Question

Every year, Americans fill out their tax return forms (this year, Tax Day was moved until May 17).A new tax preparation company wanted to advertise

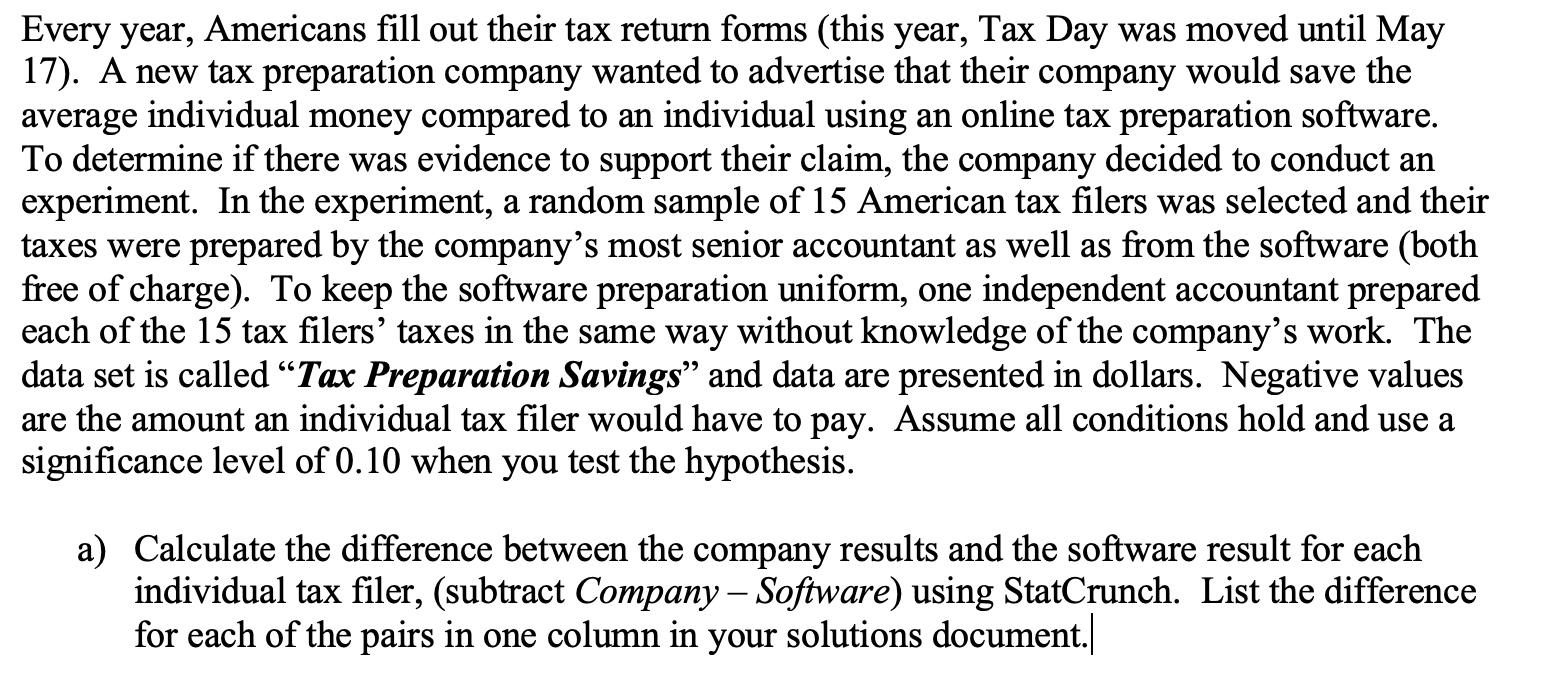

Every year, Americans fill out their tax return forms (this year, Tax Day was moved until May 17).A new tax preparation company wanted to advertise that their company would save the average individual money compared to an individual using an online tax preparation software.To determine if there was evidence to support their claim, the company decided to conduct an experiment.In the experiment, a random sample of 15 American tax filers was selected and their taxes were prepared by the company's most senior accountant as well as from the software (both free of charge).To keep the software preparation uniform, one independent accountant prepared each of the 15 tax filers' taxes in the same way without knowledge of the company's work.The data set is called "Tax Preparation Savings" and data are presented in dollars.Negative values are the amount an individual tax filer would have to pay.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started