between strategic business analysis, accounting analysis and financial analysis. Identify and utilise value-relevant information contained within financial statements. Week 10 Sunday 11:59pm The group (4 students) assignment is aimed at developing your practical skills in financial statement analysis and valuation. It is also designed to enhance teamwork, and develop your analytical and communication skills. Details of the assignment will be discussed in week 4 20% 100 marks

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

You are required to write a report to evaluate the company s performance as an external business analyst by using relevant resources latest financial statements ann ual reports the company s website a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started